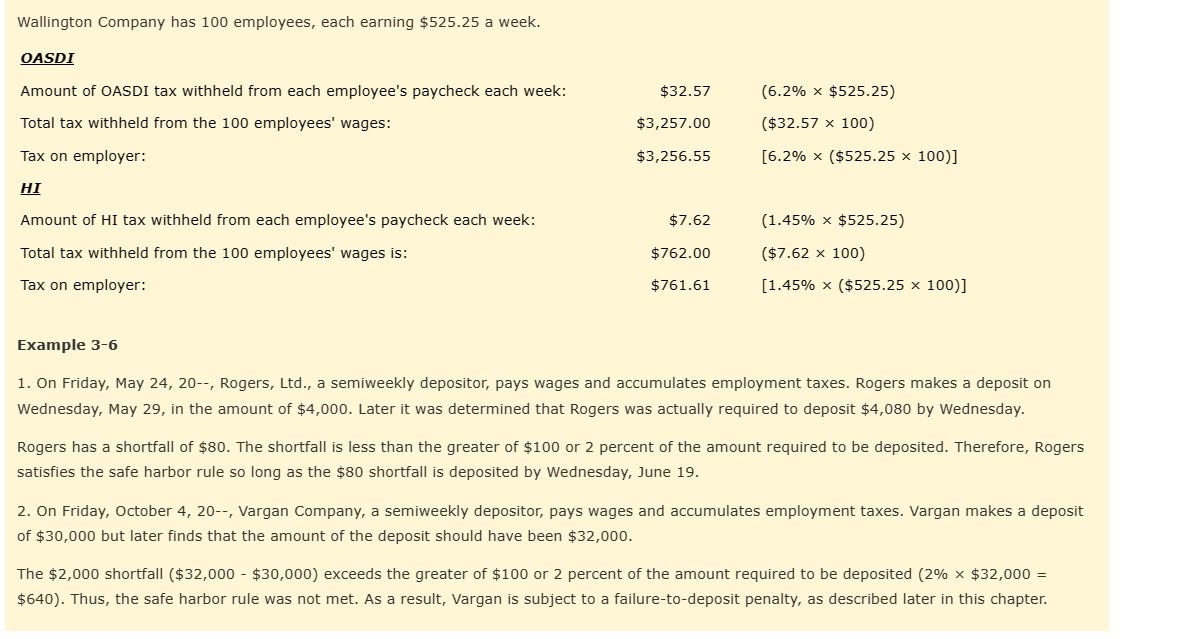

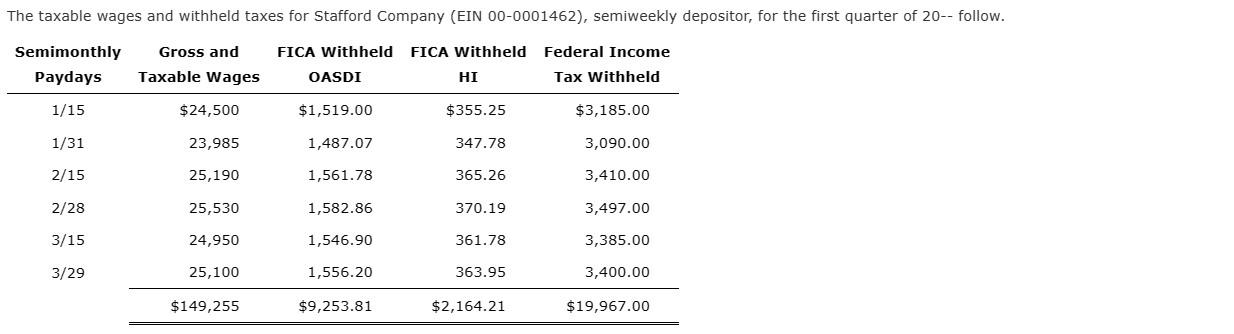

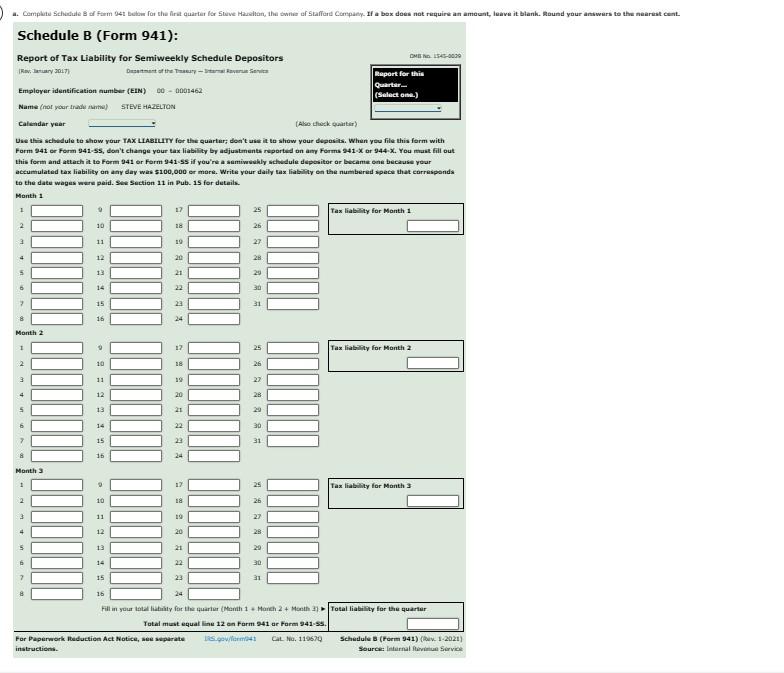

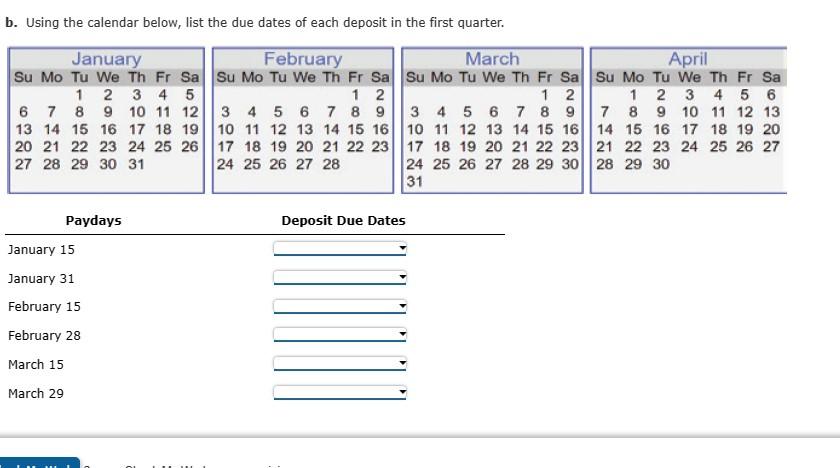

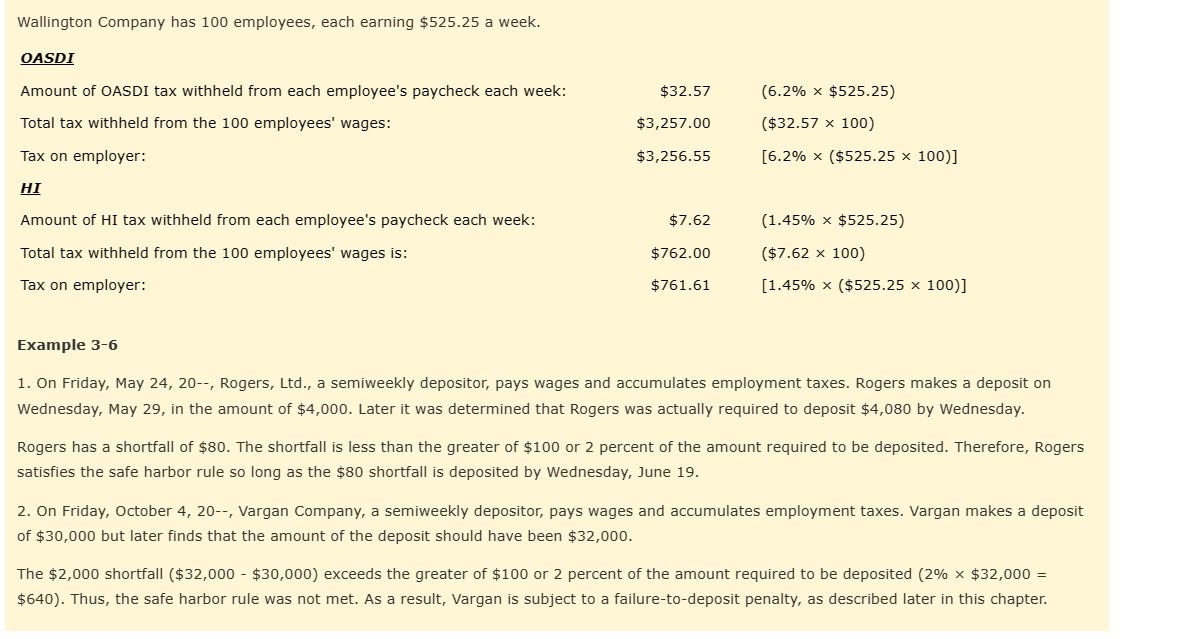

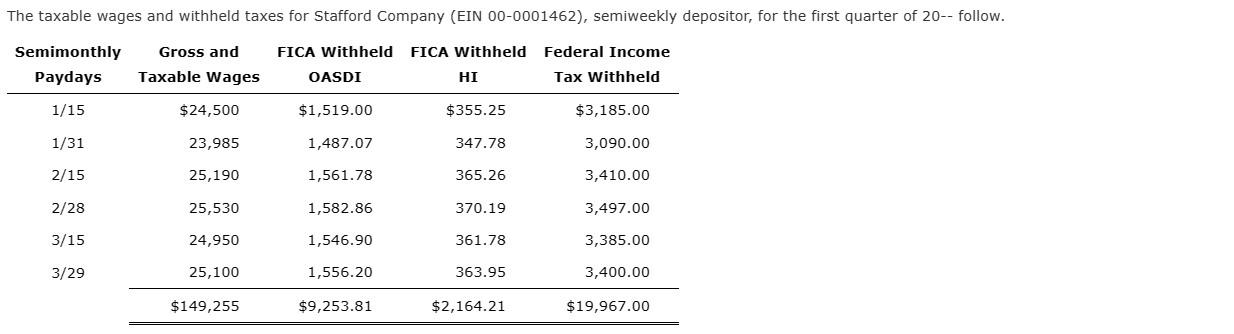

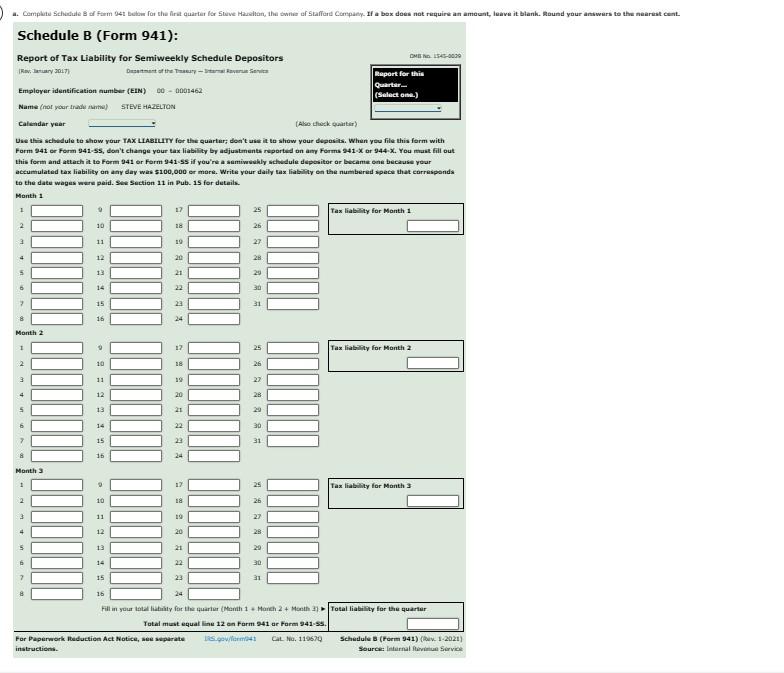

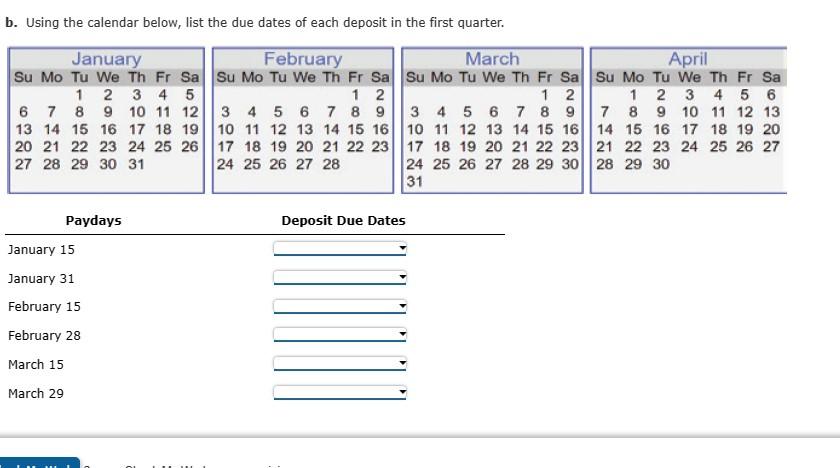

1. On Friday, May 24,20, Rogers, Ltd., a semiweekly depositor, pays wages and accumulates employment taxes. Rogers makes a deposit on Wednesday, May 29 , in the amount of $4,000. Later it was determined that Rogers was actually required to deposit $4,080 by Wednesday. Rogers has a shortfall of $80. The shortfall is less than the greater of $100 or 2 percent of the amount required to be deposited. Therefore, Rogers satisfies the safe harbor rule so long as the $80 shortfall is deposited by Wednesday, June 19. 2. On Friday, October 4, 20--, Vargan Company, a semiweekly depositor, pays wages and accumulates employment taxes. Vargan makes a deposit of $30,000 but later finds that the amount of the deposit should have been $32,000. The $2,000 shortfall ($32,000$30,000) exceeds the greater of $100 or 2 percent of the amount required to be deposited ( 2%$32,000= $640 ). Thus, the safe harbor rule was not met. As a result, Vargan is subject to a failure-to-deposit penalty, as described later in this chapter. The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 20 -- follow. \begin{tabular}{ccccc} SemimonthlyPaydays & GrossandTaxableWages & FICAWithheldOASDI & FICAWithheldHI & FederalIncomeTaxwithheld \\ \hline 1/15 & $24,500 & $1,519.00 & $355.25 & $3,185.00 \\ 1/31 & 23,985 & 1,487.07 & 347.78 & 3,090.00 \\ 2/15 & 25,190 & 1,561.78 & 365.26 & 3,410.00 \\ 2/28 & 25,530 & 1,582.86 & 370.19 & 3,497.00 \\ 3/15 & 24,950 & 1,546.90 & 361.78 & 3,385.00 \\ 3/29 & 25,100 & 1,556.20 & 363.95 & 3,400.00 \\ \hline & $149,255 & $9,253.81 & $2,164.21 & $19,967.00 \\ \hline \hline \end{tabular} Report of Tax Liability for Semiweekly Schedule Depositors [Rini, Jatuary 3047 ] Employar identification numbar (EIN) C0 - 0001462. Narti= (not your inakl thme) STEVE HAZELTCN Caterndar yabr [Ako thock quatter] Farm 241 or form 24155, don't change your tax liability loy adjuatments ruportwal an any Forms 241X ar 244 - X. You mant till out accurhulated tax liability an any day wars s100,000 er more. Write your daily tax liakily ea the numbered specu dhat carrespands to the date wages wura paid. Sta Suction 11 in Pub. 15 for details. b. Using the calendar below, list the due dates of each deposit in the first quarter. 1. On Friday, May 24,20, Rogers, Ltd., a semiweekly depositor, pays wages and accumulates employment taxes. Rogers makes a deposit on Wednesday, May 29 , in the amount of $4,000. Later it was determined that Rogers was actually required to deposit $4,080 by Wednesday. Rogers has a shortfall of $80. The shortfall is less than the greater of $100 or 2 percent of the amount required to be deposited. Therefore, Rogers satisfies the safe harbor rule so long as the $80 shortfall is deposited by Wednesday, June 19. 2. On Friday, October 4, 20--, Vargan Company, a semiweekly depositor, pays wages and accumulates employment taxes. Vargan makes a deposit of $30,000 but later finds that the amount of the deposit should have been $32,000. The $2,000 shortfall ($32,000$30,000) exceeds the greater of $100 or 2 percent of the amount required to be deposited ( 2%$32,000= $640 ). Thus, the safe harbor rule was not met. As a result, Vargan is subject to a failure-to-deposit penalty, as described later in this chapter. The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 20 -- follow. \begin{tabular}{ccccc} SemimonthlyPaydays & GrossandTaxableWages & FICAWithheldOASDI & FICAWithheldHI & FederalIncomeTaxwithheld \\ \hline 1/15 & $24,500 & $1,519.00 & $355.25 & $3,185.00 \\ 1/31 & 23,985 & 1,487.07 & 347.78 & 3,090.00 \\ 2/15 & 25,190 & 1,561.78 & 365.26 & 3,410.00 \\ 2/28 & 25,530 & 1,582.86 & 370.19 & 3,497.00 \\ 3/15 & 24,950 & 1,546.90 & 361.78 & 3,385.00 \\ 3/29 & 25,100 & 1,556.20 & 363.95 & 3,400.00 \\ \hline & $149,255 & $9,253.81 & $2,164.21 & $19,967.00 \\ \hline \hline \end{tabular} Report of Tax Liability for Semiweekly Schedule Depositors [Rini, Jatuary 3047 ] Employar identification numbar (EIN) C0 - 0001462. Narti= (not your inakl thme) STEVE HAZELTCN Caterndar yabr [Ako thock quatter] Farm 241 or form 24155, don't change your tax liability loy adjuatments ruportwal an any Forms 241X ar 244 - X. You mant till out accurhulated tax liability an any day wars s100,000 er more. Write your daily tax liakily ea the numbered specu dhat carrespands to the date wages wura paid. Sta Suction 11 in Pub. 15 for details. b. Using the calendar below, list the due dates of each deposit in the first quarter