Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On January 1, 2023, SPARROW Company issued 4,000 of its P1,000 face amount bonds at an issue price of P3,900,000. Interest of 9% is

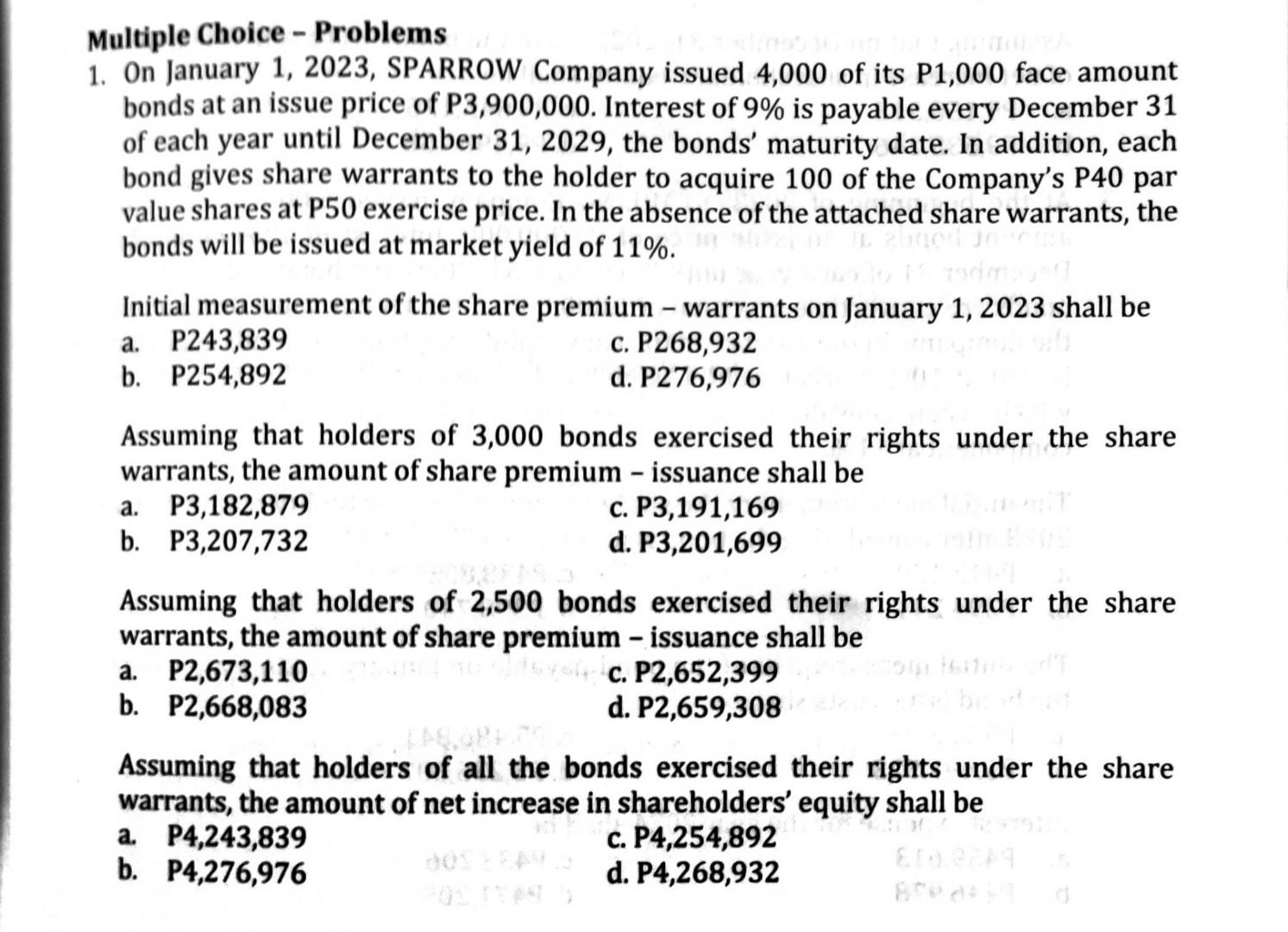

1. On January 1, 2023, SPARROW Company issued 4,000 of its P1,000 face amount bonds at an issue price of P3,900,000. Interest of 9% is payable every December 31 of each year until December 31, 2029, the bonds' maturity date. In addition, each bond gives share warrants to the holder to acquire 100 of the Company's P40 par value shares at P50 exercise price. In the absence of the attached share warrants, the bonds will be issued at market yield of 11%. Initial measurement of the share premium - warrants on January 1, 2023 shall be a. P243,839 c. P268,932 b. P254,892 d. P276,976 Assuming that holders of 3,000 bonds exercised their rights under the share warrants, the amount of share premium - issuance shall be a. P3,182,879 c. P3,191,169 b. P3,207,732 d. P3,201,699 Assuming that holders of 2,500 bonds exercised their rights under the share warrants, the amount of share premium - issuance shall be a. P2,673,110 c. P2,652,399 b. P2,668,083 d. P2,659,308 Assuming that holders of all the bonds exercised their rights under the share warrants, the amount of net increase in shareholders' equity shall be a. P4,243,839 c. P4,254,892 b. P4,276,976 d. P4,268,932

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the problems we will first need to calculate the value of the share warrants and the premiu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started