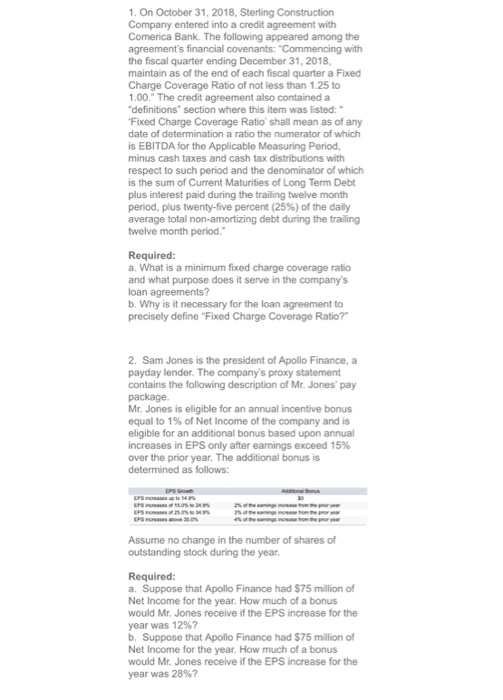

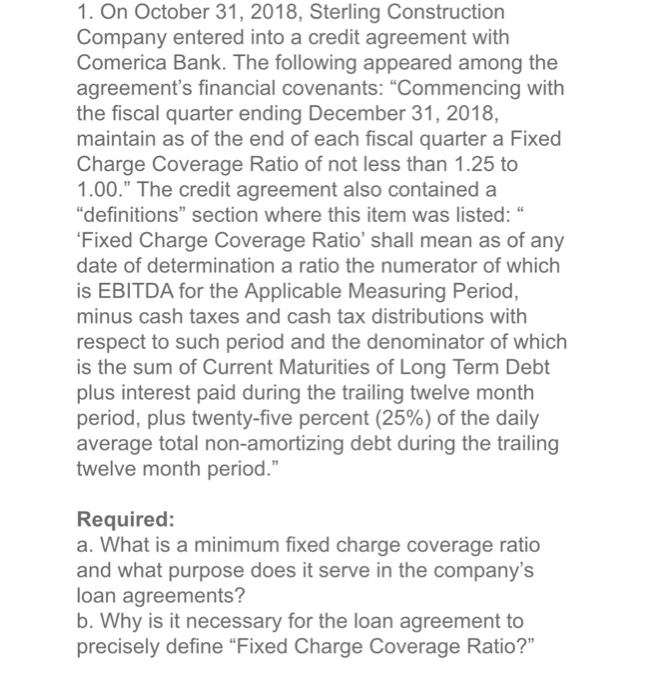

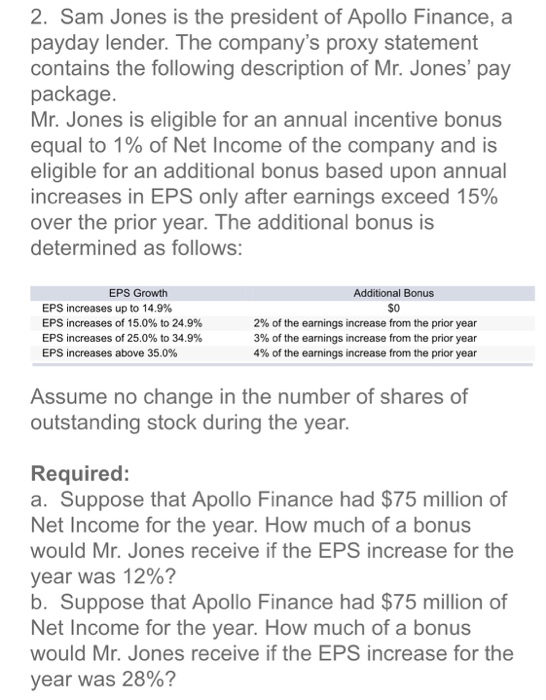

1. On October 31, 2018, Sterling Construction Company entered into a credit agreement with Comerica Bank. The following appeared among the agreement's financial covenants: "Commencing with the fiscal quarter ending December 31, 2018, maintain as of the end of each fiscal quarter a Fixed Charge Coverage Ratio of not less than 1.25 to .00. The credit agreement also contained a "definitions section where this item was listed: Fixed Charge Coverage Ratio shall mean as of any date of determination a ratio the numerator of which is EBITDA for the Applicable Measuring Period, minus cash taxes and cash tax distributions with respect to such period and the denominator of which is the sum of Current Maturities of Long Term Debt plus interest paid during the trailing twelve month penod, plus twenty-five percent (25%) of the daily average total non-amortizing debt during the trailing twelve month period Required a. What is a minimum fixed charge coverage ratio and what purpose does it serve in the company's loan agreements? b. Why is it necessary for the loan agreement to precisely define "Fixed Charge Coverage Ratio? 2. Sam Jones is the president of Apollo Finance, a payday lender. The company's proxy statement contains the following description of Mr. Jones' pay package Mr. Jones is eligible for an annual incentive bonus equal to 1% of Net Income of the company and is eligible for an additional bonus based upon annual increases in EPS only after earnings exceed 15% over the prior year. The additional bonus is determined as follows: Assume no change in the number of shares of outstanding stock during the year Required a. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr, Jones receive if the EPS increase for the year was 12%? b. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr. Jones receive if the EPS increase for the year was 28%? 1. On October 31, 2018, Sterling Construction Company entered into a credit agreement with Comerica Bank. The following appeared among the agreement's financial covenants: "Commencing with the fiscal quarter ending December 31, 2018, maintain as of the end of each fiscal quarter a Fixed Charge Coverage Ratio of not less than 1.25 to 1.00." The credit agreement also contained a "definitions" section where this item was listed: " Fixed Charge Coverage Ratio shall mean as of any date of determination a ratio the numerator of which is EBITDA for the Applicable Measuring Period, minus cash taxes and cash tax distributions with respect to such period and the denominator of which is the sum of Current Maturities of Long Term Debt plus interest paid during the trailing twelve month period, plus twenty-five percent (25%) of the daily average total non-amortizing debt during the trailing twelve month period." Required: a. What is a minimum fixed charge coverage ratio and what purpose does it serve in the company's loan agreements? b. Why is it necessary for the loan agreement to precisely define "Fixed Charge Coverage Ratio?" 2. Sam Jones is the president of Apollo Finance, a payday lender. The company's proxy statement contains the following description of Mr. Jones' pay package. Mr. Jones is eligible for an annual incentive bonus equal to 1% of Net income of the company and is eligible for an additional bonus based upon annual increases in EPS only after earnings exceed 15% over the prior year. The additional bonus is determined as follows: EPS Growth Additional Bonuss S0 EPS increases up to 14.9% EPs increases of 15.0% to 24.9% EPs increases of 25.0% to 34.9% EPs increases above 35.0% 2% of the earnings increase from the prior year 3% of the earnings increase from the prior year 4% of the earnings increase from the prior year Assume no change in the number of shares of outstanding stock during the year. Required: a. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr. Jones receive if the EPS increase for the year was 12%? b. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr. Jones receive if the EPS increase for the year was 28%? 1. On October 31, 2018, Sterling Construction Company entered into a credit agreement with Comerica Bank. The following appeared among the agreement's financial covenants: "Commencing with the fiscal quarter ending December 31, 2018, maintain as of the end of each fiscal quarter a Fixed Charge Coverage Ratio of not less than 1.25 to .00. The credit agreement also contained a "definitions section where this item was listed: Fixed Charge Coverage Ratio shall mean as of any date of determination a ratio the numerator of which is EBITDA for the Applicable Measuring Period, minus cash taxes and cash tax distributions with respect to such period and the denominator of which is the sum of Current Maturities of Long Term Debt plus interest paid during the trailing twelve month penod, plus twenty-five percent (25%) of the daily average total non-amortizing debt during the trailing twelve month period Required a. What is a minimum fixed charge coverage ratio and what purpose does it serve in the company's loan agreements? b. Why is it necessary for the loan agreement to precisely define "Fixed Charge Coverage Ratio? 2. Sam Jones is the president of Apollo Finance, a payday lender. The company's proxy statement contains the following description of Mr. Jones' pay package Mr. Jones is eligible for an annual incentive bonus equal to 1% of Net Income of the company and is eligible for an additional bonus based upon annual increases in EPS only after earnings exceed 15% over the prior year. The additional bonus is determined as follows: Assume no change in the number of shares of outstanding stock during the year Required a. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr, Jones receive if the EPS increase for the year was 12%? b. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr. Jones receive if the EPS increase for the year was 28%? 1. On October 31, 2018, Sterling Construction Company entered into a credit agreement with Comerica Bank. The following appeared among the agreement's financial covenants: "Commencing with the fiscal quarter ending December 31, 2018, maintain as of the end of each fiscal quarter a Fixed Charge Coverage Ratio of not less than 1.25 to 1.00." The credit agreement also contained a "definitions" section where this item was listed: " Fixed Charge Coverage Ratio shall mean as of any date of determination a ratio the numerator of which is EBITDA for the Applicable Measuring Period, minus cash taxes and cash tax distributions with respect to such period and the denominator of which is the sum of Current Maturities of Long Term Debt plus interest paid during the trailing twelve month period, plus twenty-five percent (25%) of the daily average total non-amortizing debt during the trailing twelve month period." Required: a. What is a minimum fixed charge coverage ratio and what purpose does it serve in the company's loan agreements? b. Why is it necessary for the loan agreement to precisely define "Fixed Charge Coverage Ratio?" 2. Sam Jones is the president of Apollo Finance, a payday lender. The company's proxy statement contains the following description of Mr. Jones' pay package. Mr. Jones is eligible for an annual incentive bonus equal to 1% of Net income of the company and is eligible for an additional bonus based upon annual increases in EPS only after earnings exceed 15% over the prior year. The additional bonus is determined as follows: EPS Growth Additional Bonuss S0 EPS increases up to 14.9% EPs increases of 15.0% to 24.9% EPs increases of 25.0% to 34.9% EPs increases above 35.0% 2% of the earnings increase from the prior year 3% of the earnings increase from the prior year 4% of the earnings increase from the prior year Assume no change in the number of shares of outstanding stock during the year. Required: a. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr. Jones receive if the EPS increase for the year was 12%? b. Suppose that Apollo Finance had $75 million of Net Income for the year. How much of a bonus would Mr. Jones receive if the EPS increase for the year was 28%