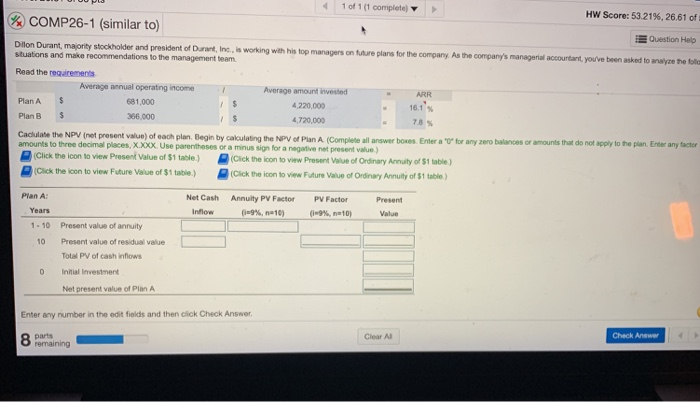

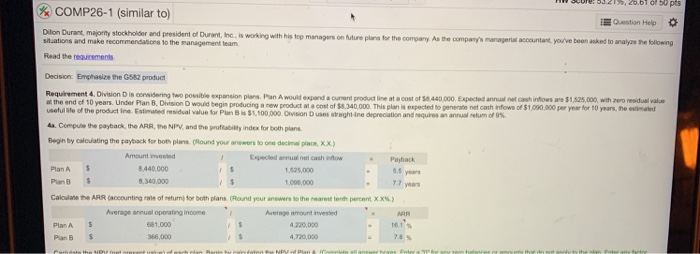

1 of 1 (1 complete) HW Score: 53.21 % , 26.61 of COMP26-1 (similar to EQuestion Help Dilon Durant, majority stockholder and president of Durant, Inc., is working with his top managers on future plans for the company As the company's managerial accountant, you've been asked to analyze the folla situations and make recommendations to the management team Read the requirements Average annual operatng income Average amount invested ARR S Plan A 681,000 4.220.000 16.1% S Plan B 366.000 4,720,000 78 % Caclulate the NPV (net present value) of each plan. Begin by caloulating the NPV of Plan A (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX Use parentheses or a minus sign for a negative net present value.) (Click the icon to view Present Value of $1 table.) (Cick the icon to view Present Value of Ordinary Annuity of $1 table) (Click the icon to view Future Value of $1 table.) (Cick the icon to view Future Value of Ordinary Annuity of $1 table) Plan A Net Cash Annuity PV Factor PV Factor Present Years (-9 % , n- 10) (i-9 % , na 10) Inflow Value 1-10 Present value of annuity 10 Present value of residual value Total PV of cash inflows. Initial Investment Net present value of Plan A Enter any number in the edit fiolds and then click Check Answer. parts remaining Check Answer Clear Al CO w.soruso3.2199, 20.OT Of 50 pts COMP26-1 (similar to) Question Help Dilon Durant, majority stockholder and president of Durant, Inc, is working with his top managers on future plans for the company As the company's managerial accountant, you've been asked to analyze the following situations and make recommendations to the management team Read the requirements Decision Emphasize the G582 product Requirement 4. Division D is considering two possible exxpansion plans. Pan A would expand a curnent product line at a cost of $8.440 000. Expected annual net cash infows ane $1,525,000, wth zero residual value at the end ef 10 years. Under Plan B, Dvision D would begin producing a new product at a cost of $s8.340 000 This plan is expected to generate net cash infows of $1,090,000 per year for 10 years, the esttmaled useful Sfe of the product Ine. Estimated residual value for Plan B is $1,100.000 Division D uses straght-ine depreciation and requires an annual retum of 9%. 4a. Compute the payback, the ARR, the NPV and the proftability index for both plans Begin by caloulating the payback for both plans (Round your anewers to one decimal place, X.X) Amount investod Espected arnual net cash innow Payback Plan A 8.440.000 1,525,000 5.5 vears 8,340,000 Plan B 77 years 1,090.000- Caloulate the ARR (accounting rate of retum) for both plans (Round your answers to the nearest tenth percent XX%) Average annual operating income Average amount invested ARR 16.1% 681,000 4220,000 Plan At 366.000 4.720.000 78% Plan B Fntee an n he Cedsta he Nm/ toed pansect us ) of eact nin eadaten Pe NPV od pan& inmnte all ane heen Enter a w anu em hr or the dnd