Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Notes or accounts receivables that result from sales transactions are often called: a) sales receivables. b) nontrade receivables. c) trade receivables. d) merchandise

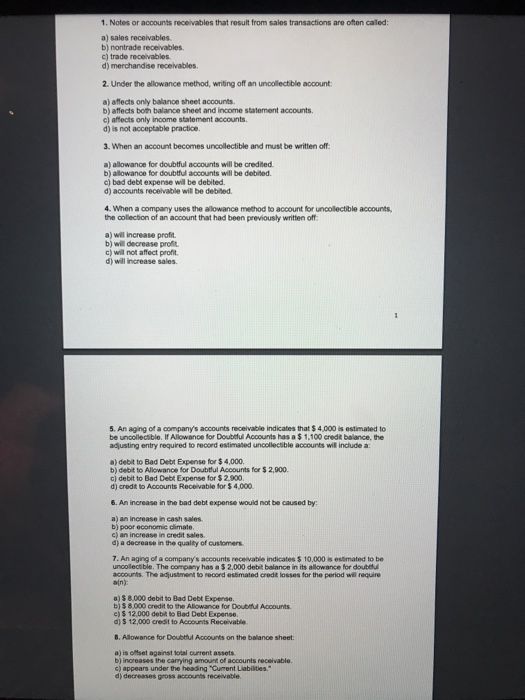

1. Notes or accounts receivables that result from sales transactions are often called: a) sales receivables. b) nontrade receivables. c) trade receivables. d) merchandise receivables. 2. Under the allowance method, writing off an uncollectible account: a) affects only balance sheet accounts. b) affects both balance sheet and income statement accounts. c) affects only income statement accounts. d) is not acceptable practice. 3. When an account becomes uncollectible and must be written off: a) allowance for doubtful accounts will be credited. b) allowance for doubtful accounts will be debited. c) bad debt expense will be debited. d) accounts receivable will be debited. 4. When a company uses the allowance method to account for uncollectible accounts, the collection of an account that had been previously written off: a) will increase profit. b) will decrease profit. c) will not affect profit. d) will increase sales. 5. An aging of a company's accounts receivable indicates that $4,000 is estimated to be uncollectible. If Allowance for Doubtful Accounts has a $1,100 credit balance, the adjusting entry required to record estimated uncollectible accounts will include a: a) debit to Bad Debt Expense for $4,000. b) debit to Allowance for Doubtful Accounts for $2,900. debit to Bad Debt Expense for $2,900. c) d) credit to Accounts Receivable for $4,000. 6. An increase in the bad debt expense would not be caused by: a) an increase in cash sales. b) poor economic climate. c) an increase in credit sales. d) a decrease in the quality of customers. 7. An aging of a company's accounts receivable indicates $ 10.000 is estimated to be uncollectible. The company has a $ 2.000 debit balance in its allowance for doubtful accounts. The adjustment to record estimated credit losses for the period will require a(n): a) $ 8,000 debit to Bad Debt Expense. b) $8,000 credit to the Allowance for Doubtful Accounts. e) $ 12,000 debit to Bad Debt Expense. d) $ 12,000 credit to Accounts Receivable. 8. Allowance for Doubtful Accounts on the balance sheet: a) is offset against total current assets. b) increases the carrying amount of accounts receivable. c) appears under the heading "Current Liabilities." d) decreases gross accounts receivable 1

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Question Solution 1 Notes or accounts receivables that results from sales transactions are often cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started