Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (Option pricing using dynamic programming) Use hw_8.xlsx to answer this question about the pricing of an American put option. The current stock price

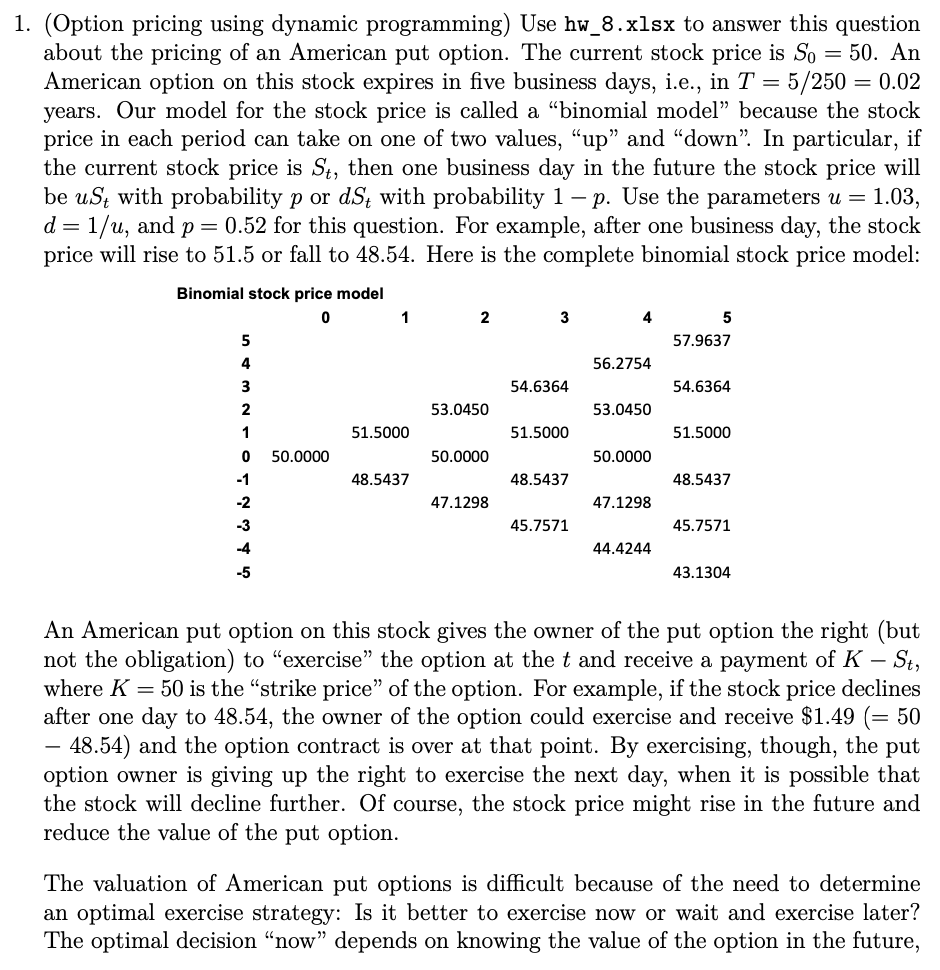

1. (Option pricing using dynamic programming) Use hw_8.xlsx to answer this question about the pricing of an American put option. The current stock price is So = 50. An American option on this stock expires in five business days, i.e., in T = 5/250 = 0.02 years. Our model for the stock price is called a "binomial model because the stock price in each period can take on one of two values, "up" and "down". In particular, if the current stock price is St, then one business day in the future the stock price will be ust with probability p or dS with probability 1 - p. Use the parameters u = 1.03, d = 1/u, and p = 0.52 for this question. For example, after one business day, the stock price will rise to 51.5 or fall to 48.54. Here is the complete binomial stock price model: Binomial stock price model 0 5 4 1 2 3 4 5 57.9637 56.2754 3 54.6364 54.6364 2 53.0450 53.0450 1 51.5000 51.5000 51.5000 0 50.0000 50.0000 50.0000 -1 48.5437 48.5437 48.5437 -2 47.1298 47.1298 -3 45.7571 45.7571 -4 44.4244 -5 43.1304 An American put option on this stock gives the owner of the put option the right (but not the obligation) to "exercise" the option at the t and receive a payment of K - St, where K = 50 is the "strike price" of the option. For example, if the stock price declines after one day to 48.54, the owner of the option could exercise and receive $1.49 (= 50 - 48.54) and the option contract is over at that point. By exercising, though, the put option owner is giving up the right to exercise the next day, when it is possible that the stock will decline further. Of course, the stock price might rise in the future and reduce the value of the put option. The valuation of American put options is difficult because of the need to determine an optimal exercise strategy: Is it better to exercise now or wait and exercise later? The optimal decision "now" depends on knowing the value of the option in the future, which depends on future optimal exercise decisions. Since the number of time periods and exercise decisions is typically very large, solving the problem by enumerating all possible exercise decisions is completely infeasible. The put option value can be determined by Bellman's dynamic programming method, starting at the end (i.e., the expiration of the option) and working backwards. At expiration, T, the value of the American put option, PT, is PT = max(K-ST, 0). - (1) ST The interpretation is that the option can be exercised if ST < K to receive K and is worth zero if ST > K. Prior to expiration, at time t (t = 0, 1, 2, 3, 4), and stock price St, the American put is worth - P = max(pP + (1 p)Pa, K St) - (2) where Pu is the put option value at the next time period if the stock price moves up and Pd is the put option value at the next time period if the stock price moves down. The first part of the expression, pPu + (1 p)P is the expected value of the put if it is not exercised. (For this problem assume that the interest rate is zero, i.e., the time period is so short that we ignore the time value of money.) Since the model is solved by working "backwards" in time, the values of the put option Pu and Pd at the next time period have already been determined. The second part of the expression, K St, is the value of the put option if it is exercised "immediately" at time t at the stock price St. - Use these dynamic programming equations to determine the value of the American put corresponding to each node in the binomial stock price model. Note: This binomial model is the basis for the famous Black-Scholes option pricing method that is used on Wall Street millions of times per day.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started