Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Optimal total cost: original problem 2. Optimal total cost: demand on day 1 is only 4000 3. How much (maximum) should OD be willing

1. Optimal total cost: original problem

2. Optimal total cost: demand on day 1 is only 4000

3. How much (maximum) should OD be willing to pay for 300 MW of power on day 1?

4. How much (maximum) should OD be willing to pay for 500 MW of power on day 1?

5. How much (maximum) should OD be willing to pay for 100 Mw of power on day 1?

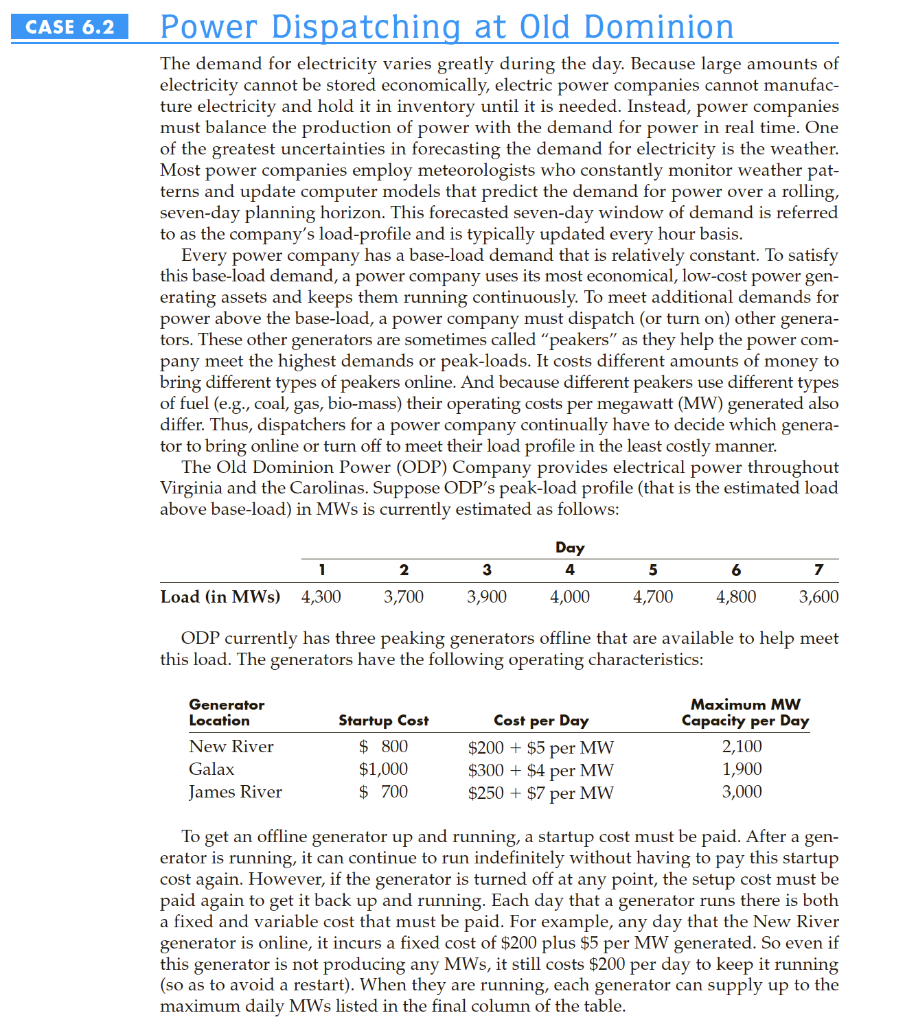

CASE 6.2 Power Dispatching at Old Dominion The demand for electricity varies greatly during the day. Because large amounts of electricity cannot be stored economically, electric power companies cannot manufac- ture electricity and hold it in inventory until it is needed. Instead, power companies must balance the production of power with the demand for power in real time. One of the greatest uncertainties in forecasting the demand for electricity is the weather. Most power companies employ meteorologists who constantly monitor weather pat- terns and update computer models that predict the demand for power over a rolling, seven-day planning horizon. This forecasted seven-day window of demand is referred to as the company's load-profile and is typically updated every hour basis. Every power company has a base-load demand that is relatively constant. To satisfy this base-load demand, a power company uses its most economical, low-cost power gen- erating assets and keeps them running continuously. To meet additional demands for power above the base-load, a power company must dispatch (or turn on) other genera- tors. These other generators are sometimes called peakers" as they help the power com- pany meet the highest demands or peak-loads. It costs different amounts of money to bring different types of peakers online. And because different peakers use different types of fuel (e.g., coal, gas, bio-mass) their operating costs per megawatt (MW) generated also differ. Thus, dispatchers for a power company continually have to decide which genera- tor to bring online or turn off to meet their load profile in the least costly manner. The Old Dominion Power (ODP) Company provides electrical power throughout Virginia and the Carolinas. Suppose ODP's peak-load profile (that is the estimated load above base-load) in MWs is currently estimated as follows: Day 4 1 2 3 5 6 7 Load (in MWs) 4,300 3,700 3,900 4,000 4,700 4,800 3,600 ODP currently has three peaking generators offline that are available to help meet this load. The generators have the following operating characteristics: Generator Location New River Galax James River Startup Cost $ 800 $1,000 $ 700 Cost per Day $200 + $5 per MW $300 + $4 per MW $250 + $7 per MW Maximum MW Capacity per Day 2,100 1,900 3,000 To get an offline generator up and running, a startup cost must be paid. After a gen- erator is running, it can continue to run indefinitely without having to pay this startup cost again. However, if the generator is turned off at any point, the setup cost must be paid again to get it back up and running. Each day that a generator runs there is both a fixed and variable cost that must be paid. For example, any day that the New River generator is online, it incurs a fixed cost of $200 plus $5 per MW generated. So even if this generator is not producing any MWs, it still costs $200 per day to keep it running (so as to avoid a restart). When they are running, each generator can supply up to the maximum daily MWs listed in the final column of the table. CASE 6.2 Power Dispatching at Old Dominion The demand for electricity varies greatly during the day. Because large amounts of electricity cannot be stored economically, electric power companies cannot manufac- ture electricity and hold it in inventory until it is needed. Instead, power companies must balance the production of power with the demand for power in real time. One of the greatest uncertainties in forecasting the demand for electricity is the weather. Most power companies employ meteorologists who constantly monitor weather pat- terns and update computer models that predict the demand for power over a rolling, seven-day planning horizon. This forecasted seven-day window of demand is referred to as the company's load-profile and is typically updated every hour basis. Every power company has a base-load demand that is relatively constant. To satisfy this base-load demand, a power company uses its most economical, low-cost power gen- erating assets and keeps them running continuously. To meet additional demands for power above the base-load, a power company must dispatch (or turn on) other genera- tors. These other generators are sometimes called peakers" as they help the power com- pany meet the highest demands or peak-loads. It costs different amounts of money to bring different types of peakers online. And because different peakers use different types of fuel (e.g., coal, gas, bio-mass) their operating costs per megawatt (MW) generated also differ. Thus, dispatchers for a power company continually have to decide which genera- tor to bring online or turn off to meet their load profile in the least costly manner. The Old Dominion Power (ODP) Company provides electrical power throughout Virginia and the Carolinas. Suppose ODP's peak-load profile (that is the estimated load above base-load) in MWs is currently estimated as follows: Day 4 1 2 3 5 6 7 Load (in MWs) 4,300 3,700 3,900 4,000 4,700 4,800 3,600 ODP currently has three peaking generators offline that are available to help meet this load. The generators have the following operating characteristics: Generator Location New River Galax James River Startup Cost $ 800 $1,000 $ 700 Cost per Day $200 + $5 per MW $300 + $4 per MW $250 + $7 per MW Maximum MW Capacity per Day 2,100 1,900 3,000 To get an offline generator up and running, a startup cost must be paid. After a gen- erator is running, it can continue to run indefinitely without having to pay this startup cost again. However, if the generator is turned off at any point, the setup cost must be paid again to get it back up and running. Each day that a generator runs there is both a fixed and variable cost that must be paid. For example, any day that the New River generator is online, it incurs a fixed cost of $200 plus $5 per MW generated. So even if this generator is not producing any MWs, it still costs $200 per day to keep it running (so as to avoid a restart). When they are running, each generator can supply up to the maximum daily MWs listed in the final column of the tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started