Question

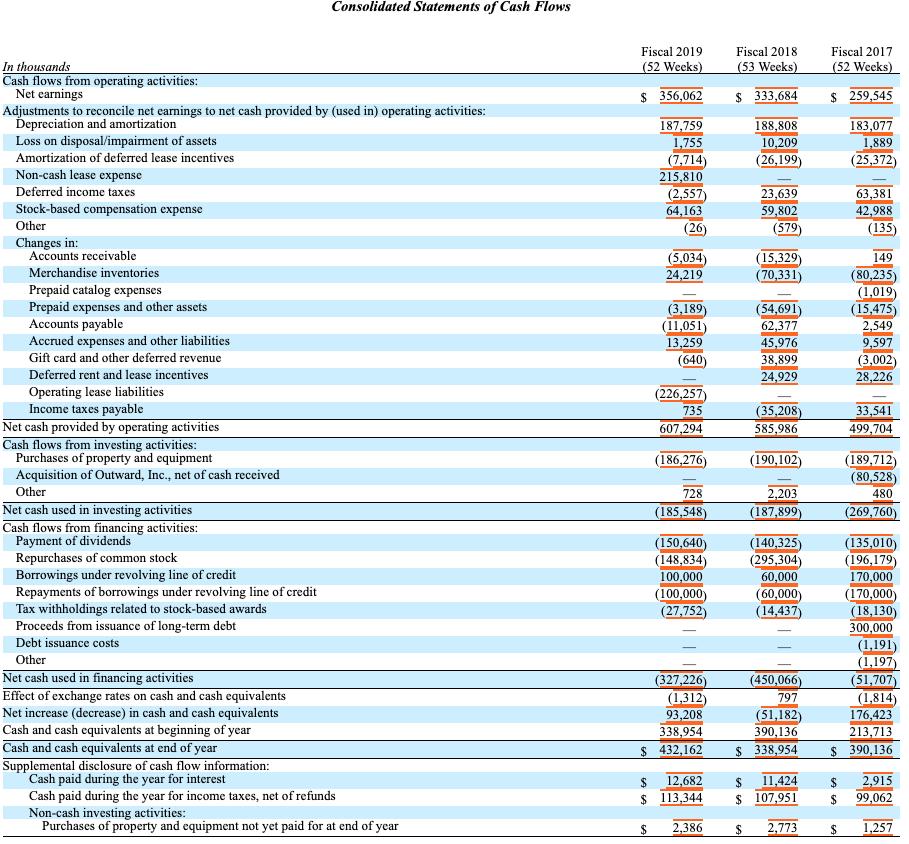

1. Net income (from the income statement) is a measure of operating activities but the income statement reports net income based on financial accounting, not

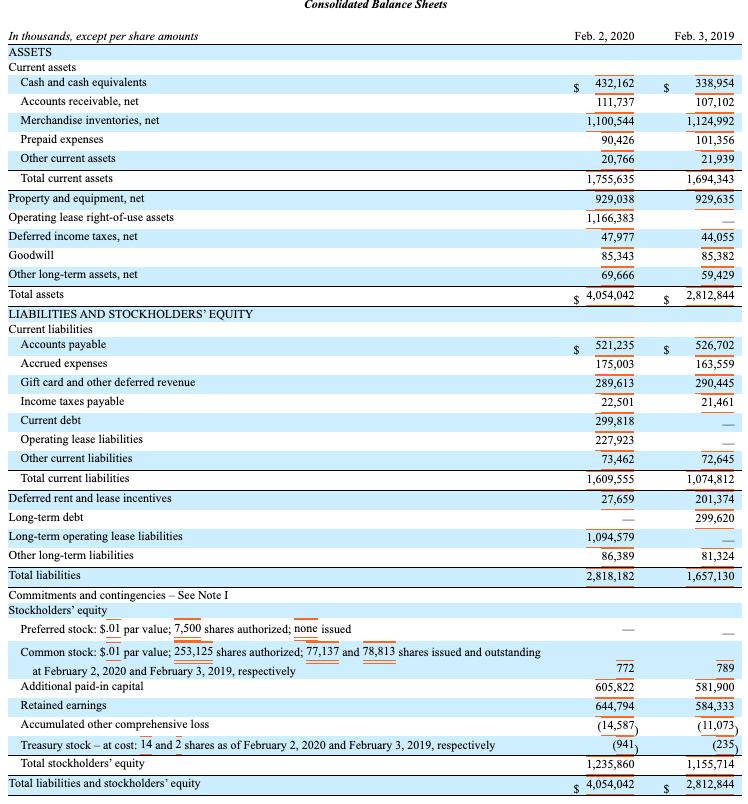

1. Net income (from the income statement) is a measure of operating activities but the income statement reports net income based on financial accounting, not based on cash flows. Thus, net income is adjusted from a financial accounting measure back to a cash flow by adding back expenses that do not affect cash (such as depreciation), subtracting non cash gains on sale of assets, adding back non cash losses from sales of assets, and adjusting for changes in current assets and current liabilities (information from the balance sheet).

2. Cash flows from the sale and purchase of long term assets are reported in the investing activities section.

3. Cash flows from changes in long term liabilities and owners’ equity are reported in the financing activities section.

Do you see net income from the income statement on your statement of cash flows? Can you recalculate the amounts reflected as changes in current assets and current liabilities from your balance sheet(s)?

In thousands Cash flows from operating activities: Net earnings Adjustments to reconcile net earnings to net cash provided by (used in) operating activities: Depreciation and amortization Loss on disposal/impairment of assets Amortization of deferred lease incentives Non-cash lease expense Deferred income taxes Stock-based compensation expense Other Changes in: Accounts receivable Merchandise inventories Prepaid catalog expenses Prepaid expenses and other assets Accounts payable Accrued expenses and other liabilities Gift card and other deferred revenue Deferred rent and lease incentives Operating lease liabilities Income taxes payable Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Acquisition of Outward, Inc., net of cash received Other Net cash used in investing activities Cash flows from financing activities: Payment of dividends Consolidated Statements of Cash Flows Repurchases of common stock Borrowings under revolving line of credit Repayments of borrowings under revolving line of credit Tax withholdings related to stock-based awards Proceeds from issuance of long-term debt Debt issuance costs Other Net cash used in financing activities Effect of exchange rates on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental disclosure of cash flow information: Cash paid during the year for interest Cash paid during the year for income taxes, net of refunds Non-cash investing activities: Purchases of property and equipment not yet paid for at end of year Fiscal 2019 (52 Weeks) $ 356,062 187,759 1,755 (7,714) 215,810 (2,557) 64,163 (26) (5,034) 24,219 (3,189) (11,051) 13,259 (640) (226,257) 735 607,294 (186,276) 728 (185,548) (150,640) (148,834) 100,000 (100,000) (27,752) (327,226) (1,312) 93,208 338,954 $ 432,162 $ 12,682 $ 113,344 $ 2,386 Fiscal 2018. (53 Weeks) $333,684 188,808 10,209 (26,199) 23,639 59,802 (579) (15,3291 (70,331) (54,691) 62,377 45,976 38,899 24,929 (35,208) 585,986 (190,102) 2,203 (187,899) (140,325) (295,304) 60,000 (60,000) (14,437) (450,066) 797 (51,182) 390,136 $ 338,954 $ 11,424 $ 107,951 $ 2,773 Fiscal 2017 (52 Weeks) $ 259,545 $ $ 183,077 1,889 (25,372) $ 63,381 42,988 (135) 149 (80,235) (1,019) (15,475) 2,549 9,597 (3,002) 28,226 33,541 499,704 (189,712) (80,528) 480 (269,760) (135,010) (196,179) 170,000 (1,191) (1,197) (51,707) (1,814) 176,423 213,713 $ 390,136 (170,000) (18,130) 300,000 2,915 99,062 1,257

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Yes the net income from the income statement is clearly shown on the statement of cash flows under Cash flows from operating activities as Net earning...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started