Question

1. Moosa problem 11.6 You are given the following information: Spot exchange rate (AUD/EUR)1.60 Oneyear forward rate (AUD/EUR)1.62 Oneyear interest rate on the Australian dollar8.5%

1. Moosa problem 11.6

You are given the following information:

Spot exchange rate (AUD/EUR)1.60

Oneyear forward rate (AUD/EUR)1.62

Oneyear interest rate on the Australian dollar8.5%

Oneyear interest rate on the euro6.5%

(a) Is there any violation of CIP?

(b) Calculate the covered margin (going short on the AUD).

(c) Calculate the interest parity forward rate and compare it with the actual forward rate.

(d) Calculate the forward spread and compare it with the interest differential.

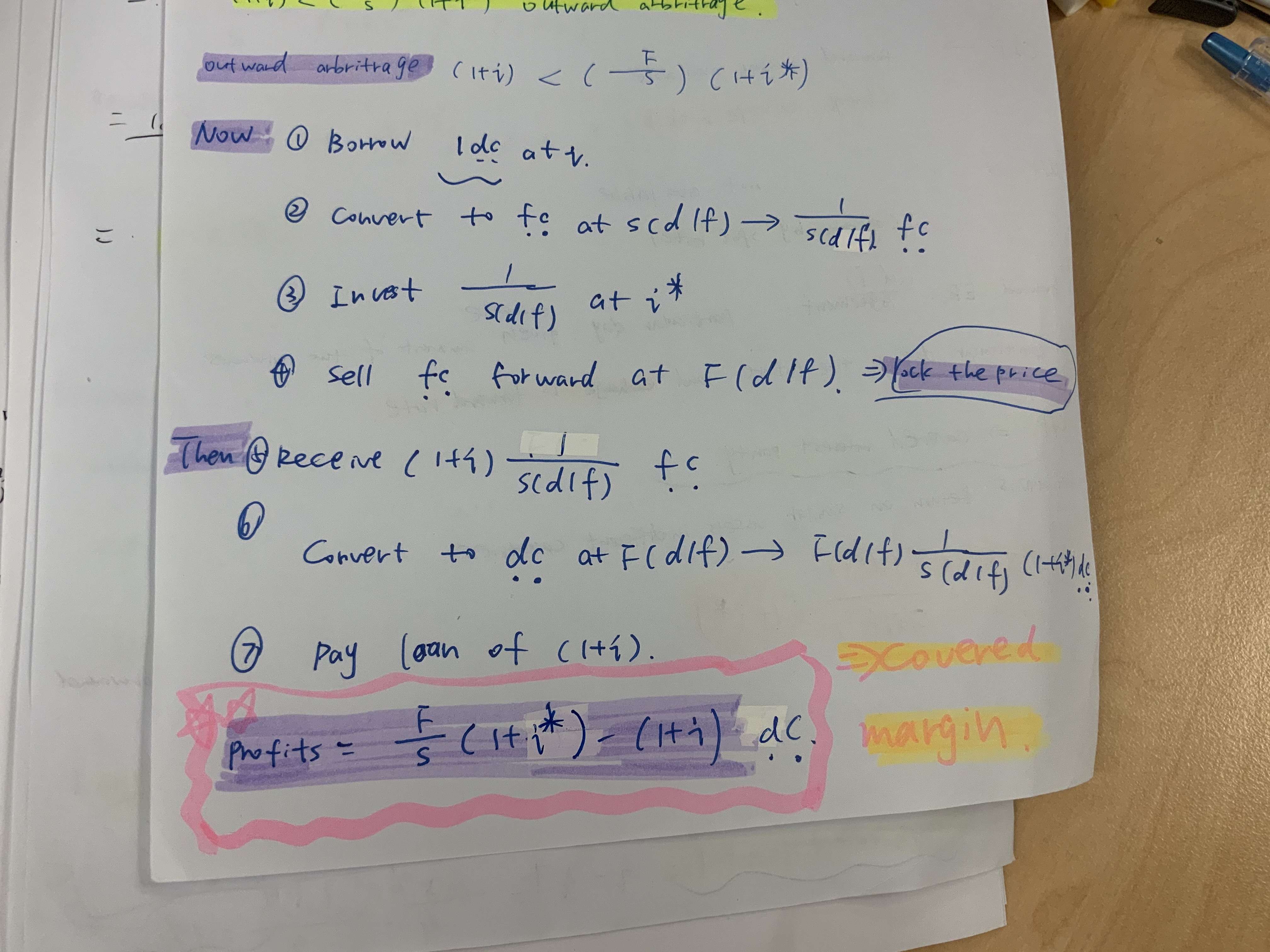

(e) What would arbitragers do?

(f) If arbitrage is initiated, suggest some values for the interest and exchange rates after it has stopped and equilibrium has been reached.

Question 1

(a) Not obviously.

(b) -0.0067.

(c) 1.6301.

(d) The forward spread is 1.25%; the interest rate differential, i-i*, is 2%

(f) Arbitrage will come to an end if . If interest rates are unchanged, the spot rate must fall to 1.5901.

Could you please explain it to me how can i do quesiton e), please your help will help me a lot a lot lot . I think my class note may be can help you a bit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started