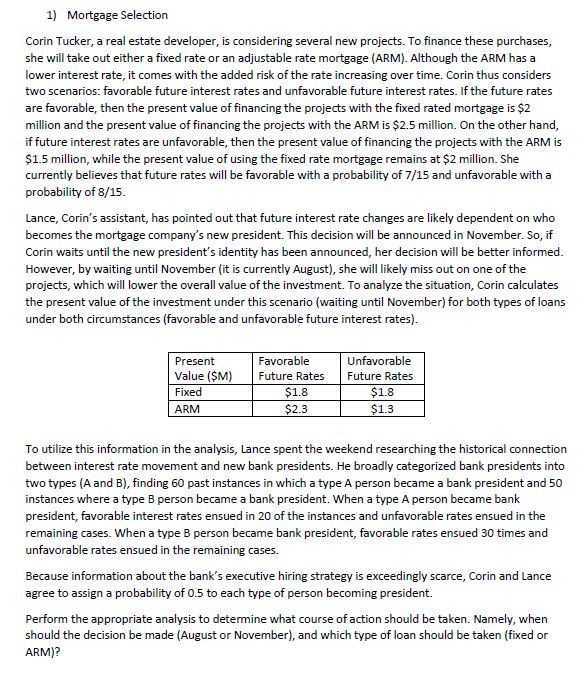

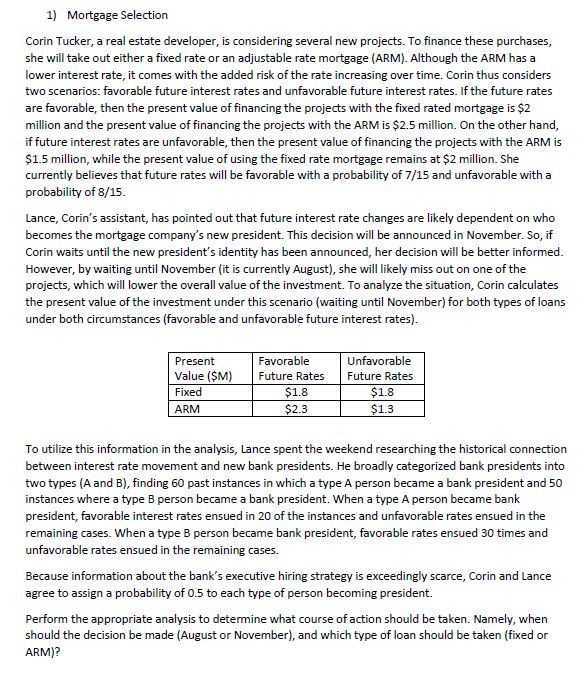

1) Mortgage Selection Corin Tucker, a real estate developer, is considering several new projects. To finance these purchases she will take out either a fixed rate or an adjustable rate mortgage (ARM). Although the ARM has a lower interest rate, it comes with the added risk of the rate increasing over time. Corin thus considers two scenarios: favorable future interest rates and unfavorable future interest rates. If the future rates are favorable, then the present value of financing the projects with the fixed rated mortgage is $2 million and the present value of financing the projects with the ARMis $2.5 million. On the other hand if future interest rates are unfavorable, then the present value of financing the projects with the ARM is $1.5 ion, while the present value of using the fixed rate mortgage remains at $2 million. She currently believes that future rates will be favorable with a probability of 7/15 and unfavorable with a probability of 8/15 Lance, Corin's assistant, has pointed out that future interest rate changes are likely dependent on who becomes the mortgage company's new president. This decision will be announced in November. So, if Corin waits until the new president's identity has been announced, her decision will be better informed However, by waiting until November (it is currently August), she will likely miss out on one of the projects, which will lower the overall value of the investment. To analyze the situation, Corin calculates the present value of the investment under this scenario (waiting until November) for both types of loans under both circumstances (favorable and unfavorable future interest rates) Favorable Unfavorable Present Value (SM) Future Rates Future Rates Fixed ARM $1.8 2.3 $1.8 1.3 To utilize this information in the analysis, Lance spent the weekend researching the historical connection between interest rate movement and new bank presidents. He broadly categorized bank presidents into two types (A and B), finding 60 past instances in which a type A person became a bank president and 50 instances where a type B person became a bank president. When a type A person became bank president, favorable interest rates ensued in 20 of the instances and unfavorable rates ensued in the remaining cases. When a type B person became bank president, favorable rates ensued 30 times and unfavorable rates ensued in the remaining cases. Because information about the bank's executive hiring strategy is exceedingly scarce, Corin and Lance agree to assign a probability of 0.5 to each type of person becoming president. Perform the appropriate analysis to determine what course of action should be taken. Namely, when should the decision be made (August or November), and which type of loan should be taken (fixed or ARM)