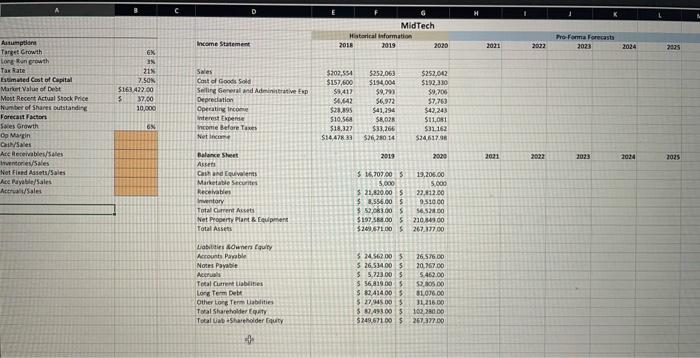

1 of 1 Valuation Modeling Assignment. Assume that Mid-Tech is expected to grow at 6% for the next five years. Beyond the fifth year, the company is expected to grow at a constant long-run growth rate of 3%. The cost of capital is 7.5%. Estimate operating value drivers based on the most recent two years. Construct a DCF valuation model for Mid-Tech and estimate its base case intrinsic enterprise value and estimated price per share. 1. Conduct a sensitivity analysis on the estimated stock price assuming a forecast error of +/- 5% for the operating assumptions. What is your estimated valuation range for Midland? Identify the upside versus downside risk. Graph your results. 2. What is your recommended target price to buy and sell the stock? Why C MidTech Material information 2018 2019 2020 Income Statement 2021 2002 Proforma Forecast 2023 2024 2035 GX 20N 7.SON $163.422.00 $ 37.00 10.000 Asumption Target Growth Long Ron growth Tax Rate Lumated Cost of Capital Market value of Debt Most Recent Actual Stock Price Nuber of shares outstanding Forecast Factors Sales Growth Do Margin CN/ Ate Receivablew Sales wtore Sales Net Fixed Assets/Sales Ace Payable/Sales Actuales Sales Cast of Goods Sold Selling General and Administrative in Depreciation Operating from interest Expen come Before Taxes Netcome $202,554 $157,600 $9,417 54.642 $28.95 $10.568 $18.327 $14,47833 5252,063 $154,004 59.79 56,972 $41,294 5.628 $32,266 $26,280 14 $252.042 $192.330 59.705 $7,760 $42.243 $11,081 $31162 $246170 2019 2000 2021 2022 2029 2024 2025 19,205.00 5.000 Balance Sheet Asset Cash and Louivalents Marketable Secure Receivables Inventory Totalcar Aucts Net Property Plant & Event Total Assets $ 16,707,00 5 5.000 $ 21,000.00 $ $ 8,556.00 $ $ 52,083.00 $ $197.588.00 5 $240671005 22.12.00 9,510.00 565.00 210.143.00 267. 177.00 Labels owners Equity Account Pagable Notes Payable Accra Total Current abilities Long Term Debt Other tong Term Liabilities Tural Shareholder Equity Total Shareholder ty S 2562005 5 26,514005 $ 5,723.00 S $ 56,819 005 5 82.414005 $ 27.500 5 $ 89,493.00 $ $249.671.00 $ 26 576.00 20.767.00 5,402.00 SO DO 81,09600 32.216.00 1020 DO 267-377.00 + 1 of 1 Valuation Modeling Assignment. Assume that Mid-Tech is expected to grow at 6% for the next five years. Beyond the fifth year, the company is expected to grow at a constant long-run growth rate of 3%. The cost of capital is 7.5%. Estimate operating value drivers based on the most recent two years. Construct a DCF valuation model for Mid-Tech and estimate its base case intrinsic enterprise value and estimated price per share. 1. Conduct a sensitivity analysis on the estimated stock price assuming a forecast error of +/- 5% for the operating assumptions. What is your estimated valuation range for Midland? Identify the upside versus downside risk. Graph your results. 2. What is your recommended target price to buy and sell the stock? Why C MidTech Material information 2018 2019 2020 Income Statement 2021 2002 Proforma Forecast 2023 2024 2035 GX 20N 7.SON $163.422.00 $ 37.00 10.000 Asumption Target Growth Long Ron growth Tax Rate Lumated Cost of Capital Market value of Debt Most Recent Actual Stock Price Nuber of shares outstanding Forecast Factors Sales Growth Do Margin CN/ Ate Receivablew Sales wtore Sales Net Fixed Assets/Sales Ace Payable/Sales Actuales Sales Cast of Goods Sold Selling General and Administrative in Depreciation Operating from interest Expen come Before Taxes Netcome $202,554 $157,600 $9,417 54.642 $28.95 $10.568 $18.327 $14,47833 5252,063 $154,004 59.79 56,972 $41,294 5.628 $32,266 $26,280 14 $252.042 $192.330 59.705 $7,760 $42.243 $11,081 $31162 $246170 2019 2000 2021 2022 2029 2024 2025 19,205.00 5.000 Balance Sheet Asset Cash and Louivalents Marketable Secure Receivables Inventory Totalcar Aucts Net Property Plant & Event Total Assets $ 16,707,00 5 5.000 $ 21,000.00 $ $ 8,556.00 $ $ 52,083.00 $ $197.588.00 5 $240671005 22.12.00 9,510.00 565.00 210.143.00 267. 177.00 Labels owners Equity Account Pagable Notes Payable Accra Total Current abilities Long Term Debt Other tong Term Liabilities Tural Shareholder Equity Total Shareholder ty S 2562005 5 26,514005 $ 5,723.00 S $ 56,819 005 5 82.414005 $ 27.500 5 $ 89,493.00 $ $249.671.00 $ 26 576.00 20.767.00 5,402.00 SO DO 81,09600 32.216.00 1020 DO 267-377.00 +