Answered step by step

Verified Expert Solution

Question

1 Approved Answer

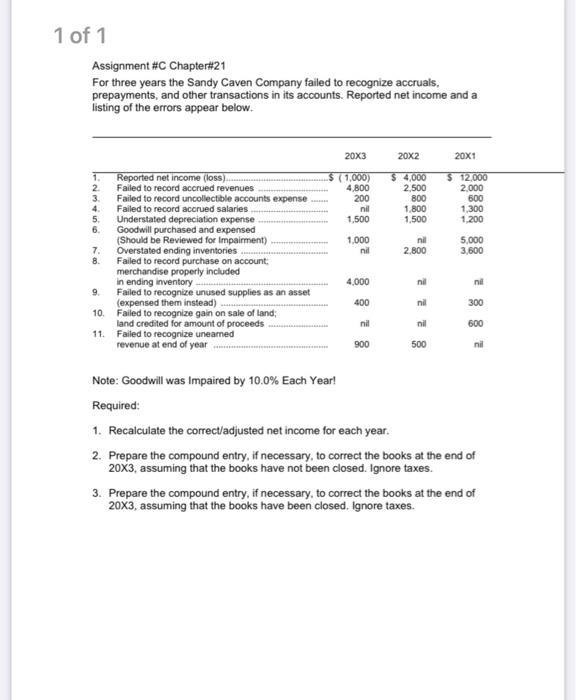

1 of 1 Assignment #C Chapter#21 For three years the Sandy Caven Company failed to recognize accruals, prepayments, and other transactions in its accounts.

1 of 1 Assignment #C Chapter#21 For three years the Sandy Caven Company failed to recognize accruals, prepayments, and other transactions in its accounts. Reported net income and a listing of the errors appear below. 20X3 20x2 20X1 1. Reported net income (loss). $ (1,000) $4,000 $12,000 2. Failed to record accrued revenues 4,800 2,500 2,000 3. Failed to record uncollectible accounts expense 200 800 600 4. Failed to record accrued salaries. nil 1,800 1,300 5. Understated depreciation expense 1,500 1,500 1,200 6. Goodwill purchased and expensed (Should be Reviewed for Impairment). 1,000 nil 5,000 7. Overstated ending inventories nil 2,800 3,600 8. Failed to record purchase on account merchandise properly included in ending inventory. 4,000 9. Failed to recognize unused supplies as an asset (expensed them instead) 400 2 2 nil ni nil 300 nil 11. Failed to recognize unearned 900 500 28 nil 600 nil 10. Failed to recognize gain on sale of land; land credited for amount of proceeds revenue at end of year Note: Goodwill was Impaired by 10.0% Each Year! Required: 1. Recalculate the correct/adjusted net income for each year. 2. Prepare the compound entry, if necessary, to correct the books at the end of 20X3, assuming that the books have not been closed. Ignore taxes. 3. Prepare the compound entry, if necessary, to correct the books at the end of 20X3, assuming that the books have been closed. Ignore taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started