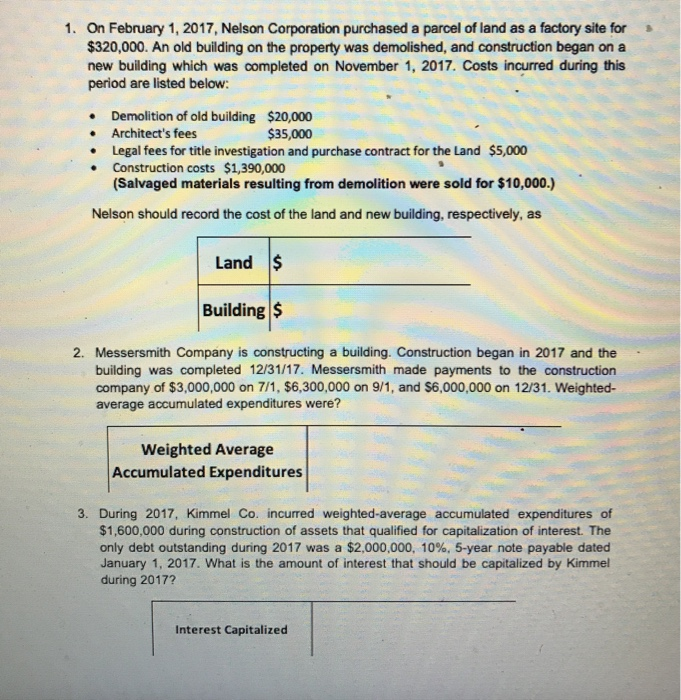

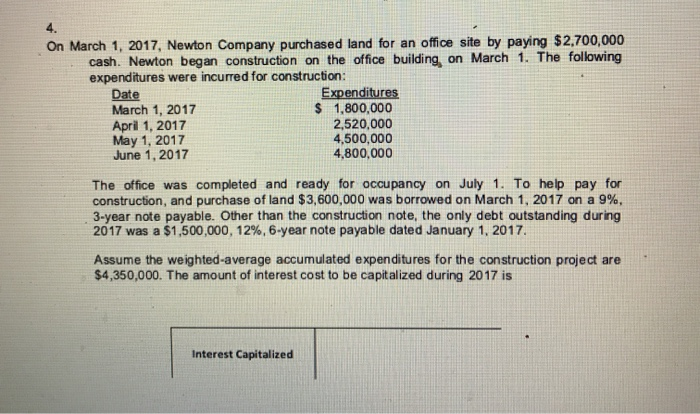

1. On February 1, 2017, Nelson Corporation purchased a parcel of land as a factory site for $320,000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2017. Costs incurred during this period are listed below: Demolition of old building $20,000 Architect's fees $35,000 Legal fees for title investigation and purchase contract for the Land $5,000 Construction costs $1,390,000 (Salvaged materials resulting from demolition were sold for $10,000.) Nelson should record the cost of the land and new building, respectively, as Land Building $ 2. Messersmith Company is constructing a building. Construction began in 2017 and the building was completed 12/31/17. Messersmith made payments to the construction company of $3,000,000 on 7/1, $6,300,000 on 9/1, and $6,000,000 on 12/31. Weighted- average accumulated expenditures were? Weighted Average Accumulated Expenditures 3. During 2017, Kimmel Co. incurred weighted-average accumulated expenditures of $1,600,000 during construction of assets that qualified for capitalization of interest. The only debt outstanding during 2017 was a $2,000,000, 10%, 5-year note payable dated 2017. What is the amount of interest that should be capitalized by Kimmel during 2017? Interest Capitalized On March 1, 2017, Newton Company purchased land for an office site by paying $2,700,000 cash. Newton began construction on the office building, on March 1. The following expenditures were incurred for construction: Date Expenditures March 1, 2017 $ 1,800,000 April 1, 2017 2,520,000 May 1, 2017 4,500,000 June 1, 2017 4,800,000 The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $3,600,000 was borrowed on March 1, 2017 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2017 was a $1,500,000, 12%, 6-year note payable dated January 1, 2017. Assume the weighted average accumulated expenditures for the construction project are $4,350,000. The amount of interest cost to be capitalized during 2017 is Interest Capitalized