Answered step by step

Verified Expert Solution

Question

1 Approved Answer

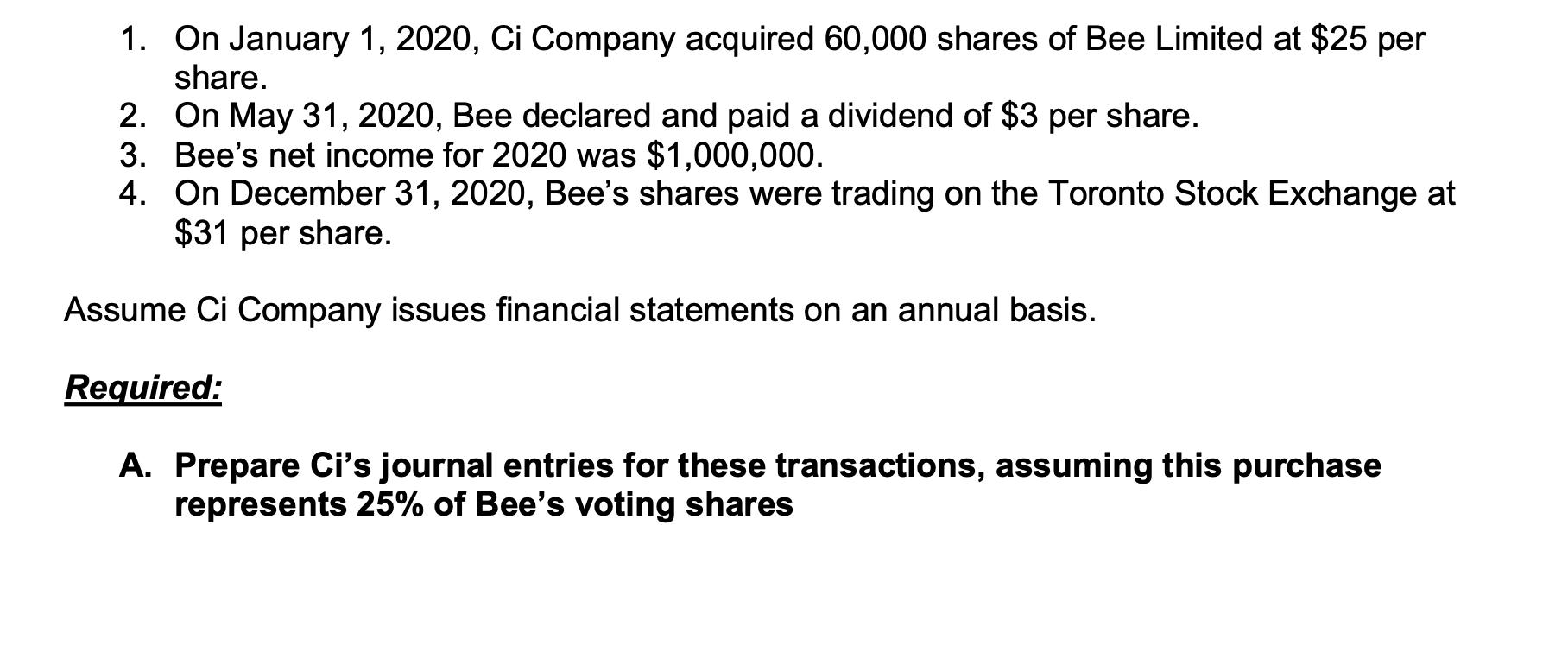

1. On January 1, 2020, Ci Company acquired 60,000 shares of Bee Limited at $25 per share. 2. On May 31, 2020, Bee declared

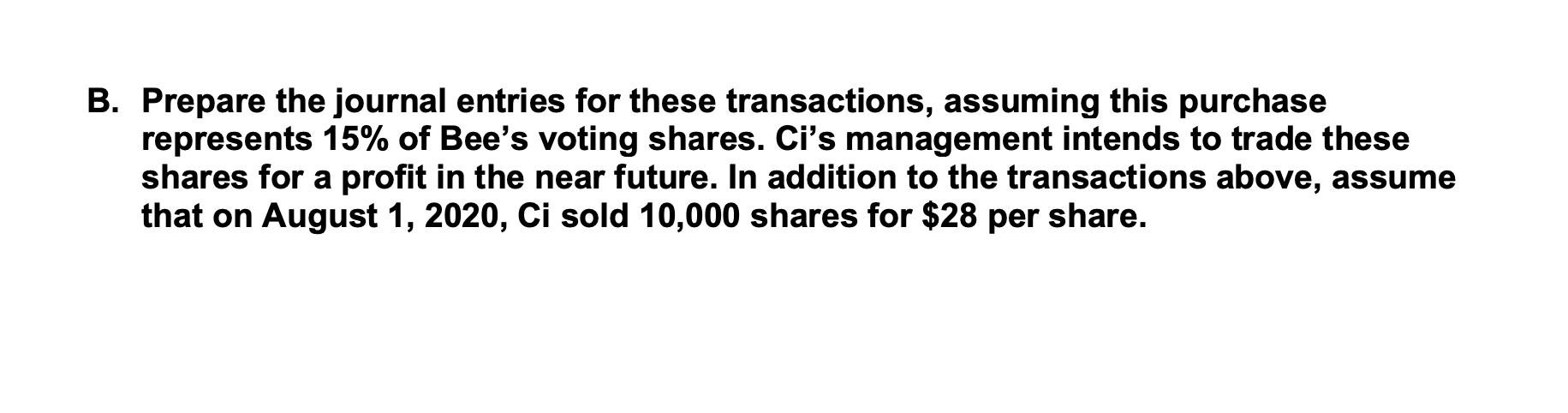

1. On January 1, 2020, Ci Company acquired 60,000 shares of Bee Limited at $25 per share. 2. On May 31, 2020, Bee declared and paid a dividend of $3 per share. 3. Bee's net income for 2020 was $1,000,000. 4. On December 31, 2020, Bee's shares were trading on the Toronto Stock Exchange at $31 per share. Assume Ci Company issues financial statements on an annual basis. Required: A. Prepare Ci's journal entries for these transactions, assuming this purchase represents 25% of Bee's voting shares B. Prepare the journal entries for these transactions, assuming this purchase represents 15% of Bee's voting shares. Ci's management intends to trade these shares for a profit in the near future. In addition to the transactions above, assume that on August 1, 2020, Ci sold 10,000 shares for $28 per share.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A Equity Method Amount Date General Journal Debit Credit Jan12020 Investment in Bee Limited ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started