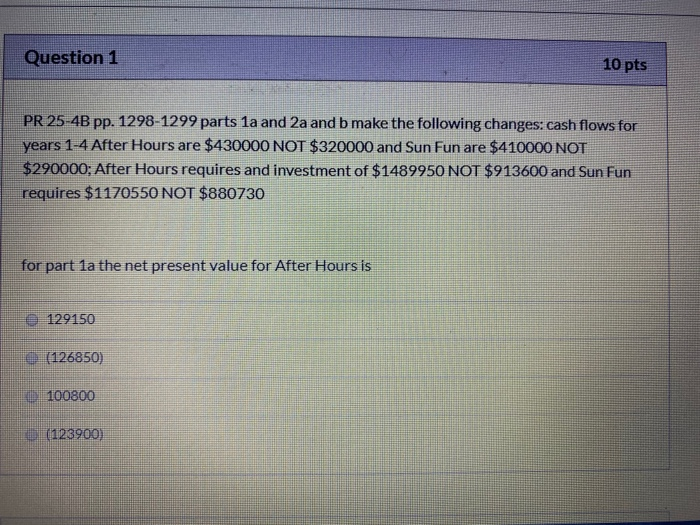

1) net present value for After Hours

2) net presnt value for Sun Fun

3) 2a- present value factor for After Hours

4) 2a- present value factor for Sun Fun

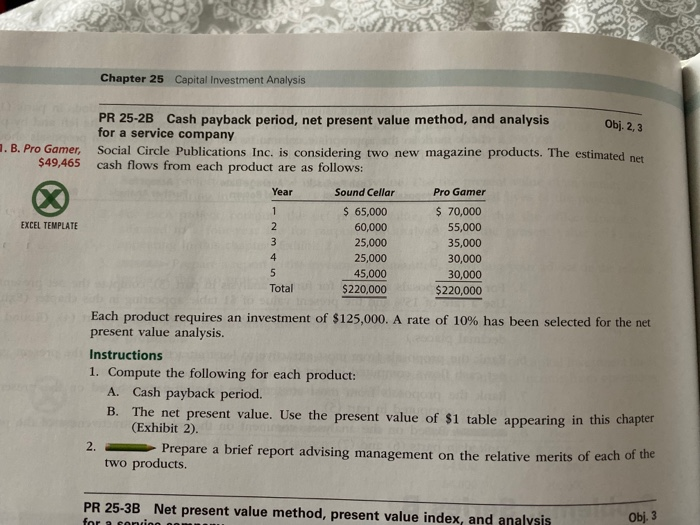

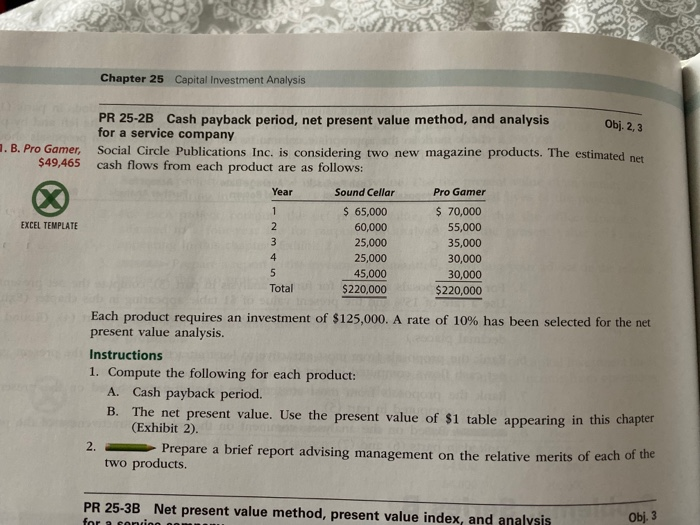

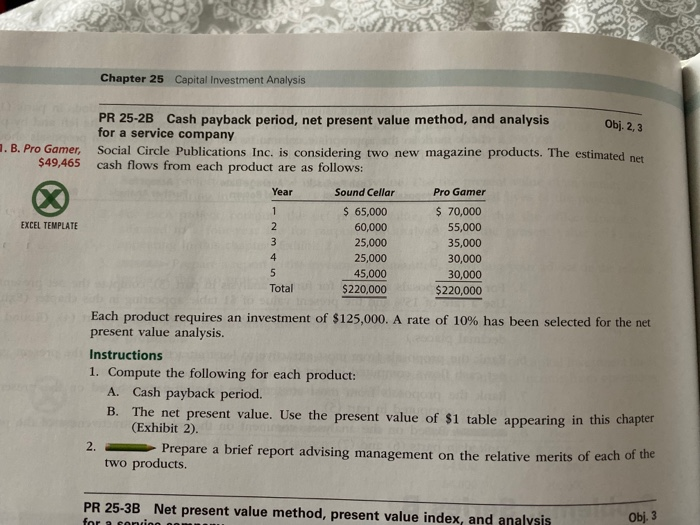

Chapter 25 Capital Investment Analysis Obj. 2, 3 1. B. Pro Gamer, $49,465 PR 25-2B Cash payback period, net present value method, and analysis for a service company Social Circle Publications Inc. is considering two new magazine products. The estimated net! cash flows from each product are as follows: Year Sound Cellar Pro Gamer $ 65,000 $ 70,000 60,000 55,000 25,000 35,000 25,000 30,000 45,000 30,000 Total $220,000 $220,000 EXCEL TEMPLATE Each product requires an investment of $125,000. A rate of 10% has been selected for the net present value analysis. Instructions 1. Compute the following for each product: A. Cash payback period. B. The net present value. Use the present value of $1 table appearing in this chapter (Exhibit 2). Prepare a brief report advising management on the relative merits of each of two products. PR 25-3B Net present value method, present value index, and analysis Obl 3 Question 1 10 pts PR 25-4B pp. 1298-1299 parts 1a and 2a and b make the following changes: cash flows for years 1-4 After Hours are $430000 NOT $320000 and Sun Fun are $410000 NOT $290000; After Hours requires and investment of $1489950 NOT $913600 and Sun Fun requires $1170550 NOT $880730 for part 1a the net present value for After Hours is 129150 (126850) 100800 (123900) Chapter 25 Capital Investment Analysis Obj. 2, 3 1. B. Pro Gamer, $49,465 PR 25-2B Cash payback period, net present value method, and analysis for a service company Social Circle Publications Inc. is considering two new magazine products. The estimated net! cash flows from each product are as follows: Year Sound Cellar Pro Gamer $ 65,000 $ 70,000 60,000 55,000 25,000 35,000 25,000 30,000 45,000 30,000 Total $220,000 $220,000 EXCEL TEMPLATE Each product requires an investment of $125,000. A rate of 10% has been selected for the net present value analysis. Instructions 1. Compute the following for each product: A. Cash payback period. B. The net present value. Use the present value of $1 table appearing in this chapter (Exhibit 2). Prepare a brief report advising management on the relative merits of each of two products. PR 25-3B Net present value method, present value index, and analysis Obl 3 Question 1 10 pts PR 25-4B pp. 1298-1299 parts 1a and 2a and b make the following changes: cash flows for years 1-4 After Hours are $430000 NOT $320000 and Sun Fun are $410000 NOT $290000; After Hours requires and investment of $1489950 NOT $913600 and Sun Fun requires $1170550 NOT $880730 for part 1a the net present value for After Hours is 129150 (126850) 100800 (123900)