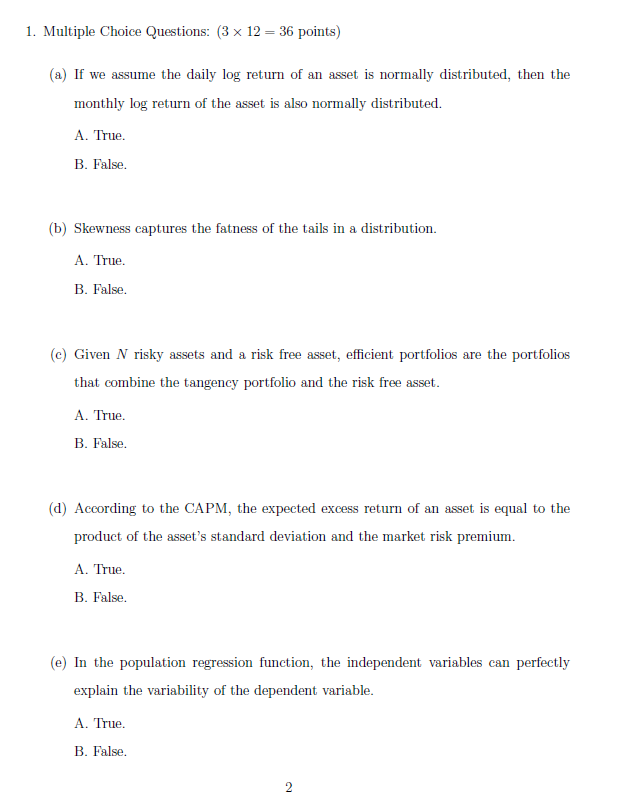

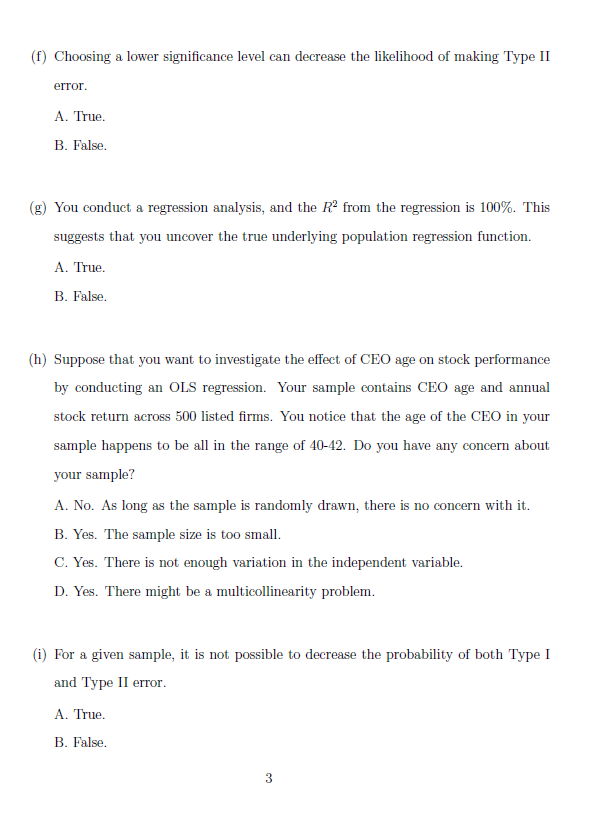

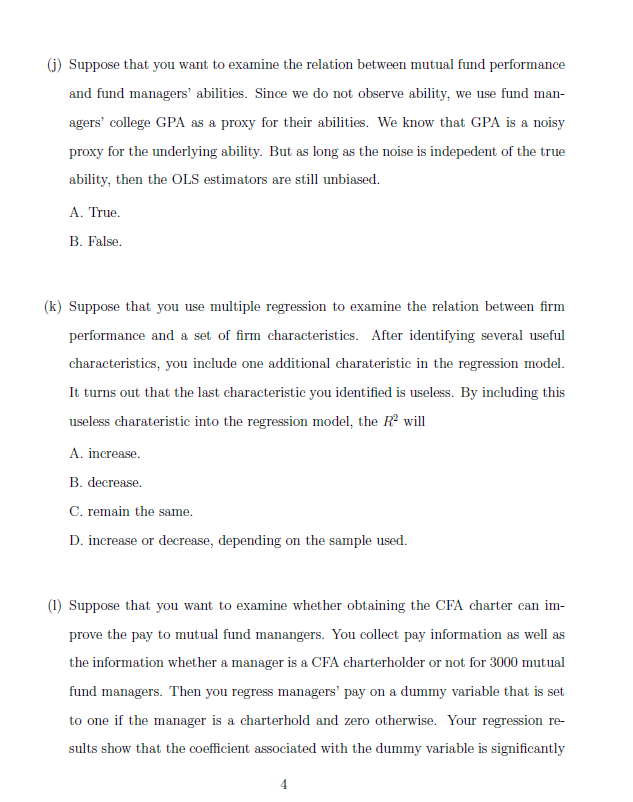

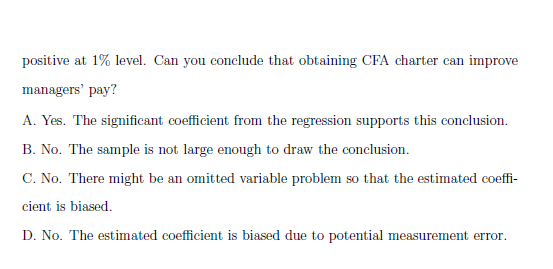

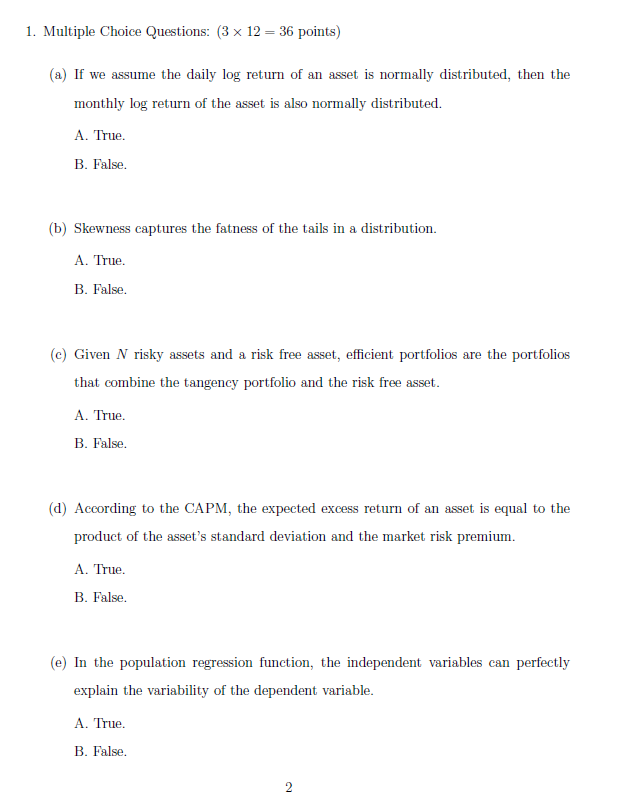

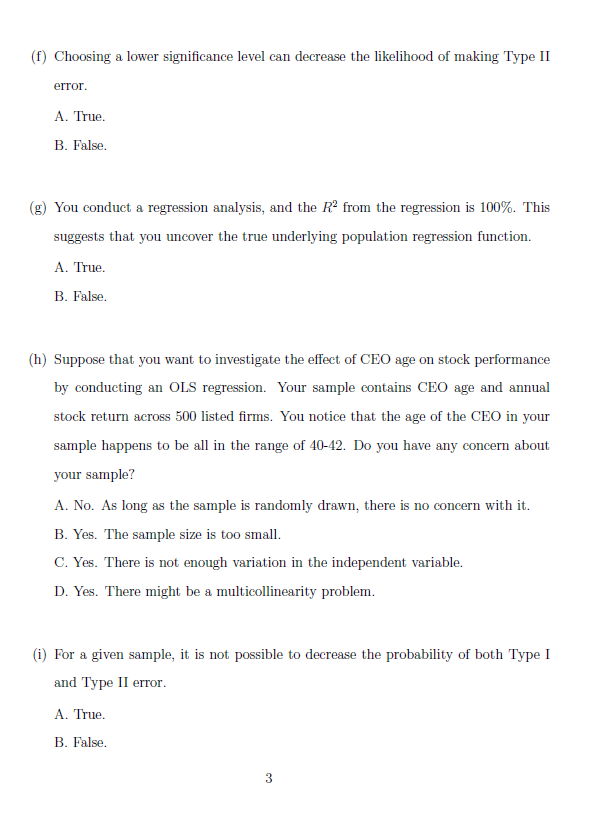

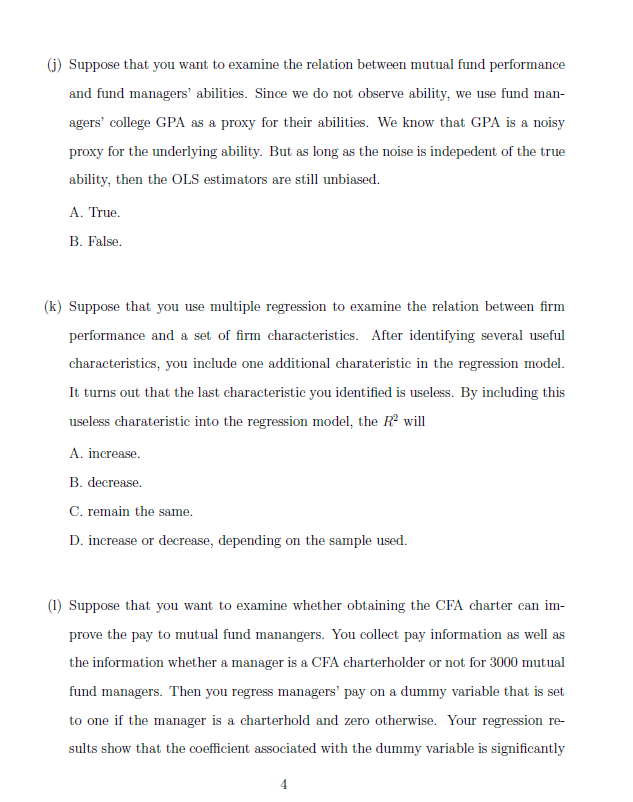

1. Multiple Choice Questions: (3 x 12 = 36 points) (a) If we assume the daily log return of an asset is normally distributed, then the monthly log return of the asset is also normally distributed. A. True. B. False. (b) Skewness captures the fatness of the tails in a distribution. A. True B. False. (c) Given N risky assets and a risk free asset, efficient portfolios are the portfolios that combine the tangency portfolio and the risk free asset. A. True. B. False. (d) According to the CAPM, the expected excess return of an asset is equal to the product of the asset's standard deviation and the market risk premium. A. True. B. False. (e) In the population regression function, the independent variables can perfectly explain the variability of the dependent variable. A. True. B. False. (f) Choosing a lower significance level can decrease the likelihood of making Type II error. A. True. B. False. (g) You conduct a regression analysis, and the R2 from the regression is 100%. This suggests that you uncover the true underlying population regression function. A. True. B. False. (h) Suppose that you want to investigate the effect of CEO age on stock performance by conducting an OLS regression. Your sample contains CEO age and annual stock return across 500 listed firms. You notice that the age of the CEO in your sample happens to be all in the range of 40-42. Do you have any concern about your sample? A. No. As long as the sample is randomly drawn, there is no concern with it. B. Yes. The sample size is too small. C. Yes. There is not enough variation in the independent variable. D. Yes. There might be a multicollinearity problem. (i) For a given sample, it is not possible to decrease the probability of both Type I and Type II error. A. True. B. False. () Suppose that you want to examine the relation between mutual fund performance and fund managers' abilities. Since we do not observe ability, we use fund man- agers' college GPA as a proxy for their abilities. We know that GPA is a noisy proxy for the underlying ability. But as long as the noise is indepedent of the true ability, then the OLS estimators are still unbiased. A. True. B. False. (k) Suppose that you use multiple regression to examine the relation between firm performance and a set of firm characteristics. After identifying several useful characteristics, you include one additional charateristic in the regression model. It turns out that the last characteristic you identified is useless. By including this useless charateristic into the regression model, the RP will A. increase. B. decrease. C. remain the same. D. increase or decrease, depending on the sample used. (1) Suppose that you want to examine whether obtaining the CFA charter can im- prove the pay to mutual fund manangers. You collect pay information as well as the information whether a manager is a CFA charterholder or not for 3000 mutual fund managers. Then you regress managers' pay on a dummy variable that is set to one if the manager is a charterhold and zero otherwise. Your regression re- sults show that the coefficient associated with the dummy variable is significantly positive at 1% level. Can you conclude that obtaining CFA charter can improve managers' pay? A. Yes. The significant coefficient from the regression supports this conclusion, B. No. The sample is not large enough to draw the conclusion. C. No. There might be an omitted variable problem so that the estimated coeffi- cient is biased. D. No. The estimated coefficient is biased due to potential measurement error 1. Multiple Choice Questions: (3 x 12 = 36 points) (a) If we assume the daily log return of an asset is normally distributed, then the monthly log return of the asset is also normally distributed. A. True. B. False. (b) Skewness captures the fatness of the tails in a distribution. A. True B. False. (c) Given N risky assets and a risk free asset, efficient portfolios are the portfolios that combine the tangency portfolio and the risk free asset. A. True. B. False. (d) According to the CAPM, the expected excess return of an asset is equal to the product of the asset's standard deviation and the market risk premium. A. True. B. False. (e) In the population regression function, the independent variables can perfectly explain the variability of the dependent variable. A. True. B. False. (f) Choosing a lower significance level can decrease the likelihood of making Type II error. A. True. B. False. (g) You conduct a regression analysis, and the R2 from the regression is 100%. This suggests that you uncover the true underlying population regression function. A. True. B. False. (h) Suppose that you want to investigate the effect of CEO age on stock performance by conducting an OLS regression. Your sample contains CEO age and annual stock return across 500 listed firms. You notice that the age of the CEO in your sample happens to be all in the range of 40-42. Do you have any concern about your sample? A. No. As long as the sample is randomly drawn, there is no concern with it. B. Yes. The sample size is too small. C. Yes. There is not enough variation in the independent variable. D. Yes. There might be a multicollinearity problem. (i) For a given sample, it is not possible to decrease the probability of both Type I and Type II error. A. True. B. False. () Suppose that you want to examine the relation between mutual fund performance and fund managers' abilities. Since we do not observe ability, we use fund man- agers' college GPA as a proxy for their abilities. We know that GPA is a noisy proxy for the underlying ability. But as long as the noise is indepedent of the true ability, then the OLS estimators are still unbiased. A. True. B. False. (k) Suppose that you use multiple regression to examine the relation between firm performance and a set of firm characteristics. After identifying several useful characteristics, you include one additional charateristic in the regression model. It turns out that the last characteristic you identified is useless. By including this useless charateristic into the regression model, the RP will A. increase. B. decrease. C. remain the same. D. increase or decrease, depending on the sample used. (1) Suppose that you want to examine whether obtaining the CFA charter can im- prove the pay to mutual fund manangers. You collect pay information as well as the information whether a manager is a CFA charterholder or not for 3000 mutual fund managers. Then you regress managers' pay on a dummy variable that is set to one if the manager is a charterhold and zero otherwise. Your regression re- sults show that the coefficient associated with the dummy variable is significantly positive at 1% level. Can you conclude that obtaining CFA charter can improve managers' pay? A. Yes. The significant coefficient from the regression supports this conclusion, B. No. The sample is not large enough to draw the conclusion. C. No. There might be an omitted variable problem so that the estimated coeffi- cient is biased. D. No. The estimated coefficient is biased due to potential measurement error