Answered step by step

Verified Expert Solution

Question

1 Approved Answer

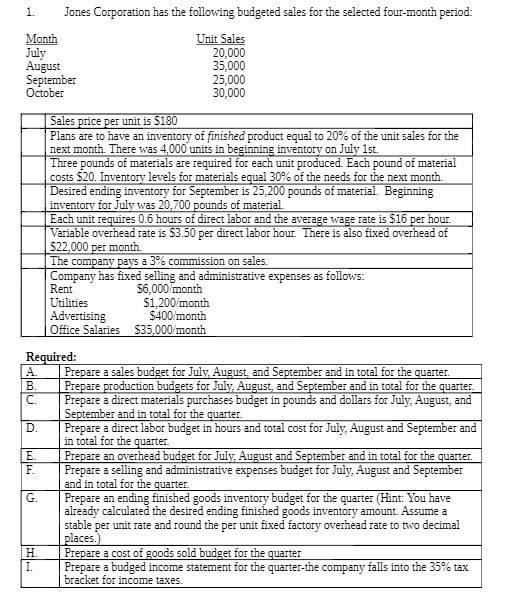

1. Month July Jones Corporation has the following budgeted sales for the selected four-month period: August September October Unit Sales 20,000 35,000 25,000 30,000

1. Month July Jones Corporation has the following budgeted sales for the selected four-month period: August September October Unit Sales 20,000 35,000 25,000 30,000 Sales price per unit is $180 Plans are to have an inventory of finished product equal to 20% of the unit sales for the next month. There was 4,000 units in beginning inventory on July 1st. Three pounds of materials are required for each unit produced. Each pound of material costs $20. Inventory levels for materials equal 30% of the needs for the next month. Desired ending inventory for September is 25,200 pounds of material. Beginning inventory for July was 20,700 pounds of material. Each unit requires 0.6 hours of direct labor and the average wage rate is $16 per hour. Variable overhead rate is $3.50 per direct labor hour. There is also fixed overhead of $22,000 per month. The company pays a 3% commission on sales. Company has fixed selling and administrative expenses as follows: Rent Utilities Advertising Office Salaries Required: A. B. C. D. E. F. G. H. I $6,000/month $1,200/month $400/month $35,000/month Prepare a sales budget for July, August, and September and in total for the quarter. Prepare production budgets for July, August, and September and in total for the quarter. Prepare a direct materials purchases budget in pounds and dollars for July, August, and September and in total for the quarter. Prepare a direct labor budget in hours and total cost for July, August and September and in total for the quarter. Prepare an overhead budget for July, August and September and in total for the quarter. Prepare a selling and administrative expenses budget for July, August and September and in total for the quarter. Prepare an ending finished goods inventory budget for the quarter (Hint: You have already calculated the desired ending finished goods inventory amount. Assume a stable per unit rate and round the per unit fixed factory overhead rate to two decimal places.) Prepare a cost of goods sold budget for the quarter Prepare a budged income statement for the quarter-the company falls into the 35% tax bracket for income taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Sales Budget July 20000 units x 180 3600000 August 30000 units x 180 5400000 September 35000 units x 180 6300000 Total Quarter 3600000 5400000 6300000 15300000 B Production Budget July 20000 units t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started