Answered step by step

Verified Expert Solution

Question

1 Approved Answer

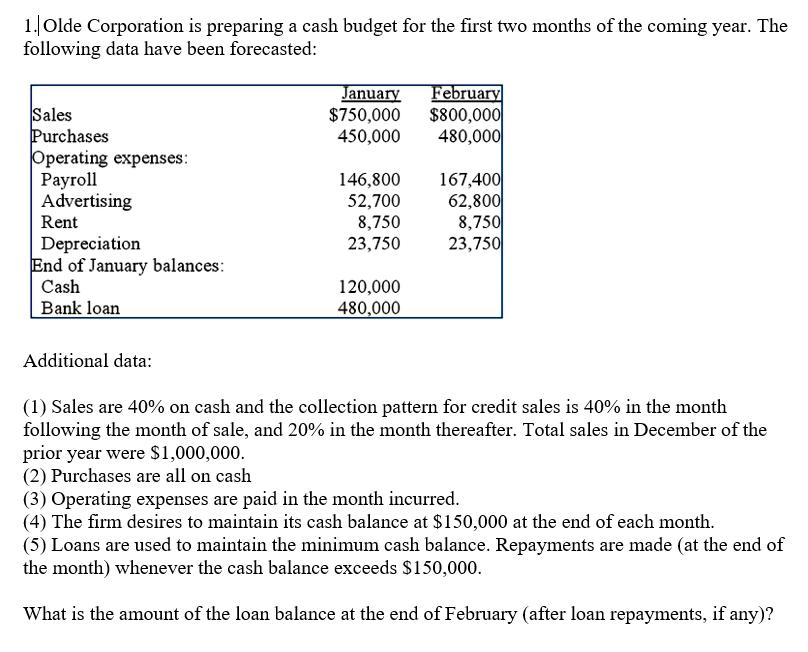

1. Olde Corporation is preparing a cash budget for the first two months of the coming year. The following data have been forecasted: Sales

1. Olde Corporation is preparing a cash budget for the first two months of the coming year. The following data have been forecasted: Sales Purchases Operating expenses: Payroll Advertising Rent Depreciation End of January balances: Cash Bank loan Additional data: January $750,000 450,000 146,800 52,700 8,750 23,750 120,000 480,000 February $800,000 480,000 167,400 62,800 8,750 23,750 (1) Sales are 40% on cash and the collection pattern for credit sales is 40% in the month following the month of sale, and 20% in the month thereafter. Total sales in December of the prior year were $1,000,000. (2) Purchases are all on cash (3) Operating expenses are paid in the month incurred. (4) The firm desires to maintain its cash balance at $150,000 at the end of each month. (5) Loans are used to maintain the minimum cash balance. Repayments are made (at the end of the month) whenever the cash balance exceeds $150,000. What is the amount of the loan balance at the end of February (after loan repayments, if any)?

Step by Step Solution

★★★★★

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Beginning cash balance Collection from sales Total Cash available to spend Less ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started