Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1- Ms Sally is working as an architect with Mega Sdn. Bhd. For the whole of 2021, she receives the following income: Salary RM

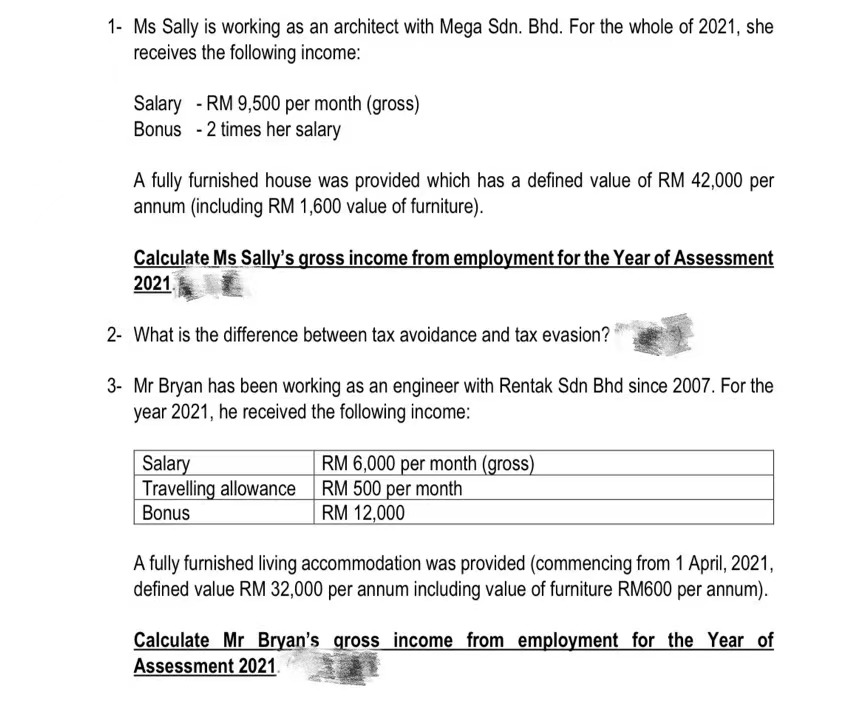

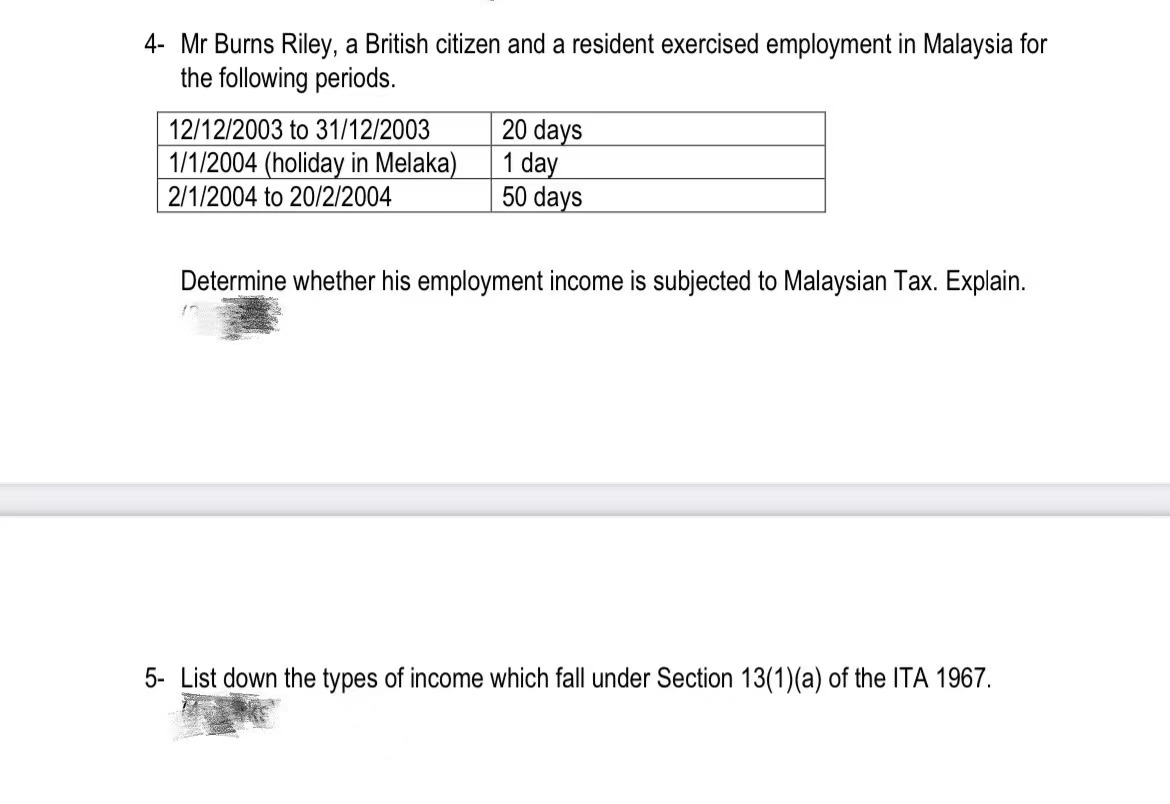

1- Ms Sally is working as an architect with Mega Sdn. Bhd. For the whole of 2021, she receives the following income: Salary RM 9,500 per month (gross) Bonus 2 times her salary A fully furnished house was provided which has a defined value of RM 42,000 per annum (including RM 1,600 value of furniture). Calculate Ms Sally's gross income from employment for the Year of Assessment 2021. 2- What is the difference between tax avoidance and tax evasion? 3- Mr Bryan has been working as an engineer with Rentak Sdn Bhd since 2007. For the year 2021, he received the following income: Salary RM 6,000 per month (gross) Travelling allowance RM 500 per month Bonus RM 12,000 A fully furnished living accommodation was provided (commencing from 1 April, 2021, defined value RM 32,000 per annum including value of furniture RM600 per annum). Calculate Mr Bryan's gross income from employment for the Year of Assessment 2021. 4- Mr Burns Riley, a British citizen and a resident exercised employment in Malaysia for the following periods. 12/12/2003 to 31/12/2003 1/1/2004 (holiday in Melaka) 2/1/2004 to 20/2/2004 20 days 1 day 50 days Determine whether his employment income is subjected to Malaysian Tax. Explain. 5- List down the types of income which fall under Section 13(1)(a) of the ITA 1967.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started