Question

1. On January 1, 20X1, Peter Company acquires an 80% interest in Sardine Company by issuing 10,000 shares of its common stock with a par

1. On January 1, 20X1, Peter Company acquires an 80% interest in Sardine Company by issuing 10,000 shares of its common stock with a par value of $10 per share and a fair value of $72 per share. At the time of the purchase, Sardine has the following balance sheet:

Assets Liabilities and Equity____________

Current assets $100,000 Current liabilities $ 80,000

Investments 150,000 Bonds payable 250,000

Land 120,000 Common stock ($10 Par) 100,000

Building (net) 350,000 Paid-in-Capital 200,000

Equipment 160,000 Retained earnings 250,000

Total assets $880,000 Total liab. & equity $880,000

Appraisals indicate that book values are representative of fair values with the exception of land and buildings. The land has a fair value of $190,000, and the building is appraised at $450,000. The building has an estimated remaining life of 20 years. Any remaining excess is goodwill.

The following summary of Sardines retained earnings applies to 20X1 and 20X2:

Balance, January 1, 20X1 $250,000

Net income for 20X1 60,000

Dividends paid in 20X1 (10,000)

Balance, Dec. 31, 20X1 $300,000

Net income for 20X2 45,000

Dividends paid in 20X2 (10,000)

Balance, December 32, 20X2 $335,000

Required:

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Sardine Company. As a part of the schedule, indicate annual amortization of excess adjustments.

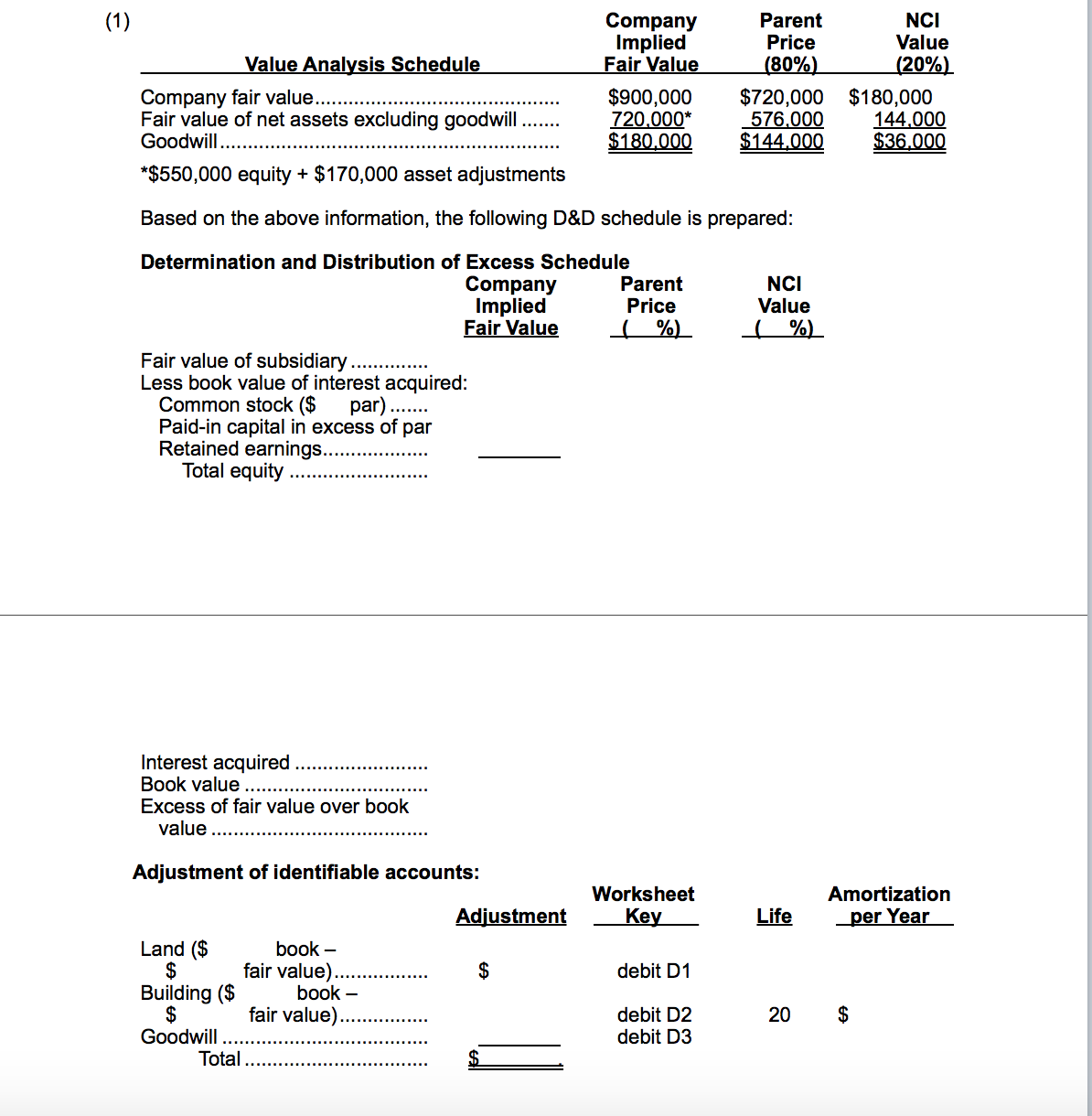

(1) Company Parent NCI

Implied Price Value

Value Analysis Schedule Fair Value (80%) (20%)

Company fair value $900,000 $720,000 $180,000

Fair value of net assets excluding goodwill 720,000* 576,000 144,000

Goodwill $180,000 $144,000 $ 36,000

*$550,000 equity + $170,000 asset adjustments

Based on the above information, the following D&D schedule is prepared:

Determination and Distribution of Excess Schedule

Company Parent NCI

Implied Price Value

Fair Value ( %) ( %)

Fair value of subsidiary

Fair value of subsidiary

Less book value of interest acquired:

Common stock ($ par)

Paid-in capital in excess of par

Retained earnings

Total equity

Interest acquired

Book value

Excess of fair value over book

value

Adjustment of identifiable accounts:

Worksheet Amortization

Adjustment Key Life per Year

Land ($ book

$ fair value) $ debit D1

Building ($ book

$ fair value) debit D2 20 $

Goodwill debit D3

Total $ .

Company Implied Fair Value Parent Price 80% NCI Value 20% Value Analysis Schedule $900,000 $720,000 $180,000 720,000* Fair value of net assets excluding goodwill.... *$550,000 equity $170,000 asset adjustments Based on the above information, the following D&D schedule is prepared: Determination and Distribution of Excess Schedule 576.000 144,000 $36.000 Companjy Implied Fair Value Parent Price NCI Value 0 0 Fair value of subsidiary Less book value of interest acquired: Paid-in capital in excess of par Total equity.. Common stock ($par)... Excess of fair value over book Adjustment of identifiable accounts: Worksheet Amortization Adiustment _Key- debit D1 debit D2 Adjustment Key Life _per Year Land ($ Building ($ book- 20$ Goodwill debit D3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started