Answered step by step

Verified Expert Solution

Question

1 Approved Answer

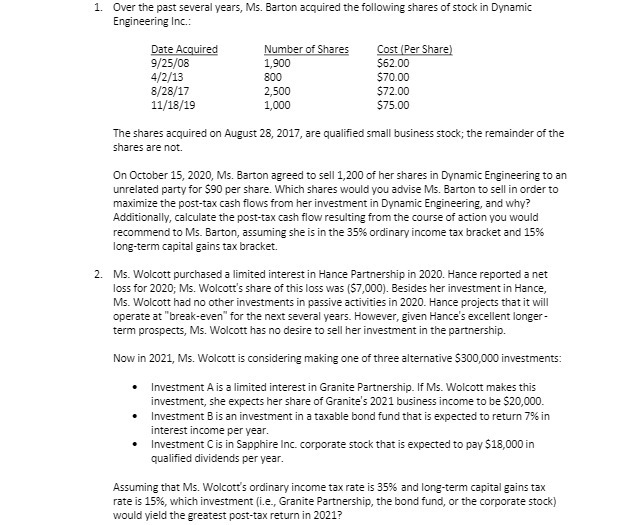

1. Over the past several years, Ms. Barton acquired the following shares of stock in Dynamic Engineering Inc.: Date Acquired 9/25/08 4/2/13 8/28/17 11/18/19

1. Over the past several years, Ms. Barton acquired the following shares of stock in Dynamic Engineering Inc.: Date Acquired 9/25/08 4/2/13 8/28/17 11/18/19 Number of Shares 1,900 800 2,500 1,000 Cost (Per Share) $62.00 $70.00 $72.00 $75.00 The shares acquired on August 28, 2017, are qualified small business stock; the remainder of the shares are not. On October 15, 2020, Ms. Barton agreed to sell 1,200 of her shares in Dynamic Engineering to an unrelated party for $90 per share. Which shares would you advise Ms. Barton to sell in order to maximize the post-tax cash flows from her investment in Dynamic Engineering, and why? Additionally, calculate the post-tax cash flow resulting from the course of action you would recommend to Ms. Barton, assuming she is in the 35% ordinary income tax bracket and 15% long-term capital gains tax bracket. 2. Ms. Wolcott purchased a limited interest in Hance Partnership in 2020. Hance reported a net loss for 2020; Ms. Wolcott's share of this loss was ($7,000). Besides her investment in Hance, Ms. Wolcott had no other investments in passive activities in 2020. Hance projects that it will operate at "break-even" for the next several years. However, given Hance's excellent longer- term prospects, Ms. Wolcott has no desire to sell her investment in the partnership. Now in 2021, Ms. Wolcott is considering making one of three alternative $300,000 investments: Investment A is a limited interest in Granite Partnership. If Ms. Wolcott makes this investment, she expects her share of Granite's 2021 business income to be $20,000. Investment B is an investment in a taxable bond fund that is expected to return 7% in interest income per year. Investment C is in Sapphire Inc. corporate stock that is expected to pay $18,000 in qualified dividends per year. Assuming that Ms. Wolcott's ordinary income tax rate is 35% and long-term capital gains tax rate is 15%, which investment (i.e., Granite Partnership, the bond fund, or the corporate stock) would yield the greatest post-tax return in 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To determine which shares Ms Barton should sell in order to maximize posttax cash flows from her investment in Dynamic Engineering we need to consider the tax implications of each share First lets i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started