Question

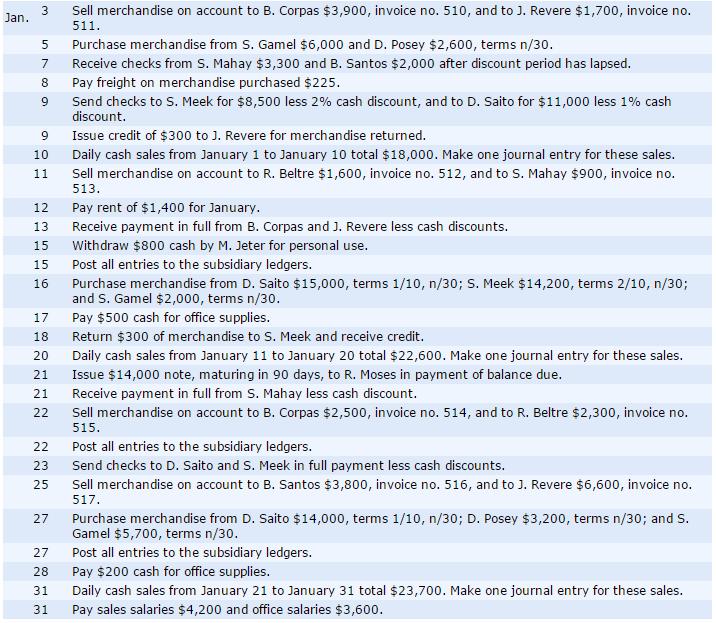

Record the January transactions in a cash payments journal and a two-column general journal. Post the journals to the general ledger. Prepare a trial balance

Record the January transactions in a cash payments journal and a two-column general journal.

Post the journals to the general ledger.

Prepare a trial balance at January 31, 2014, in the trial balance columns of the worksheet. Complete the worksheet using the following additional information.

Office supplies at January 31 total $900.

Insurance coverage expires on October 31, 2017

Annual depreciation on the equipment is $1,500.

Interest of $50 has accrued on the note payable.

Prepare a multiple-step income statement and an owner's equity statement for January and a classified balance sheet at the end of January.

Prepare and post adjusting and closing entries.

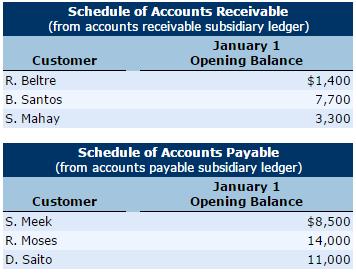

Prepare a post-closing trial balance, and determine whether the subsidiary ledgers agree with the control accounts in the general ledger.

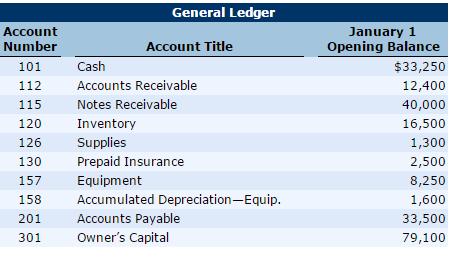

Account Number 101 112 115 120 126 130 157 158 201 301 General Ledger Account Title Cash Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equip. Accounts Payable Owner's Capital January 1 Opening Balance $33,250 12,400 40,000 16,500 1,300 2,500 8,250 1,600 33,500 79,100

Step by Step Solution

3.54 Rating (182 Votes )

There are 3 Steps involved in it

Step: 1

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT 3 Jan Accounts Receivable BC 3900 Accounts Receivable JR 1700 Sales 5600 To record sales on account 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started