Answered step by step

Verified Expert Solution

Question

1 Approved Answer

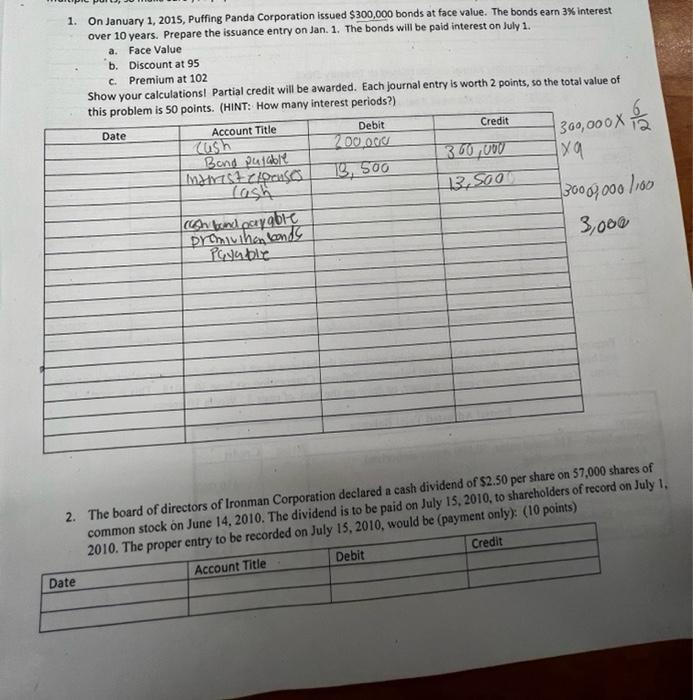

1. On January 1, 2015, Puffing Panda Corporation issued $300,000 bonds at face value. The bonds earn 3% interest over 10 years. Prepare the

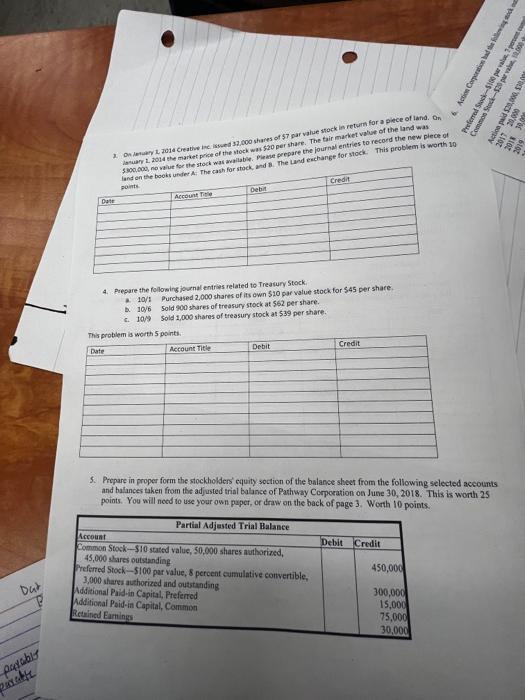

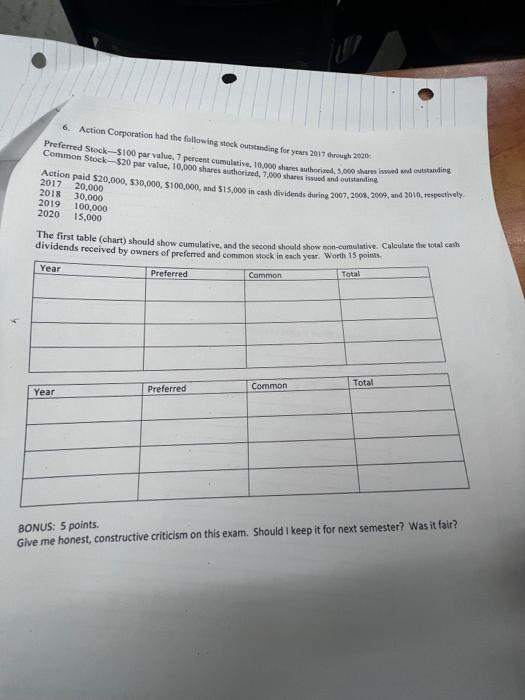

1. On January 1, 2015, Puffing Panda Corporation issued $300,000 bonds at face value. The bonds earn 3% interest over 10 years. Prepare the issuance entry on Jan. 1. The bonds will be paid interest on July 1. a. Face Value b. Discount at 95 C. Premium at 102 Date Show your calculations! Partial credit will be awarded. Each journal entry is worth 2 points, so the total value of this problem is 50 points. (HINT: How many interest periods?) Date Account Title cush Bond putable mamist expenses con band pay gole promivihan bonds Payable Debit 200,000 13, 500 Credit 300,000 13,500 300,000 X 1xq 3000,000/100 3,000 2. The board of directors of Ironman Corporation declared a cash dividend of $2.50 per share on 57,000 shares of common stock on June 14, 2010. The dividend is to be paid on July 15, 2010, to shareholders of record on July 1, 2010. The proper entry to be recorded on July 15, 2010, would be (payment only): (10 points) Account Title Debit Credit Dut parably patte Date On January 1, 2014 Creative Inc. issued 32,000 shares of 57 par value stock in return for a piece of land. On January 1, 2014 the market price of the stock was 520 per share. The fair market value of the land was 1.300.000 ne value for the stock was available. Please prepare the journal entries to record the new plece of land on the books under A The cash for stock, and 8. The Land exchange for stock. This problem is worth 10 points Account Title 4. Prepare the following journal entries related to Treasury Stock 10/1 b. 10/6 10/9 This problem is worth 5 points. Date Debit Account Title Purchased 2,000 shares of its own $10 par value stock for $45 per share. Sold 900 shares of treasury stock at 562 per share. Sold 1,000 shares of treasury stock at $39 per share. Debit Additional Paid-in Capital, Preferred Additional Paid-in Capital, Common Retained Earnings Credit Preferred Stock-$100 par value, 8 percent cumulative convertible, 3,000 shares authorized and outstanding Credit 5. Prepare in proper form the stockholders' equity section of the balance sheet from the following selected accounts and balances taken from the adjusted trial balance of Pathway Corporation on June 30, 2018. This is worth 25 points. You will need to use your own paper, or draw on the back of page 3. Worth 10 points. Partial Adjusted Trial Balance Account Common Stock-$10 stated value, 50,000 shares authorized, 45,000 shares outstanding Debit Credit Preferred Stock Common Stock- 450,000 300,000 15,000 75,000 30,000 Action Corporation had the following stock out prad - 2017 20.00000578 Action paid $20,00 2010 6. Action Corporation had the following stock outstanding for years 2017 through 2020: Preferred Stock-$100 par value, 7 percent cumulative, 10,000 shares authorized, 5,000 shares issued and outstanding Common Stock-$20 par value, 10,000 shares authorized, 7,000 shares issued and outstanding Action paid $20,000, $30,000, $100,000, and $15,000 in cash dividends during 2007, 2008, 2009, and 2010, respectively. 2017 20,000 2018 30,000 2019 100,000 2020 15,000 The first table (chart) should show cumulative, and the second should show non-cumulative. Calculate the total cash dividends received by owners of preferred and common stock in each year. Worth 15 points. Total Year Preferred Common Year Preferred Common Total BONUS: 5 points. Give me honest, constructive criticism on this exam. Should I keep it for next semester? Was it fair?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are my thoughts on the exam The questions covered important accounting concepts like bonds paya...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started