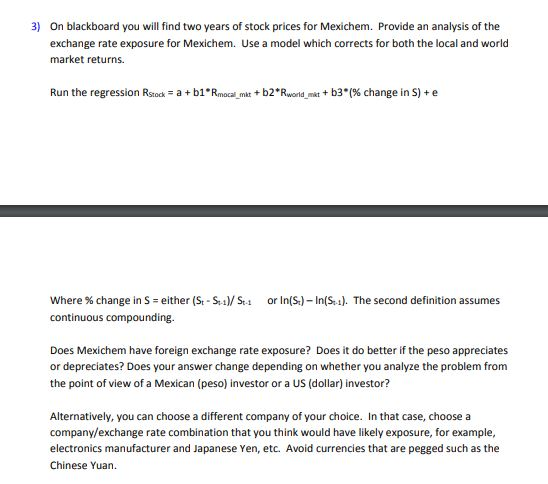

1) Mexichem, a Mexican company specializing in certain piping, vinyl, and other chemical products, exports 70% of its $5.7 billion in annual sales: 30% to the U.S. and 20% each to Japan and Europe. Assume it incurs all its costs in Mexican pesos, while most of its export sales are priced in the local currency. a. How is Mexichem affected by exchange rate changes? Be specific about what exchange rate changes would have positive or negative effects. b. Describe Mexichem's transaction exposure and differentiate it from its operating exposure. c. How would Mexichem protect itself against transaction exposure? d. What financial, marketing, and production techniques would Mexichem use to protect itself against operating exposure? e. Can Mexichem eliminate its operating exposure by hedging its position every time it makes a foreign sale or by pricing all foreign sales in pesos? Why or why not? 2) in 1989 and 1990, the Japanese company Mitsubishi Estate Co. paid the Rockefeller family $1.4 billion for an 80 percent stake in New York's Rockefeller Center. At the time, the exchange rate was 145 X/$. When the investor went to sell the building five years later, in early 1995, the exchange rate was 85 X/$ and the property's value had decreased to $800 million. a. What exchange risk did Mitsubishi Estate face at the time of the purchase? b. How could Mitsubishi Estate have hedged his risk? C. Assume the purchase was $1.1 billion in total and that the value declines to $450 million. Suppose the investor financed the purchase with a $100 million down payment in yen and a $1 billion dollar loan accumulating interest at the rate of 8% per annum. Since this is a zero-coupon loan, the interest on it (along with the principal) is not due and payable until the building is sold. How much has the investor lost in yen terms? In dollar terms? Suppose the investor financed the building with a $100 million down payment in yen and a yen loan for the remaining amount accumulating interest at the rate of 3% per annum. Since this is a zero-coupon loan, the interest on it (along with the principal) is not due and payable until the building is sold. How much has the investor lost in yen terms? In dollar terms? 3) On blackboard you will find two years of stock prices for Mexichem. Provide an analysis of the exchange rate exposure for Mexichem. Use a model which corrects for both the local and world market returns. Run the regression stock = a + b1 Rmocal_mkt + b2*Rworld_mkt + b3% change in S) + e or In(St) - In(S1). The second definition assumes Where % change in S = either (S: - S1)/St1 continuous compounding. Does Mexichem have foreign exchange rate exposure? Does it do better if the peso appreciates or depreciates? Does your answer change depending on whether you analyze the problem from the point of view of a Mexican (peso) investor or a US (dollar) investor? Alternatively, you can choose a different company of your choice. In that case, choose a company/exchange rate combination that you think would have likely exposure, for example, electronics manufacturer and Japanese Yen, etc. Avoid currencies that are pegged such as the Chinese Yuan 1) Mexichem, a Mexican company specializing in certain piping, vinyl, and other chemical products, exports 70% of its $5.7 billion in annual sales: 30% to the U.S. and 20% each to Japan and Europe. Assume it incurs all its costs in Mexican pesos, while most of its export sales are priced in the local currency. a. How is Mexichem affected by exchange rate changes? Be specific about what exchange rate changes would have positive or negative effects. b. Describe Mexichem's transaction exposure and differentiate it from its operating exposure. c. How would Mexichem protect itself against transaction exposure? d. What financial, marketing, and production techniques would Mexichem use to protect itself against operating exposure? e. Can Mexichem eliminate its operating exposure by hedging its position every time it makes a foreign sale or by pricing all foreign sales in pesos? Why or why not? 2) in 1989 and 1990, the Japanese company Mitsubishi Estate Co. paid the Rockefeller family $1.4 billion for an 80 percent stake in New York's Rockefeller Center. At the time, the exchange rate was 145 X/$. When the investor went to sell the building five years later, in early 1995, the exchange rate was 85 X/$ and the property's value had decreased to $800 million. a. What exchange risk did Mitsubishi Estate face at the time of the purchase? b. How could Mitsubishi Estate have hedged his risk? C. Assume the purchase was $1.1 billion in total and that the value declines to $450 million. Suppose the investor financed the purchase with a $100 million down payment in yen and a $1 billion dollar loan accumulating interest at the rate of 8% per annum. Since this is a zero-coupon loan, the interest on it (along with the principal) is not due and payable until the building is sold. How much has the investor lost in yen terms? In dollar terms? Suppose the investor financed the building with a $100 million down payment in yen and a yen loan for the remaining amount accumulating interest at the rate of 3% per annum. Since this is a zero-coupon loan, the interest on it (along with the principal) is not due and payable until the building is sold. How much has the investor lost in yen terms? In dollar terms? 3) On blackboard you will find two years of stock prices for Mexichem. Provide an analysis of the exchange rate exposure for Mexichem. Use a model which corrects for both the local and world market returns. Run the regression stock = a + b1 Rmocal_mkt + b2*Rworld_mkt + b3% change in S) + e or In(St) - In(S1). The second definition assumes Where % change in S = either (S: - S1)/St1 continuous compounding. Does Mexichem have foreign exchange rate exposure? Does it do better if the peso appreciates or depreciates? Does your answer change depending on whether you analyze the problem from the point of view of a Mexican (peso) investor or a US (dollar) investor? Alternatively, you can choose a different company of your choice. In that case, choose a company/exchange rate combination that you think would have likely exposure, for example, electronics manufacturer and Japanese Yen, etc. Avoid currencies that are pegged such as the Chinese Yuan