Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. NPV Calculation: Create an Excel spreadsheet to calculate the net present value of investing in bottling (including the purchase of the label machine and

1. NPV Calculation: Create an Excel spreadsheet to calculate the net present value of investing in bottling (including the purchase of the label machine and training). Describe the NPV highlighting the key assumptions made. Would you or would you not invest in this project?

2. Calculate NPV if interest rates were 5%, 8%, 10%, and 12%. Discuss how NPV would change and the impact of that change on your decision to invest?

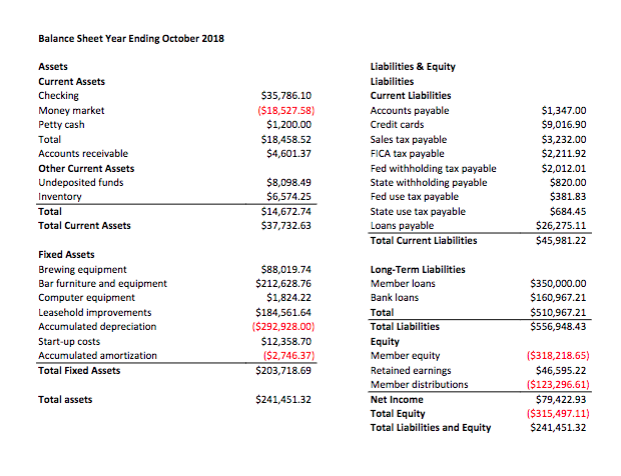

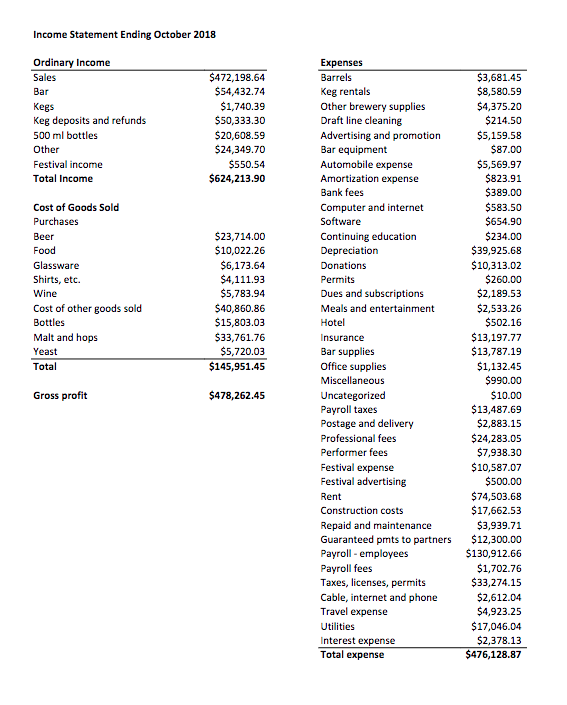

Balance Sheet Year Ending October 2018 3,232.00 Accounts receivable Fed withholding tax payable t Assets t Assets Total Current Liabilities Bar furniture and equipment Member loans $292,928.00) 203,718.69 Income Statement Ending October 2018 Ordinary Income Keg deposits and refunds Festival income Amortization expense Cost of Goods Sold Computer and internet ases Shirts, etc. tions Cost of other goods sold 5 permits Balance Sheet Year Ending October 2018 3,232.00 Accounts receivable Fed withholding tax payable t Assets t Assets Total Current Liabilities Bar furniture and equipment Member loans $292,928.00) 203,718.69 Income Statement Ending October 2018 Ordinary Income Keg deposits and refunds Festival income Amortization expense Cost of Goods Sold Computer and internet ases Shirts, etc. tions Cost of other goods sold 5 permitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started