Answered step by step

Verified Expert Solution

Question

1 Approved Answer

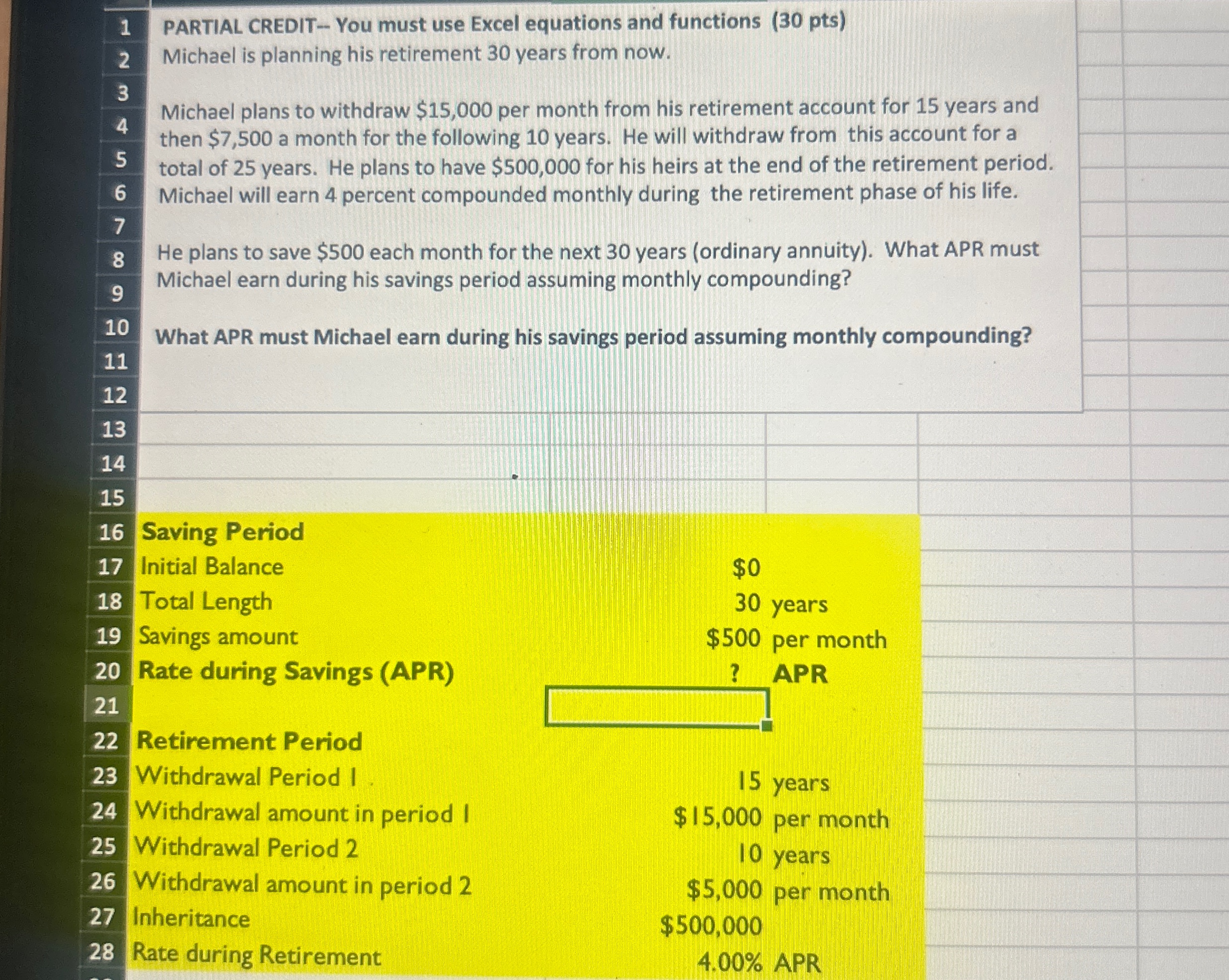

1 PARTIAL CREDIT - - You must use Excel equations and functions ( 3 0 pts ) Michael is planning his retirement 3 0 years

PARTIAL CREDIT You must use Excel equations and functions pts

Michael is planning his retirement years from now.

Michael plans to withdraw $ per month from his retirement account for years and then $ a month for the following years. He will withdraw from this account for a total of years. He plans to have $ for his heirs at the end of the retirement period. Michael will earn percent compounded monthly during the retirement phase of his life.

He plans to save $ each month for the next years ordinary annuity What APR must Michael earn during his savings period assuming monthly compounding?

What APR must Michael earn during his savings period assuming monthly compounding?

PARTIAL CREDITYou must use Excel equations and functions pts

Michael is planning his retirement years from now.

Michael plans to withdraw $ per month from his retirement account for years and then $ a month for the following years. He will withdraw from this account for a total of years. He plans to have $ for his heirs at the end of the retirement period. Michael will earn percent compounded monthly during the retirement phase of his life.

He plans to save $ each month for the next years ordinary annuity What APR must Michael earn during his savings period assuming monthly compounding?

What APR must Michael earn during his savings period assuming monthly compounding?

Saving Period

Initial Balance

Total Length

Savings amount

Rate during Savings APR

Retirement Period

Withdrawal Period I

Withdrawal amount in period I

Withdrawal Period

Withdrawal amount in period

Inheritance

Rate during Retirement

table$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started