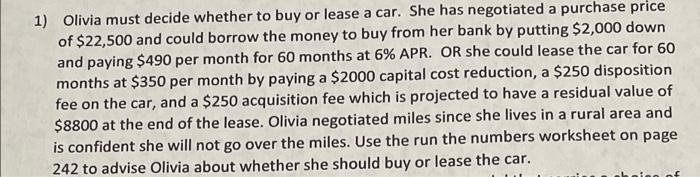

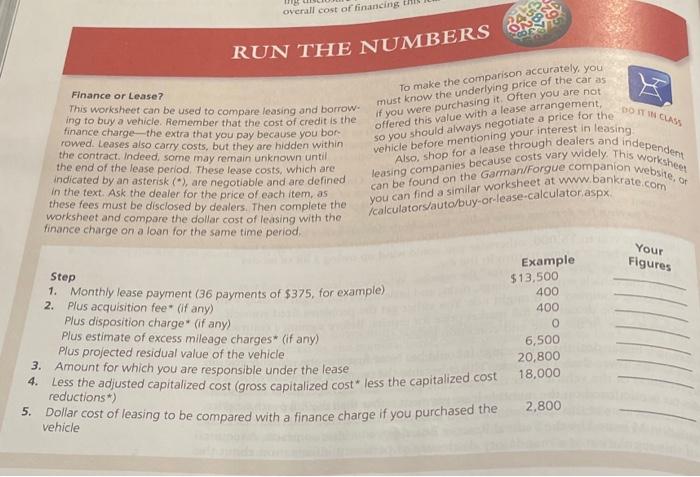

1) Olivia must decide whether to buy or lease a car. She has negotiated a purchase price of $22,500 and could borrow the money to buy from her bank by putting $2,000 down and paying $490 per month for 60 months at 6% APR. OR she could lease the car for 60 months at $350 per month by paying a $2000 capital cost reduction, a $250 disposition fee on the car, and a $250 acquisition fee which is projected to have a residual value of $8800 at the end of the lease. Olivia negotiated miles since she lives in a rural area and is confident she will not go over the miles. Use the run the numbers worksheet on page 242 to advise Olivia about whether she should buy or lease the car. a overall cost of financing RUN THE NUMBERS Vy DO IT IN CLASS To make the comparison accurately, you must know the underlying price of the car as if you were purchasing it. Often you are not offered this value with a lease arrangement, so you should always negotiate a price for the vehicle before mentioning your interest in leasing Finance or Lease? This worksheet can be used to compare leasing and borrow- ing to buy a vehicle. Remember that the cost of credit is the finance charge-the extra that you pay because you bor rowed. Leases also carry costs, but they are hidden within the contract. Indeed, some may remain unknown until the end of the lease period. These lease costs, which are indicated by an asterisk (*), are negotiable and are defined in the text. Ask the dealer for the price of each item, as these fees must be disclosed by dealers. Then complete the worksheet and compare the dollar cost of leasing with the finance charge on a loan for the same time period. leasing companies because costs vary widely. This worksheet Also, shop for a lease through dealers and independent can be found on the Garman/Forgue companion website, of find I calculators/auto/buy-or-lease-calculator.aspx Your Figures Step 2. 1. Monthly lease payment (36 payments of $375, for example) Plus acquisition fee* (if any) Plus disposition charge" (if any) Plus estimate of excess mileage charges* (if any) Plus projected residual value of the vehicle 3. Amount for which you are responsible under the lease 4. Less the adjusted capitalized cost (gross capitalized cost* less the capitalized cost reductions *) 5. Dollar cost of leasing to be compared with a finance charge if you purchased the vehicle Example $13,500 400 400 0 6,500 20,800 18,000 2,800