Answered step by step

Verified Expert Solution

Question

1 Approved Answer

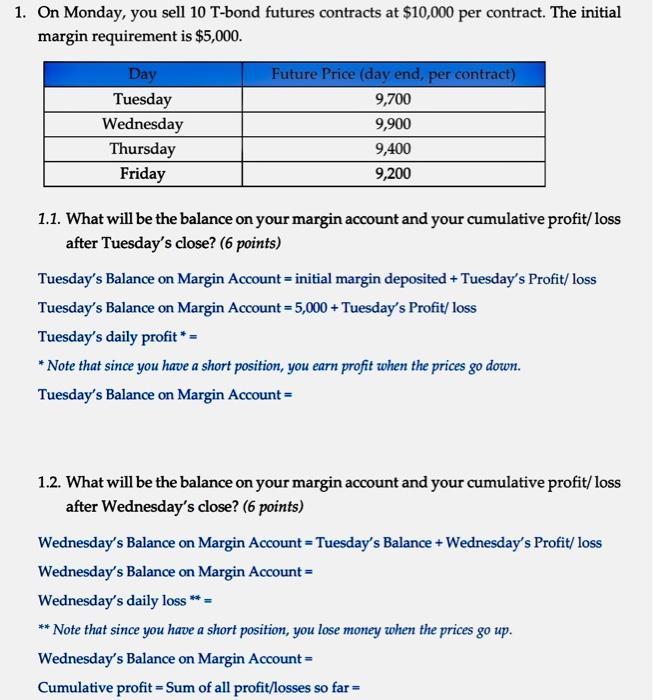

1. On Monday, you sell 10 T-bond futures contracts at $10,000 per contract. The initial margin requirement is $5,000. Day Tuesday Wednesday Thursday Friday

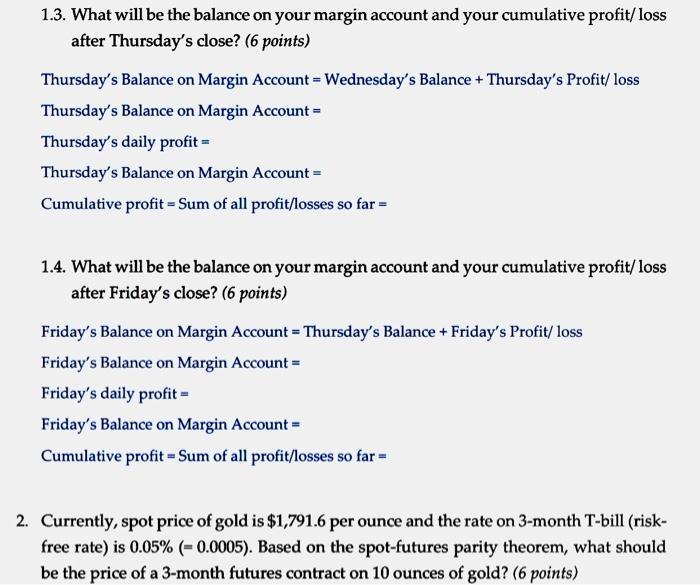

1. On Monday, you sell 10 T-bond futures contracts at $10,000 per contract. The initial margin requirement is $5,000. Day Tuesday Wednesday Thursday Friday Future Price (day end, per contract) 9,700 9,900 9,400 9,200 1.1. What will be the balance on your margin account and your cumulative profit/loss after Tuesday's close? (6 points) Tuesday's Balance on Margin Account = initial margin deposited + Tuesday's Profit/ loss Tuesday's Balance on Margin Account = 5,000+ Tuesday's Profit/ loss Tuesday's daily profit * = *Note that since you have a short position, you earn profit when the prices go down. Tuesday's Balance on Margin Account = 1.2. What will be the balance on your margin account and your cumulative profit/ loss after Wednesday's close? (6 points) Wednesday's Balance on Margin Account = Tuesday's Balance + Wednesday's Profit/ loss Wednesday's Balance on Margin Account = Wednesday's daily loss **. ** Note that since you have a short position, you lose money when the prices go up. Wednesday's Balance on Margin Account = Cumulative profit = Sum of all profit/losses so far = 1.3. What will be the balance on your margin account and your cumulative profit/loss after Thursday's close? (6 points) Thursday's Balance on Margin Account = Wednesday's Balance + Thursday's Profit/ loss Thursday's Balance on Margin Account = Thursday's daily profit = Thursday's Balance on Margin Account = Cumulative profit = Sum of all profit/losses so far = 1.4. What will be the balance on your margin account and your cumulative profit/loss after Friday's close? (6 points) Friday's Balance on Margin Account = Thursday's Balance + Friday's Profit/ loss Friday's Balance on Margin Account = Friday's daily profit= Friday's Balance on Margin Account = Cumulative profit = Sum of all profit/losses so far = 2. Currently, spot price of gold is $1,791.6 per ounce and the rate on 3-month T-bill (risk- free rate) is 0.05% (-0.0005). Based on the spot-futures parity theorem, what should be the price of a 3-month futures contract on 10 ounces of gold? (6 points)

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the balance on your margin account and the cumulative profitloss after each day as follows Initial Data Sell 10 Tbond futures contracts at 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started