Answered step by step

Verified Expert Solution

Question

1 Approved Answer

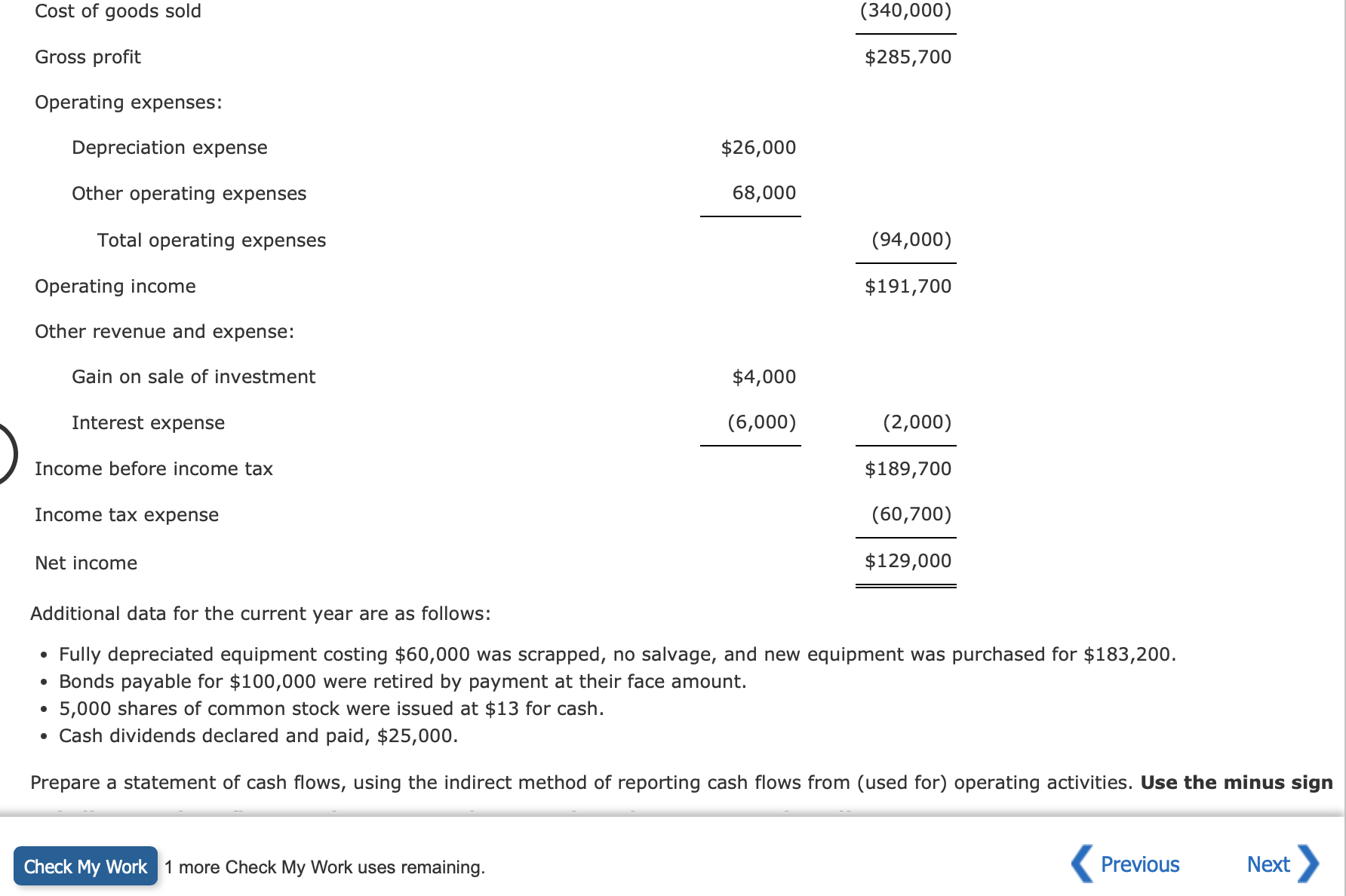

1 more Check My Work uses remaining. Additional data for the current year are as follows: - Fully depreciated equipment costing $60,000 was scrapped, no

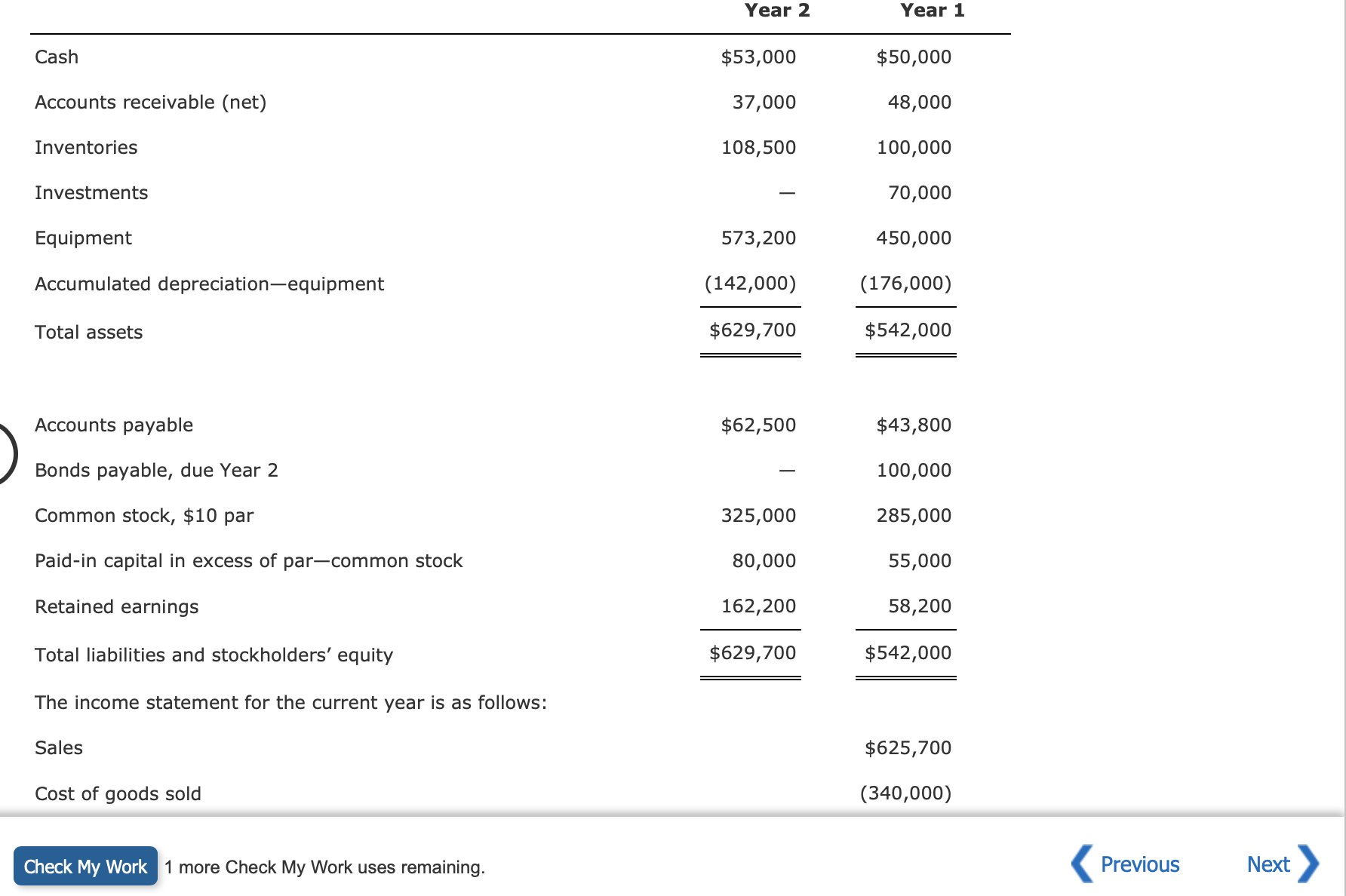

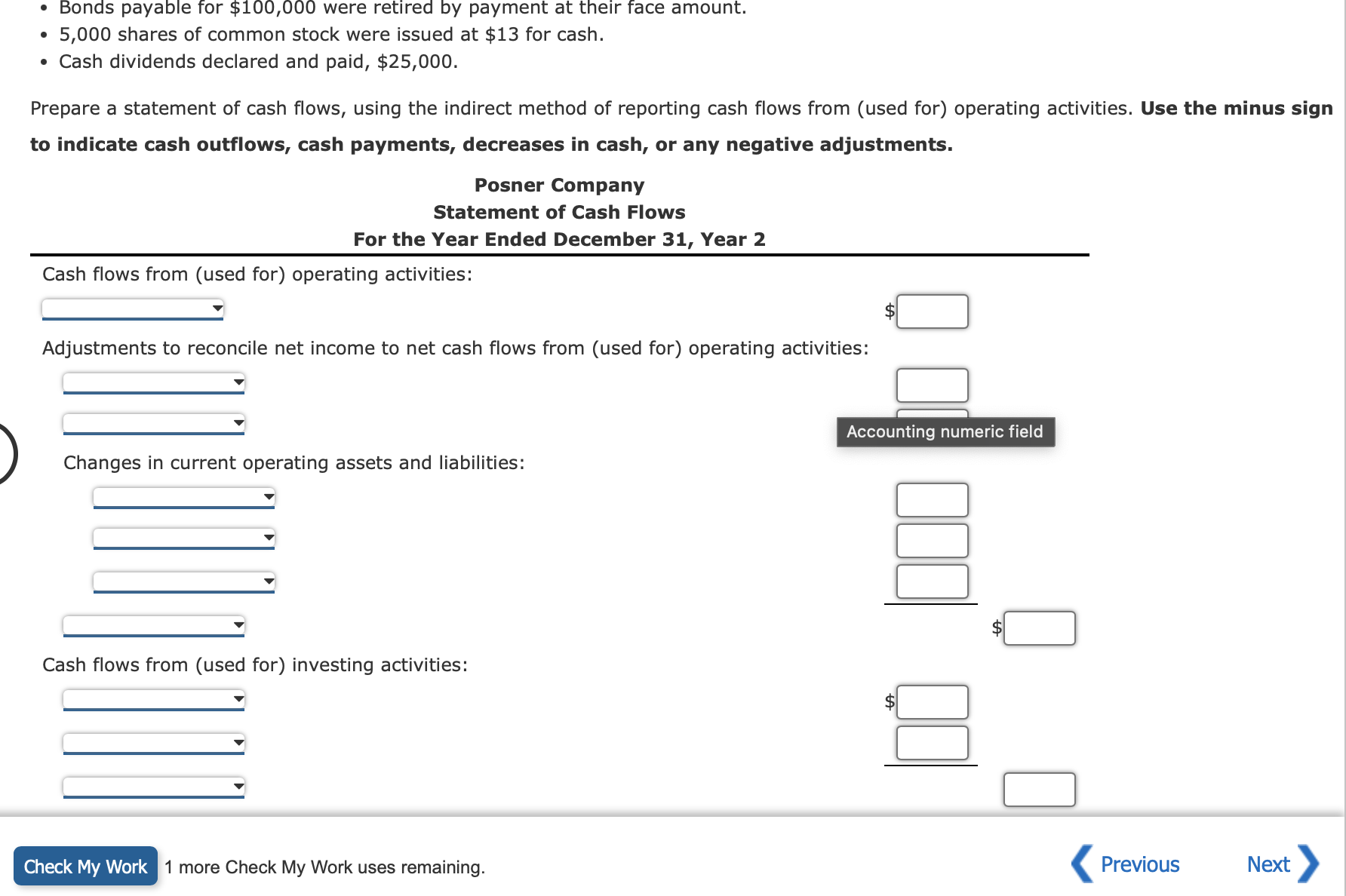

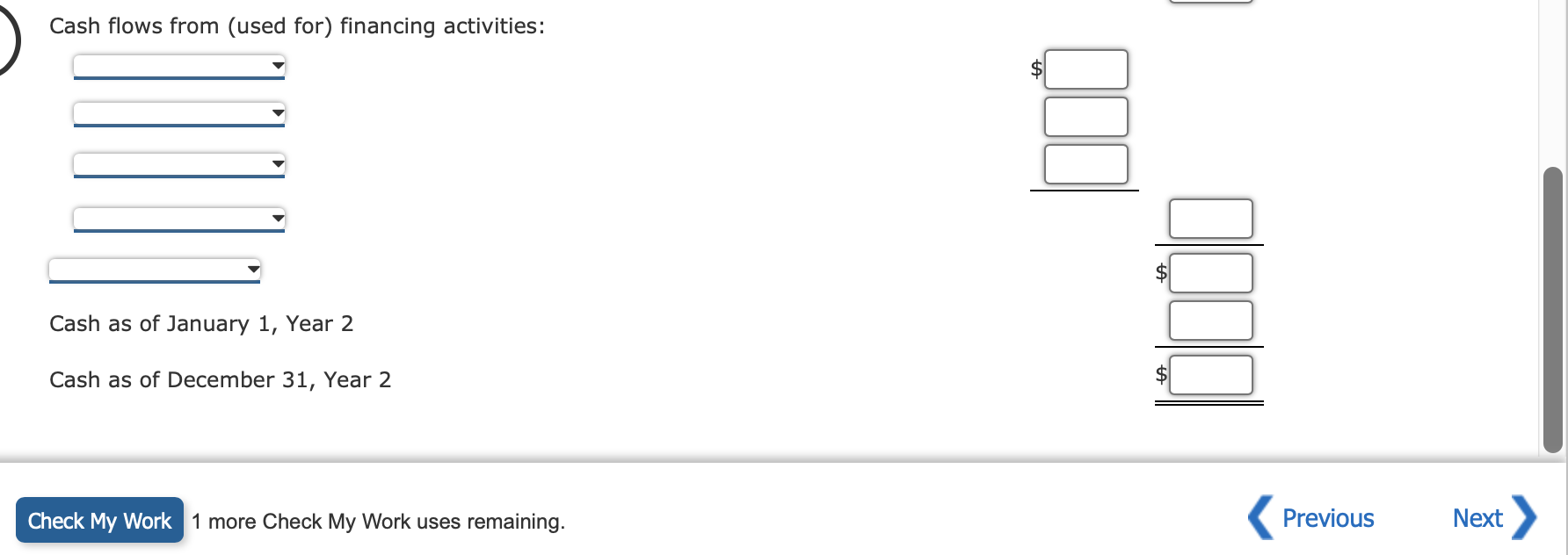

1 more Check My Work uses remaining. Additional data for the current year are as follows: - Fully depreciated equipment costing $60,000 was scrapped, no salvage, and new equipment was purchased for $183,200. - Bonds payable for $100,000 were retired by payment at their face amount. - 5,000 shares of common stock were issued at $13 for cash. - Cash dividends declared and paid, $25,000. Prepare a statement of cash flows, using the indirect method of reporting cash flows from (used for) operating activities. Use the mi - Bonds payable for $100,000 were retired by payment at their face amount. - 5,000 shares of common stock were issued at $13 for cash. - Cash dividends declared and paid, $25,000. Prepare a statement of cash flows, using the indirect method of reporting cash flows from (used for) operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Posner Company Statement of Cash Flows For the Year Ended December 31, Year 2 1 more Check My Work uses remaining. Cash flows from (used for) financing activities: Cash as of January 1, Year 2 Cash as of December 31 , Year 2 1 more Check My Work uses remaining

1 more Check My Work uses remaining. Additional data for the current year are as follows: - Fully depreciated equipment costing $60,000 was scrapped, no salvage, and new equipment was purchased for $183,200. - Bonds payable for $100,000 were retired by payment at their face amount. - 5,000 shares of common stock were issued at $13 for cash. - Cash dividends declared and paid, $25,000. Prepare a statement of cash flows, using the indirect method of reporting cash flows from (used for) operating activities. Use the mi - Bonds payable for $100,000 were retired by payment at their face amount. - 5,000 shares of common stock were issued at $13 for cash. - Cash dividends declared and paid, $25,000. Prepare a statement of cash flows, using the indirect method of reporting cash flows from (used for) operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Posner Company Statement of Cash Flows For the Year Ended December 31, Year 2 1 more Check My Work uses remaining. Cash flows from (used for) financing activities: Cash as of January 1, Year 2 Cash as of December 31 , Year 2 1 more Check My Work uses remaining Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started