Answered step by step

Verified Expert Solution

Question

1 Approved Answer

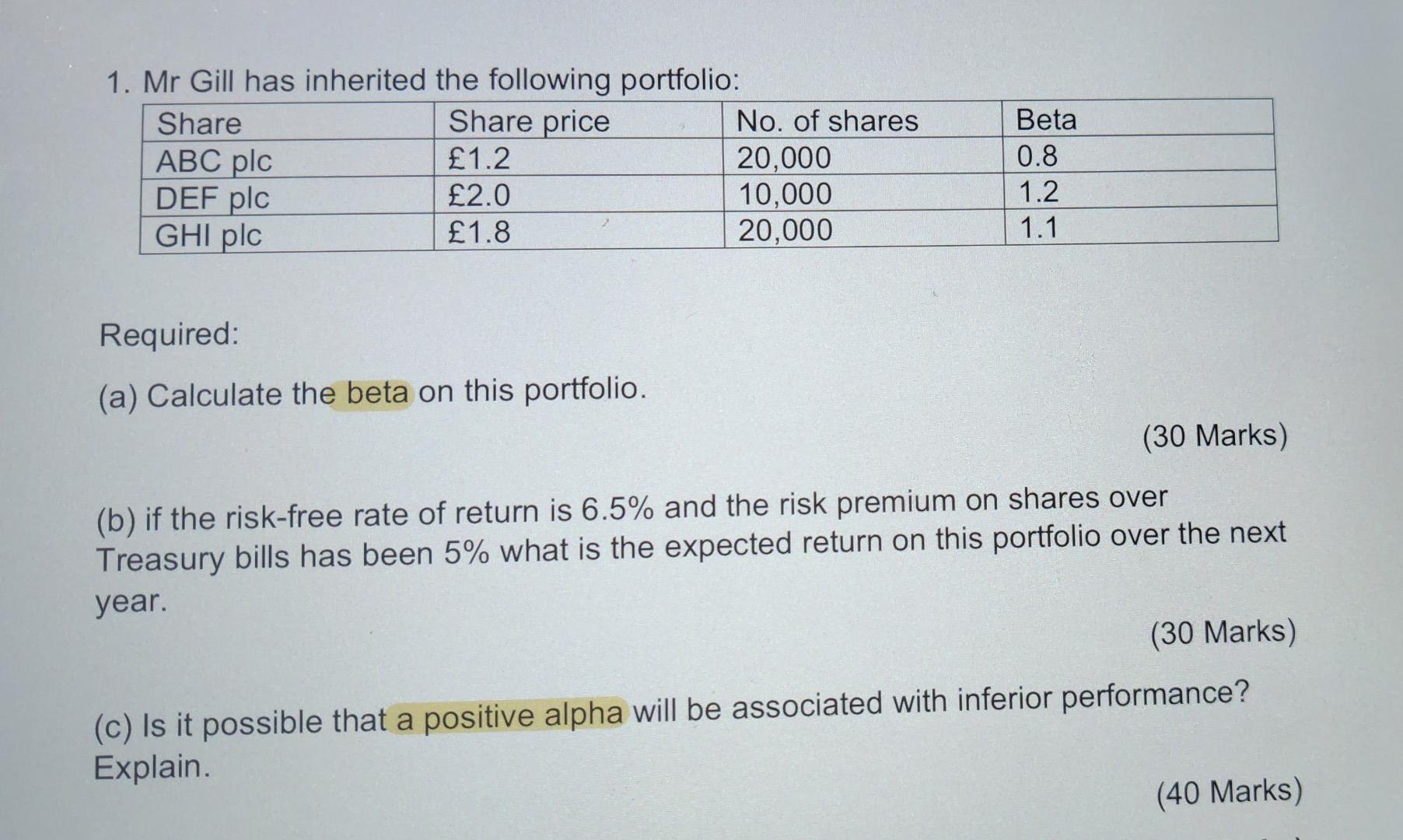

1. Mr Gill has inherited the following portfolio: Share Share price No. of shares Beta ABC plc 1.2 20,000 0.8 DEF plc 2.0 10,000 1.2

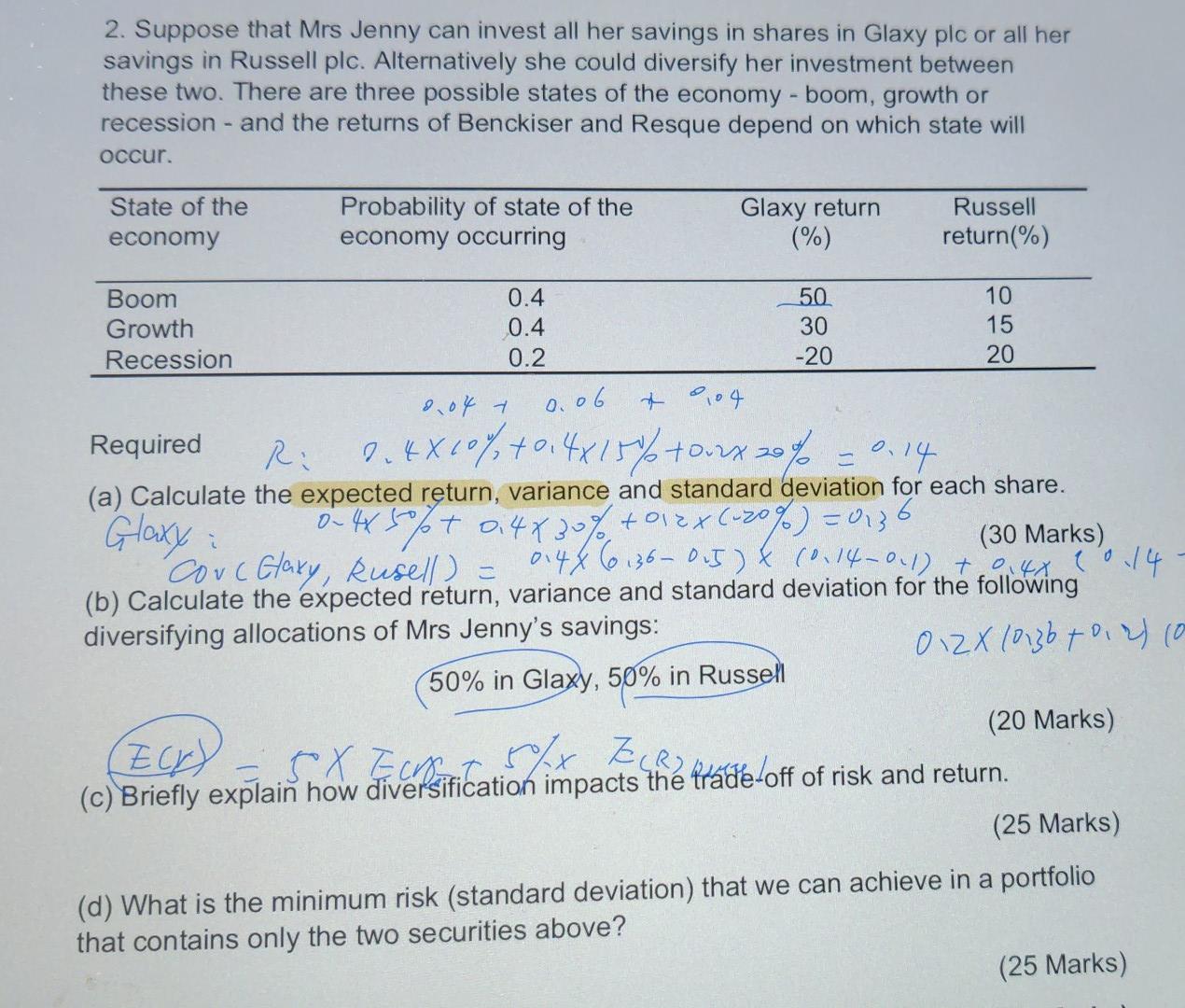

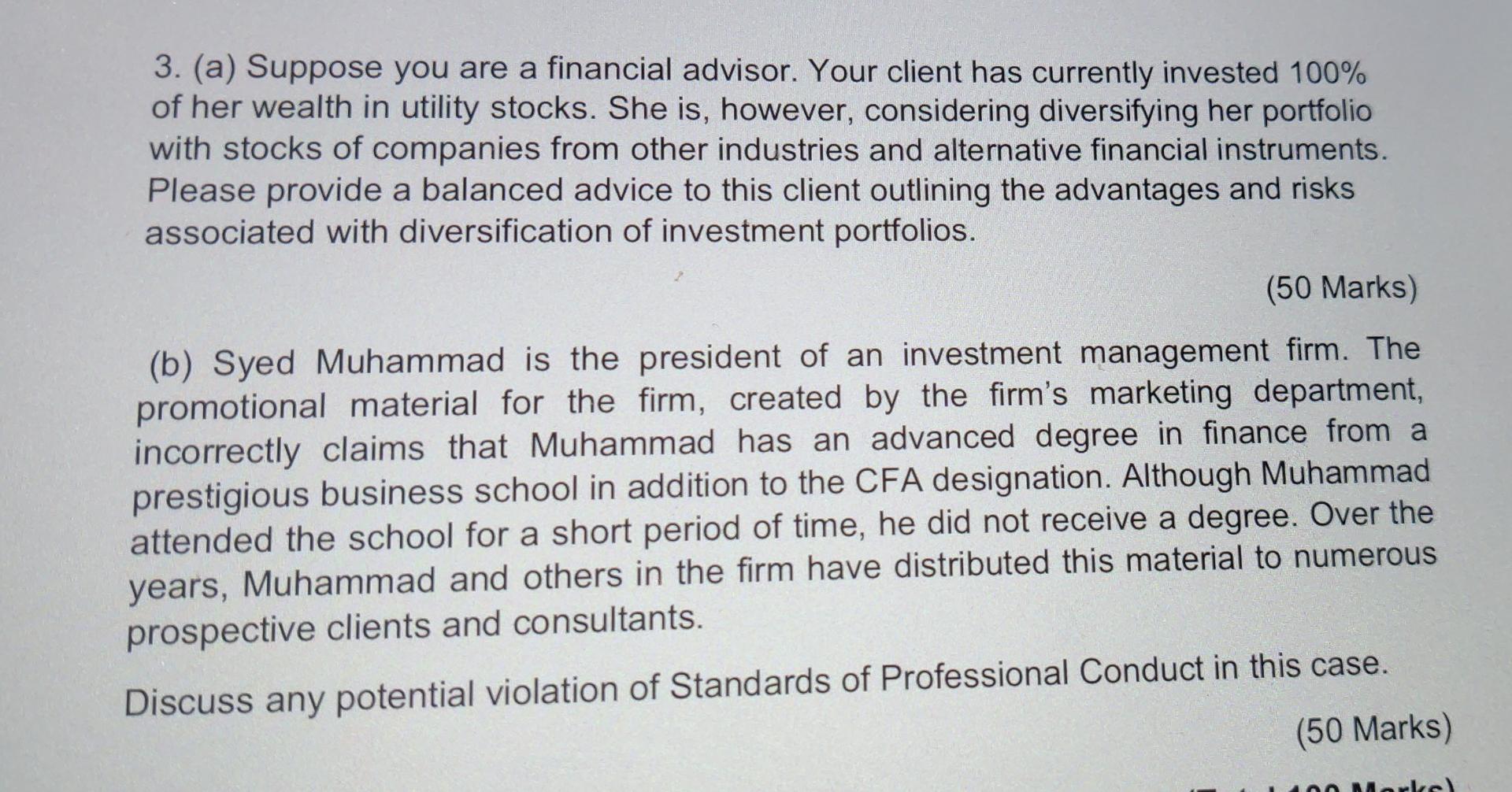

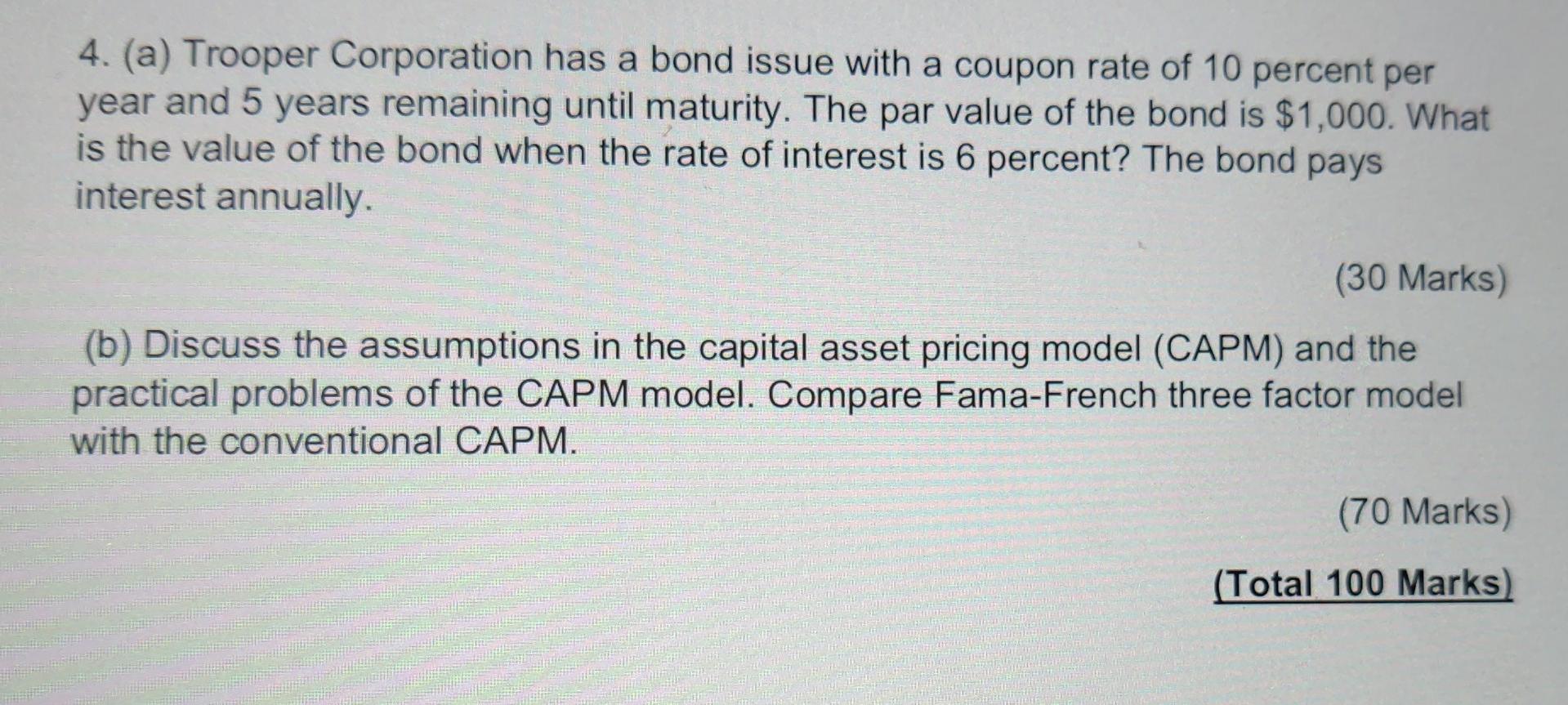

1. Mr Gill has inherited the following portfolio: Share Share price No. of shares Beta ABC plc 1.2 20,000 0.8 DEF plc 2.0 10,000 1.2 GHI plc 1.8 20,000 1.1 Required: (a) Calculate the beta on this portfolio. (30 Marks) (b) if the risk-free rate of return is 6.5% and the risk premium on shares over Treasury bills has been 5% what is the expected return on this portfolio over the next year. (30 Marks) (c) Is it possible that a positive alpha will be associated with inferior performance? Explain. (40 Marks) 2. Suppose that Mrs Jenny can invest all her savings in shares in Glaxy plc or all her savings in Russell plc. Alternatively she could diversify her investment between these two. There are three possible states of the economy - boom, growth or recession - and the returns of Benckiser and Resque depend on which state will occur. Probability of state of the State of the economy Glaxy return economy occurring Russell return(%) (%) 0.4 50 10 Boom Growth Recession 0.4 30 15 0.2 -20 20 2.04 1 0.06 + 104 Required Ri 2.410% +0.4x15% +0nx 20% = 0.14 Glaxy 0-4x50%+ 0.4 30% +012x (-20%) = 0136 i (a) Calculate the expected return, variance and standard deviation for each share. (30 Marks) 014 (6136-015) X (0.14-0-1) +014x 2014 (b) Calculate the expected return, variance and standard deviation for the following diversifying allocations of Mrs Jenny's savings: Cove Glaxy, Rusell) 012x 10136 +012) (0 50% in Glaxy, 50% in Russell (20 Marks) EC) 5.X ECST 5% X EUR) (c) Briefly explain how diversification impacts the trade-off of risk and return. (25 Marks) (d) What is the minimum risk (standard deviation) that we can achieve in a portfolio that contains only the two securities above? (25 Marks) 3. (a) Suppose you are a financial advisor. Your client has currently invested 100% of her wealth in utility stocks. She is, however, considering diversifying her portfolio with stocks of companies from other industries and alternative financial instruments. Please provide a balanced advice to this client outlining the advantages and risks associated with diversification of investment portfolios. (50 Marks) (b) Syed Muhammad is the president of an investment management firm. The promotional material for the firm, created by the firm's marketing department, incorrectly claims that Muhammad has an advanced degree in finance from a prestigious business school in addition to the CFA designation. Although Muhammad attended the school for a short period of time, he did not receive a degree. Over the years, Muhammad and others in the firm have distributed this material to numerous prospective clients and consultants. Discuss any potential violation of Standards of Professional Conduct in this case. (50 Marks) kel 4. (a) Trooper Corporation has a bond issue with a coupon rate of 10 percent per year and 5 years remaining until maturity. The par value of the bond is $1,000. What is the value of the bond when the rate of interest is 6 percent? The bond pays interest annually. (30 Marks) (b) Discuss the assumptions in the capital asset pricing model (CAPM) and the practical problems of the CAPM model. Compare Fama-French three factor model with the conventional CAPM. (70 Marks) (Total 100 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started