Answered step by step

Verified Expert Solution

Question

1 Approved Answer

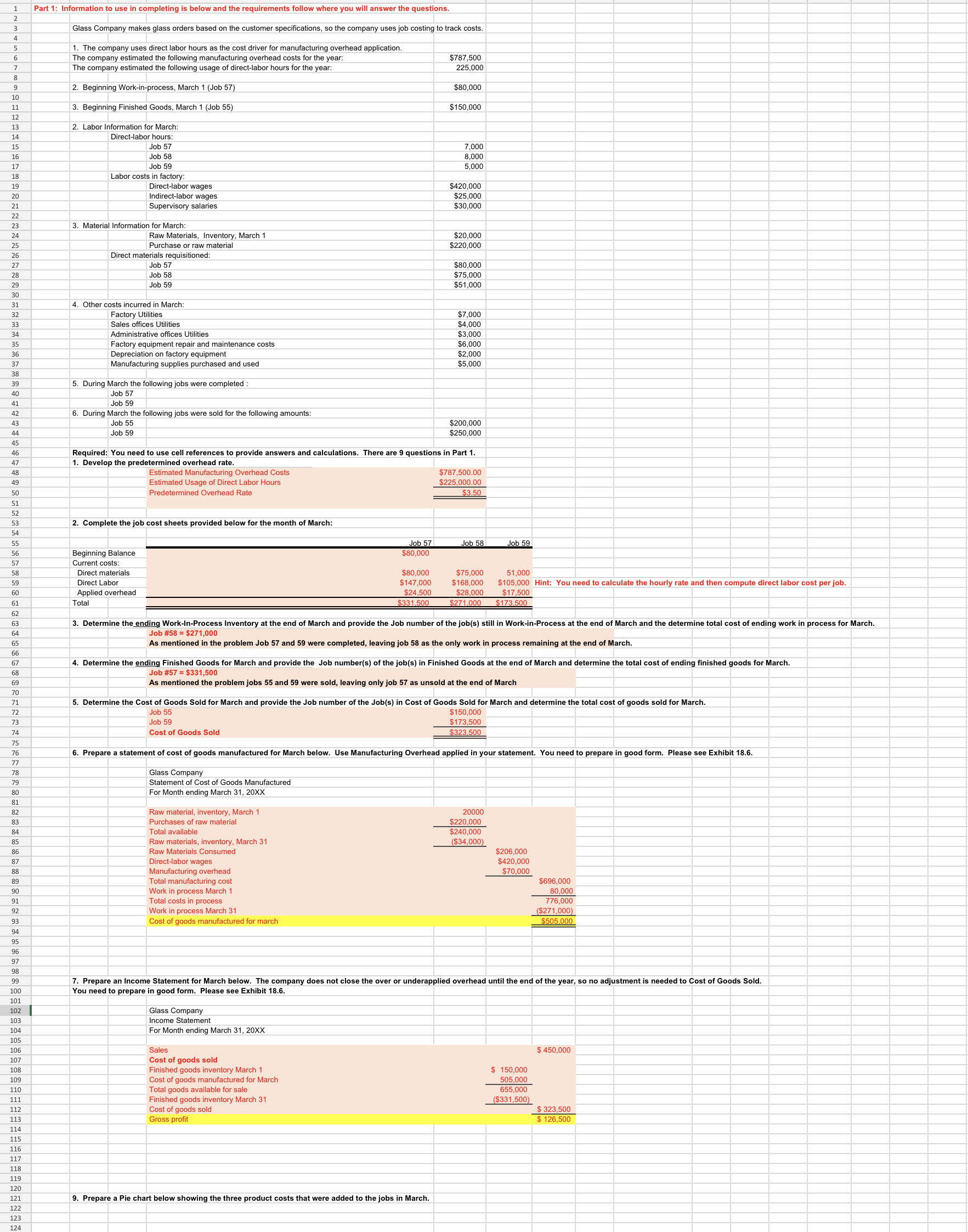

1 Part 1: Information to use in completing is below and the requirements follow where you will answer the questions. 2 3 Glass Company

1 Part 1: Information to use in completing is below and the requirements follow where you will answer the questions. 2 3 Glass Company makes glass orders based on the customer specifications, so the company uses job costing to track costs. 4 5 1. The company uses direct labor hours as the cost driver for manufacturing overhead application. 6 The company estimated the following manufacturing overhead costs for the year: 7 The company estimated the following usage of direct-labor hours for the year: 8 9 2. Beginning Work-in-process, March 1 (Job 57) 10 11 3. Beginning Finished Goods, March 1 (Job 55) $787,500 225,000 $80,000 $150,000 12 13 2. Labor Information for March: 14 Direct-labor hours: 15 Job 57 16 Job 58 17 Job 59 18 19 Labor costs in factory: Direct-labor wages 20 Indirect-labor wages 21 Supervisory salaries 7,000 8,000 5,000 $420,000 $25,000 $30,000 22 23 3. Material Information for March: 24 Raw Materials, Inventory, March 1 $20,000 25 Purchase or raw material $220,000 26 Direct materials requisitioned: 27 Job 57 $80,000 28 Job 58 $75,000 29 Job 59 $51,000 30 31 32 33 34 35 36 37 4. Other costs incurred in March: Factory Utilities Sales offices Utilities Administrative offices Utilities Factory equipment repair and maintenance costs Depreciation on factory equipment Manufacturing supplies purchased and used $3,000 $7,000 $4,000 $6,000 $2,000 $5,000 38 39 5. During March the following jobs were completed: 40 Job 57 41 Job 59 42 6. During March the following jobs were sold for the following amounts: 43 Job 55 $200,000 44 Job 59 45 46 47 48 $250,000 Required: You need to use cell references to provide answers and calculations. There are 9 questions in Part 1. 1. Develop the predetermined overhead rate. Estimated Manufacturing Overhead Costs 49 50 Estimated Usage of Direct Labor Hours Predetermined Overhead Rate $787,500.00 $225,000.00 $3.50 51 52 53 2. Complete the job cost sheets provided below for the month of March: 54 55 56 Beginning Balance Job 57 $80,000 Job 58 Job 59 57 Current costs: 58 Direct materials 59 Direct Labor 60 Applied overhead 61 Total $80,000 $147,000 $24,500 $331,500 $75,000 $168,000 $28,000 $271,000 51,000 62 63 64 $105,000 Hint: You need to calculate the hourly rate and then compute direct labor cost per job. $17,500 $173,500 3. Determine the ending Work-In-Process Inventory at the end of March and provide the Job number of the job(s) still in Work-in-Process at the end of March and the determine total cost of ending work in process for March. Job # 58 $271,000 65 As mentioned in the problem Job 57 and 59 were completed, leaving job 58 as the only work in process remaining at the end of March. 66 67 68 4. Determine the ending Finished Goods for March and provide the Job number(s) of the job(s) in Finished Goods at the end of March and determine the total cost of ending finished goods for March. Job # 57 = $331,500 69 As mentioned the problem jobs 55 and 59 were sold, leaving only job 57 as unsold at the end of March 70 71 5. Determine the Cost of Goods Sold for March and provide the Job number of the Job(s) in Cost of Goods Sold for March and determine the total cost of goods sold for March. 72 Job 55 73 Job 59 74 Cost of Goods Sold $150,000 $173,500 $323,500 75 76 6. Prepare a statement of cost of goods manufactured for March below. Use Manufacturing Overhead applied in your statement. You need to prepare in good form. Please see Exhibit 18.6. 77 78 79 Glass Company Statement of Cost of Goods Manufactured 80 81 82 83 84 85 86 87 88 89 90 91 92 For Month ending March 31, 20XX Raw material, inventory, March 1 Purchases of raw material Total available Raw materials, inventory, March 31 Raw Materials Consumed Direct-labor wages Manufacturing overhead Total manufacturing cost Work in process March 1 Total costs in process Work in process March 31 20000 $220,000 $240,000 ($34,000) $206,000 $420,000 $70,000 $696,000 93 Cost of goods manufactured for march 80,000 776,000 ($271,000) $505,000 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 7. Prepare an Income Statement for March below. The company does not close the over or underapplied overhead until the end of the year, so no adjustment is needed to Cost of Goods Sold. You need to prepare in good form. Please see Exhibit 18.6. Glass Company Income Statement For Month ending March 31, 20XX Sales Cost of goods sold Finished goods inventory March 1 Cost of goods manufactured for March Total goods available for sale Finished goods inventory March 31 Cost of goods sold Gross profit $ 323,500 $ 126,500 $450,000 $ 150,000 505,000 655,000 ($331,500) 114 115 116 117 118 119 120 121 9. Prepare a Pie chart below showing the three product costs that were added to the jobs in March. 122 123 124

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started