Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Net Revenue before bad debt is _________. a) $ 700,000 b) $ 500,000 c) $ 1,200,000 d) $ 990,000 e) None of the above

1) Net Revenue before bad debt is _________.

a) $ 700,000

b) $ 500,000

c) $ 1,200,000

d) $ 990,000

e) None of the above

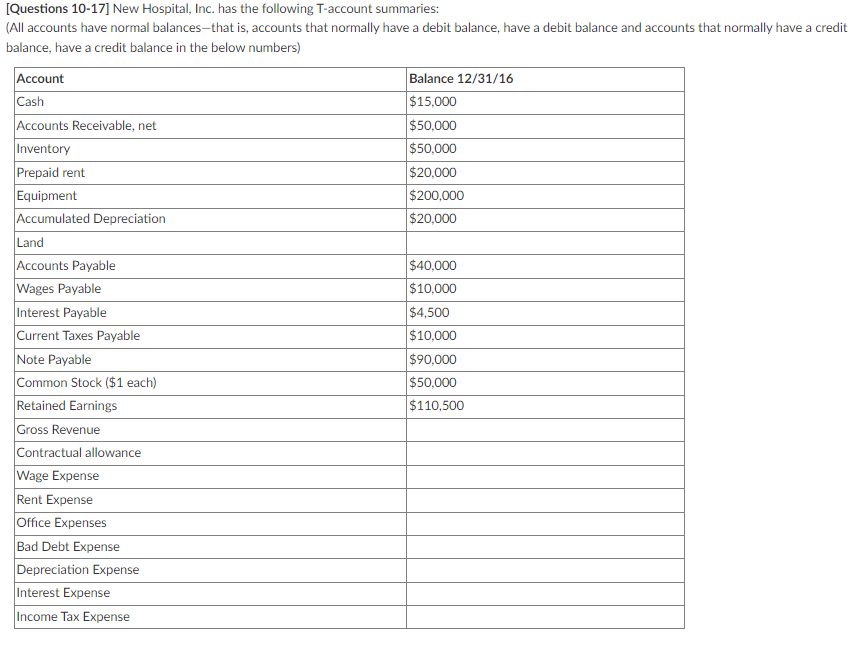

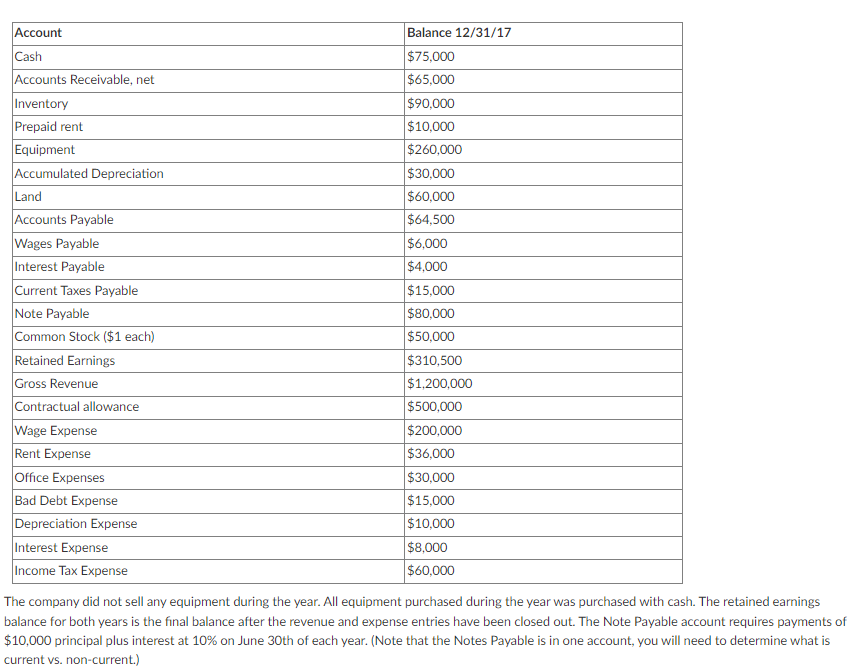

[Questions 10-17] New Hospital, Inc. has the following T-account summaries: (All accounts have normal balances-that is, accounts that normally have a debit balance, have a debit balance and accounts that normally have a credit balance, have a credit balance in the below numbers) Account Balance 12/31/16 Cash $15,000 Accounts Receivable, net $50,000 Inventory $50,000 Prepaid rent $20,000 Equipment $200,000 Accumulated Depreciation $20,000 Land Accounts Payable $40,000 Wages Payable $10,000 Interest Payable $4,500 Current Taxes Payable $10,000 Note Payable $90,000 Common Stock ($1 each) $50,000 Retained Earnings $110,500 Gross Revenue Contractual allowance Wage Expense Rent Expense Office Expenses Bad Debt Expense Depreciation Expense Interest Expense Income Tax Expense Account Balance 12/31/17 Cash $75,000 Accounts Receivable, net $65,000 Inventory $90,000 Prepaid rent $10,000 Equipment $260,000 Accumulated Depreciation $30,000 Land $60,000 Accounts Payable $64,500 Wages Payable $6,000 Interest Payable $4,000 Current Taxes Payable $15,000 Note Payable $80,000 Common Stock ($1 each) $50,000 Retained Earnings $310,500 Gross Revenue $1,200,000 Contractual allowance $500,000 Wage Expense $200,000 Rent Expense $36,000 Office Expenses $30,000 Bad Debt Expense $15,000 Depreciation Expense $10,000 Interest Expense $8,000 $60,000 Income Tax Expense The company did not sell any equipment during the year. All equipment purchased during the year was purchased with cash. The retained earnings balance for both years is the final balance after the revenue and expense entries have been closed out. The Note Payable account requires payments of $10,000 principal plus interest at 10% on June 30th of each year. (Note that the Notes Payable is in one account, you will need to determine what is current vs. non-current.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started