Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Penang Corporation acquired Minang Corporation and took over its assets and operations, at the same time dis- solving Minang Corporation. This type of

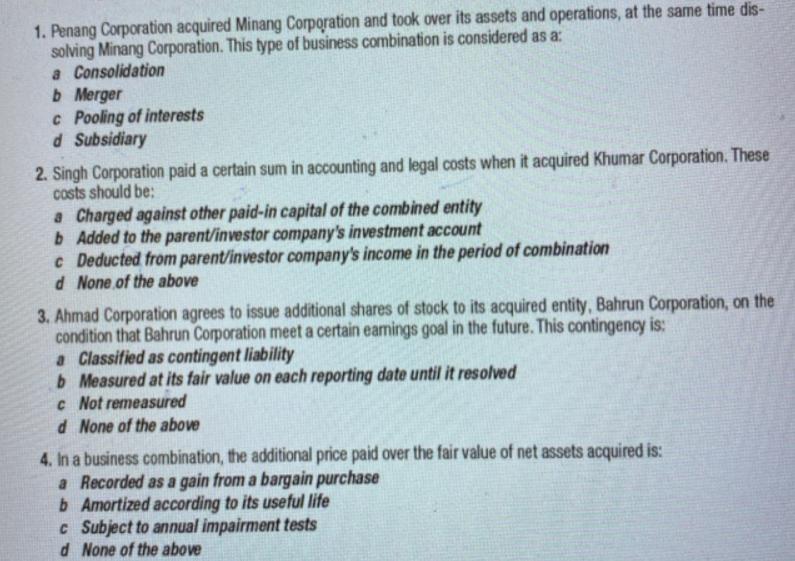

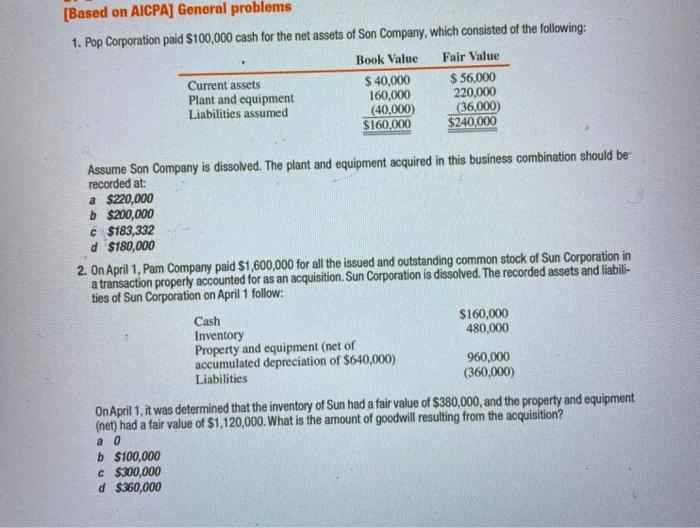

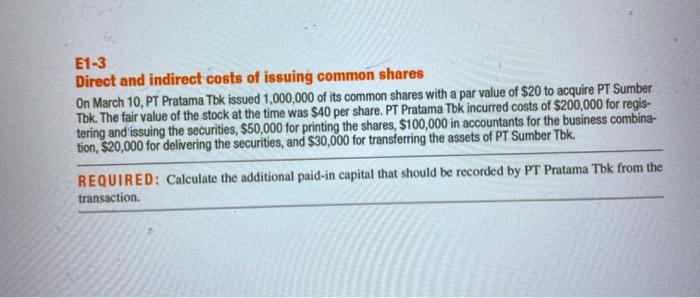

1. Penang Corporation acquired Minang Corporation and took over its assets and operations, at the same time dis- solving Minang Corporation. This type of business combination is considered as a: a Consolidation b Merger c Pooling of interests d Subsidiary 2. Singh Corporation paid a certain sum in accounting and legal costs when it acquired Khumar Corporation. These costs should be: a Charged against other paid-in capital of the combined entity b Added to the parent/investor company's investment account c Deducted from parent/investor company's income in the period of combination d None of the above 3. Ahmad Corporation agrees to issue additional shares of stock to its acquired entity, Bahrun Corporation, on the condition that Bahrun Corporation meet a certain earnings goal in the future. This contingency is: a Classified as contingent liability b Measured at its fair value on each reporting date until it resolved C Not remeasured d None of the above 4. In a business combination, the additional price paid over the fair value of net assets acquired is: a Recorded as a gain from a bargain purchase b Amortized according to its useful life c Subject to annual impairment tests d None of the above [Based on AICPA] General problems 1. Pop Corporation paid $100,000 cash for the net assets of Son Company, which consisted of the following: Current assets Plant and equipment Liabilities assumed Book Value Fair Value $40,000 $ 56,000 160,000 220,000 (40,000) (36,000) $160,000 $240,000 Assume Son Company is dissolved. The plant and equipment acquired in this business combination should be recorded at: a $220,000 b $200,000 6 $183,332 d $180,000 2. On April 1, Pam Company paid $1,600,000 for all the issued and outstanding common stock of Sun Corporation in a transaction properly accounted for as an acquisition. Sun Corporation is dissolved. The recorded assets and liabili- ties of Sun Corporation on April 1 follow: Cash Inventory Property and equipment (net of accumulated depreciation of $640,000) Liabilities $160,000 480,000 960,000 (360,000) On April 1, it was determined that the inventory of Sun had a fair value of $380,000, and the property and equipment (net) had a fair value of $1,120,000. What is the amount of goodwill resulting from the acquisition? a 0 b $100,000 c $300,000 d $360,000 E1-3 Direct and indirect costs of issuing common shares On March 10, PT Pratama Tbk issued 1,000,000 of its common shares with a par value of $20 to acquire PT Sumber Tbk. The fair value of the stock at the time was $40 per share. PT Pratama Tbk incurred costs of $200,000 for regis- tering and issuing the securities, $50,000 for printing the shares, $100,000 in accountants for the business combina- tion, $20,000 for delivering the securities, and $30,000 for transferring the assets of PT Sumber Tbk. REQUIRED: Calculate the additional paid-in capital that should be recorded by PT Pratama Tbk from the transaction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The type of business combination where one company acquires another and takes over its assets and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e793d29abd_881642.pdf

180 KBs PDF File

661e793d29abd_881642.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started