Question

1) Office equipment is being depreciated over 60 months. 2) At 31 December 2019, $2,500 of previously unearned agency fees had been earned. 3) Accrued

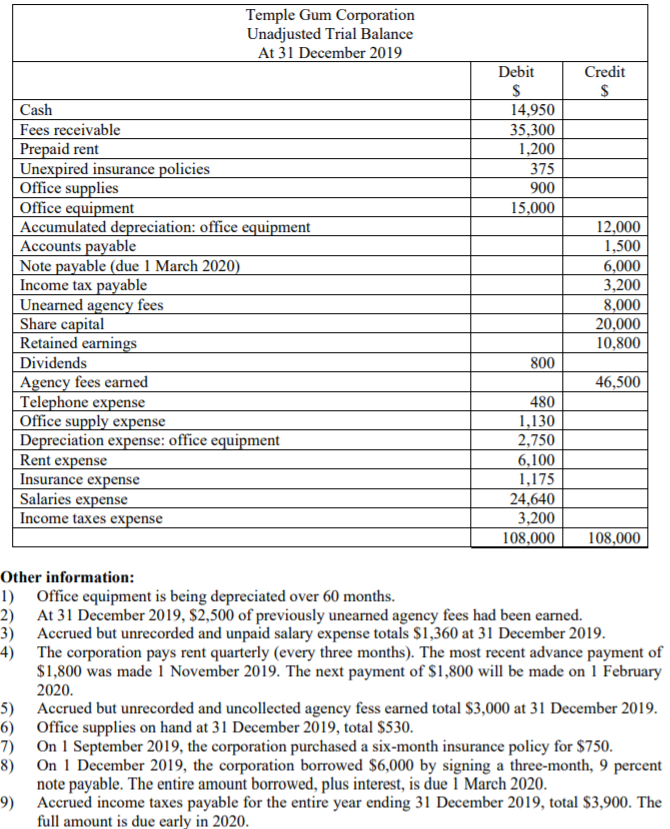

1) Office equipment is being depreciated over 60 months.

2) At 31 December 2019, $2,500 of previously unearned agency fees had been earned.

3) Accrued but unrecorded and unpaid salary expense totals $1,360 at 31 December 2019.

4) The corporation pays rent quarterly (every three months). The most recent advance payment of $1,800 was made 1 November 2019. The next payment of $1,800 will be made on 1 February 2020.

5) Accrued but unrecorded and uncollected agency fess earned total $3,000 at 31 December 2019.

6) Office supplies on hand at 31 December 2019, total $530.

7) On 1 September 2019, the corporation purchased a six-month insurance policy for $750.

8) On 1 December 2019, the corporation borrowed $6,000 by signing a three-month, 9 percent note payable. The entire amount borrowed, plus interest, is due 1 March 2020.

9) Accrued income taxes payable for the entire year ending 31 December 2019, total $3,900. The full amount is due early in 2020.

Question 2

Prepare an after-closing trial balance at 31 December 2019

Temple Gum Corporation Unadjusted Trial Balance At 31 December 2019 Debit Credit 14,950 35,300 1,200 375 900 15,000 Cash Fees receivable Prepaid rent Unexpired insurance policies Office supplies Office equipment Accumulated depreciation: office equipment Accounts payable Note payable (due 1 March 2020) Income tax payable Unearned agency fees Share capital Retained earnings Dividends Agency fees earned Telephone expense Office supply expense Depreciation expense: office equipment Rent expense Insurance expense Salaries expense Income taxes expense 12.000 1,500 6,000 3,200 8.000 20,000 10,800 800 46,500 480 1,130 2,750 6,100 1,175 24,640 3,200 108,000 108,000 Other information: 1) Office equipment is being depreciated over 60 months 2) At 31 December 2019, $2,500 of previously unearned agency fees had been earned. 3) Accrued but unrecorded and unpaid salary expense totals $1,360 at 31 December 2019. 4) The corporation pays rent quarterly (every three months). The most recent advance payment of $1,800 was made 1 November 2019. The next payment of $1,800 will be made on 1 February 2020. 5) Accrued but unrecorded and uncollected agency fess earned total $3,000 at 31 December 2019. 6) Office supplies on hand at 31 December 2019, total $530. 7) On 1 September 2019, the corporation purchased a six-month insurance policy for $750. On 1 December 2019, the corporation borrowed $6,000 by signing a three-month, 9 percent note payable. The entire amount borrowed, plus interest, is due 1 March 2020. 9) Accrued income taxes payable for the entire year ending 31 December 2019, total $3,900. The full amount is due early in 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started