Answered step by step

Verified Expert Solution

Question

1 Approved Answer

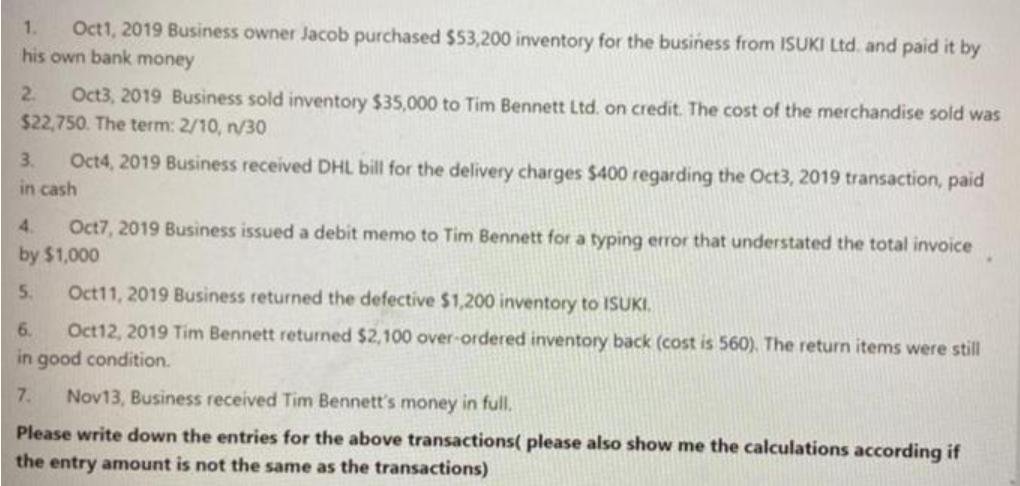

1. Oct1, 2019 Business owner Jacob purchased $53,200 inventory for the business from ISUKI Ltd. and paid it by his own bank money Oct3,

1. Oct1, 2019 Business owner Jacob purchased $53,200 inventory for the business from ISUKI Ltd. and paid it by his own bank money Oct3, 2019 Business sold inventory $35,000 to Tim Bennett Ltd. on credit. The cost of the merchandise sold was $22,750. The term: 2/10, n/30 2. Oct4, 2019 Business received DHL bill for the delivery charges $400 regarding the Oct3, 2019 transaction, paid in cash 3. 4. Oct7, 2019 Business issued a debit memo to Tim Bennett for a typing error that understated the total invoice by $1,000 5. Oct11, 2019 Business returned the defective $1,200 inventory to ISUKI. 6. Oct12, 2019 Tim Bennett returned $2,100 over-ordered inventory back (cost is 560), The return items were still in good condition. 7. Nov13, Business received Tim Bennett's money in full. Please write down the entries for the above transactions( please also show me the calculations according if the entry amount is not the same as the transactions)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Particular 1Oct Inventory Date Debit Credit 53200 to capital 5320...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started