Question

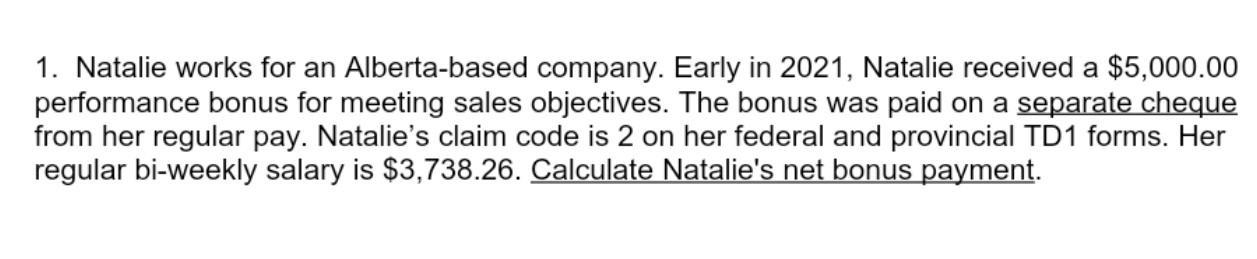

1. Natalie works for an Alberta-based company. Early in 2021, Natalie received a $5,000.00 performance bonus for meeting sales objectives. The bonus was paid

1. Natalie works for an Alberta-based company. Early in 2021, Natalie received a $5,000.00 performance bonus for meeting sales objectives. The bonus was paid on a separate cheque from her regular pay. Natalie's claim code is 2 on her federal and provincial TD1 forms. Her regular bi-weekly salary is $3,738.26. Calculate Natalie's net bonus payment. For each question, marks will be given for correct CPP, EI, federal tax, and provincial tax deductions, in addition to net pay. 5 marks will be available per question. ANY errors in the calculation deductions will result in an incorrect net pay, and a 0 for that part of the question. 20 marks available.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bonus received is subject to federal withholding at a 22 flat rate except those bonuses which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

12th Edition

978-0030243998, 30243998, 324422695, 978-0324422696

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App