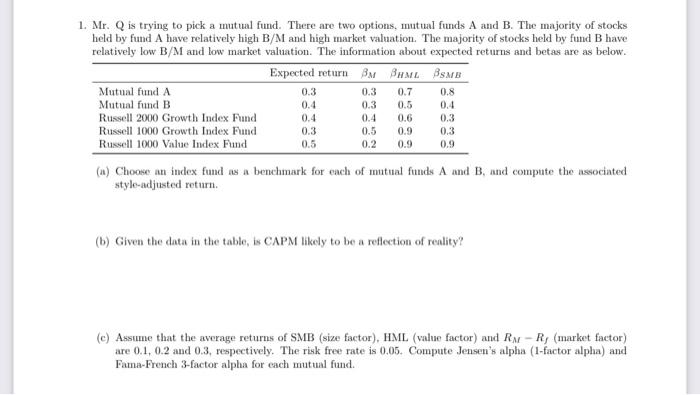

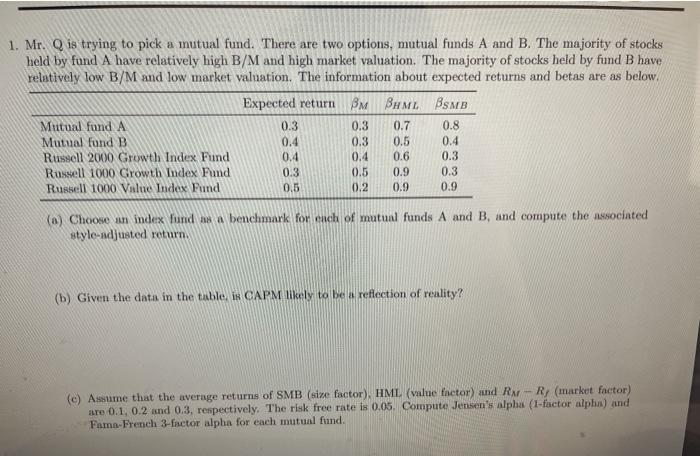

1. Mr. Q is trying to pick a mutual fund. There are two options, mutual funds A and B. The majority of stocks held by fund A have relatively high B/M and high market valuation. The majority of stocks held by fund B have relatively low B/M and low market valuation. The information about expected returns and betas are as below. Expected return BM BHML BSB Mutual fund A 0.3 0.7 0.8 Mutual fund B 0.4 0.3 0.5 0.4 Russell 2000 Growth Index Fund 0.4 0.3 Russell 1000 Growth Index Fund 0,3 Russell 1000 Value Index Fund 0.9 0.3 0.3 0.5 0.4 0.5 0.2 0.6 0.9 0.9 (a) Choose an index fund as a benchmark for each of mutual funds A and B, and compute the associated style-adjusted return. (b) Given the data in the table, is CAPM likely to be a reflection of reality? (c) Assume that the average returns of SMB (size factor), HML (value factor) and RN-R(market factor) are 0.1, 0.2 and 0.3, respectively. The risk free rate is 0.05. Compute Jensen's alpha (1-factor alpha) and Fama French 3-factor alpha for each mutual fund. 1. Mr. Q is trying to pick a mutual fund. There are two options, mutual funds A and B. The majority of stocks held by fund A have relatively high B/M and high market valuation. The majority of stocks held by fund B have relatively low B/M and low market valuation. The information about expected returns and betas are as below. Expected return $MSHMLBSMB Mutual fund A 0.3 0.3 0.7 0.8 Mutual fund B 0.4 0.3 0.5 0.4 Russell 2000 Growth Index Fund 0.4 0.4 0.6 0.3 Russell 1000 Growth Index Fund 0.3 0.5 0.9 0.3 Russell 1000 Value Index Fund 0.5 0.2 0.9 0.9 (a) Choose an index fund benchmark for each of mutual funds A and B, and compute the associated style-adjusted return. (b) Given the data in the table in CAPM likely to be a reflection of reality? (c) Assume that the average returns of SMB (size factor), HML (value thetor) and Rn - R (market factor) are 0.1, 0.2 and 0.3, respectively. The risk free rate is 0.05. Compute Jensen's alpha (1-factor alphin) and Fama-French 3-factor alpha for each mutual fund. 1. Mr. Q is trying to pick a mutual fund. There are two options, mutual funds A and B. The majority of stocks held by fund A have relatively high B/M and high market valuation. The majority of stocks held by fund B have relatively low B/M and low market valuation. The information about expected returns and betas are as below. Expected return BM BHML BSB Mutual fund A 0.3 0.7 0.8 Mutual fund B 0.4 0.3 0.5 0.4 Russell 2000 Growth Index Fund 0.4 0.3 Russell 1000 Growth Index Fund 0,3 Russell 1000 Value Index Fund 0.9 0.3 0.3 0.5 0.4 0.5 0.2 0.6 0.9 0.9 (a) Choose an index fund as a benchmark for each of mutual funds A and B, and compute the associated style-adjusted return. (b) Given the data in the table, is CAPM likely to be a reflection of reality? (c) Assume that the average returns of SMB (size factor), HML (value factor) and RN-R(market factor) are 0.1, 0.2 and 0.3, respectively. The risk free rate is 0.05. Compute Jensen's alpha (1-factor alpha) and Fama French 3-factor alpha for each mutual fund. 1. Mr. Q is trying to pick a mutual fund. There are two options, mutual funds A and B. The majority of stocks held by fund A have relatively high B/M and high market valuation. The majority of stocks held by fund B have relatively low B/M and low market valuation. The information about expected returns and betas are as below. Expected return $MSHMLBSMB Mutual fund A 0.3 0.3 0.7 0.8 Mutual fund B 0.4 0.3 0.5 0.4 Russell 2000 Growth Index Fund 0.4 0.4 0.6 0.3 Russell 1000 Growth Index Fund 0.3 0.5 0.9 0.3 Russell 1000 Value Index Fund 0.5 0.2 0.9 0.9 (a) Choose an index fund benchmark for each of mutual funds A and B, and compute the associated style-adjusted return. (b) Given the data in the table in CAPM likely to be a reflection of reality? (c) Assume that the average returns of SMB (size factor), HML (value thetor) and Rn - R (market factor) are 0.1, 0.2 and 0.3, respectively. The risk free rate is 0.05. Compute Jensen's alpha (1-factor alphin) and Fama-French 3-factor alpha for each mutual fund