Answered step by step

Verified Expert Solution

Question

1 Approved Answer

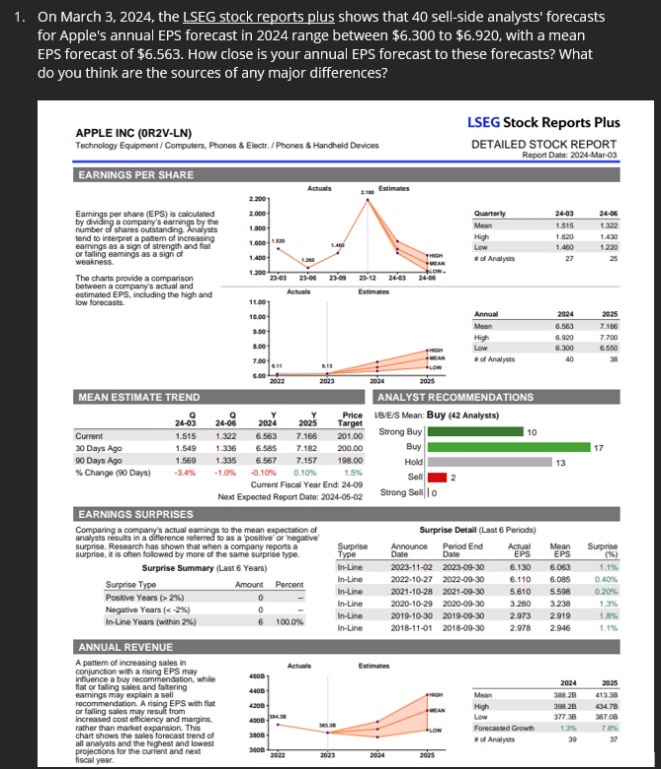

1. On March 3, 2024, the LSEG stock reports plus shows that 40 sell-side analysts' forecasts for Apple's annual EPS forecast in 2024 range

1. On March 3, 2024, the LSEG stock reports plus shows that 40 sell-side analysts' forecasts for Apple's annual EPS forecast in 2024 range between $6.300 to $6.920, with a mean EPS forecast of $6.563. How close is your annual EPS forecast to these forecasts? What do you think are the sources of any major differences? APPLE INC (0R2V-LN) Technology Equipment/Computers, Phones & Electr./Phones & Handheld Devices EARNINGS PER SHARE LSEG Stock Reports Plus DETAILED STOCK REPORT Report Date: 2024-Mar-03 Actuals Estimates 2.2001 Earnings per share (EPS) is calculated by dividing a company's earnings by the number of shares outstanding. Analysts tend to interpret a pattem of increasing earnings as a sign of strength and flat or falling eamings as a sign of weakness. The charts provide a comparison between a company's actual and estimated EPS, including the high and low forecasts. 2.000 1.800 1.600 152 MEAN ESTIMATE TREND Quarterly 24-03 24-06 Mean 1.515 1.322 High 1.620 1.430 Low 1.460 1.220 1.400- #of Analysts 27 25 1.200 23-03 23-06 23-09 23-12 24-03 24-06 Actuals 11.001 10.00 9.00 8.00 Annual 2024 2025 Mean 6.563 7.166 High 6.920 7.700 Low 6.300 6.550 40 6.13 2022 2023 2025 ANALYST RECOMMENDATIONS IBE/S Mean: Buy (42 Analysts) Strong Buy 24-03 24-06 2024 Current 1.515 1.322 Price 2025 Target 6.563 7.166 201.00 30 Days Ago 90 Days Ago % Change (90 Days) 1.549 1.336 6.585 7.182 1.569 1.335 6.567 7.157 -3.4% -1.0% -0.10% 0.10% Current Fiscal Year End: 24-09 Next Expected Report Date: 2024-05-02 200.00 198.00 Buy Hold 1.5% Sell Strong Sell o 10 17 EARNINGS SURPRISES Comparing a company's actual eamings to the mean expectation of analysts results in a difference referred to as a positive or negative surprise. Research has shown that when a company reports a surprise, it is often followed by more of the same surprise type. Surprise Summary (Last 6 Years) Surprise Detail (Last 6 Periods) Surprise Announce Period End Actual Mean Type Date Date EPS EPS Surprise (%) In-Line 2023-11-02 2023-09-30 6.130 6.063 1.1% In-Line 2022-10-27 2022-09-30 6.110 6.085 Surprise Type Positive Years (>2%) Negative Years ( < < -2%) 0.40% Amount Percent In-Line 2021-10-28 2021-09-30 5.610 5.598 0.20% 0 In-Line 2020-10-29 2020-09-30 3.280 3.238 1.3% In-Line In-Line Years (within 2%) 6 100.0% In-Line 2019-10-30 2019-09-30 2018-11-01 2018-09-30 2.973 2.919 1.8% 2.978 2.946 1.1% ANNUAL REVENUE A pattern of increasing sales in Actuals conjunction with a rising EPS may earnings may explain a sell influence a buy recommendation, while flat or falling sales and faltering 4608 440B 4208- recommendation. A rising EPS with flat or falling sales may result from increased d cost efficiency and margins, rather than market expansion. This chart shows the sales forecast trend of all analysts and the highest and lowest projections for the current and next fiscal year. HIGH Mean 2024 388.28 2025 413.38 High 398.2B 434.7B Low LOW Forecasted Growth of Analysts 377.38 1.3% 387.08 7.8% 39 37 3800 3608- 2022 2023 2024 2025

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to your questions 1 My annual EPS forecast for Apple in 2024 is 66 which is wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started