Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Pentland is a medium size prospect, with recoverable reserves of 400 million barrels of oil (36 API) and 200 x 10standard cubic feet

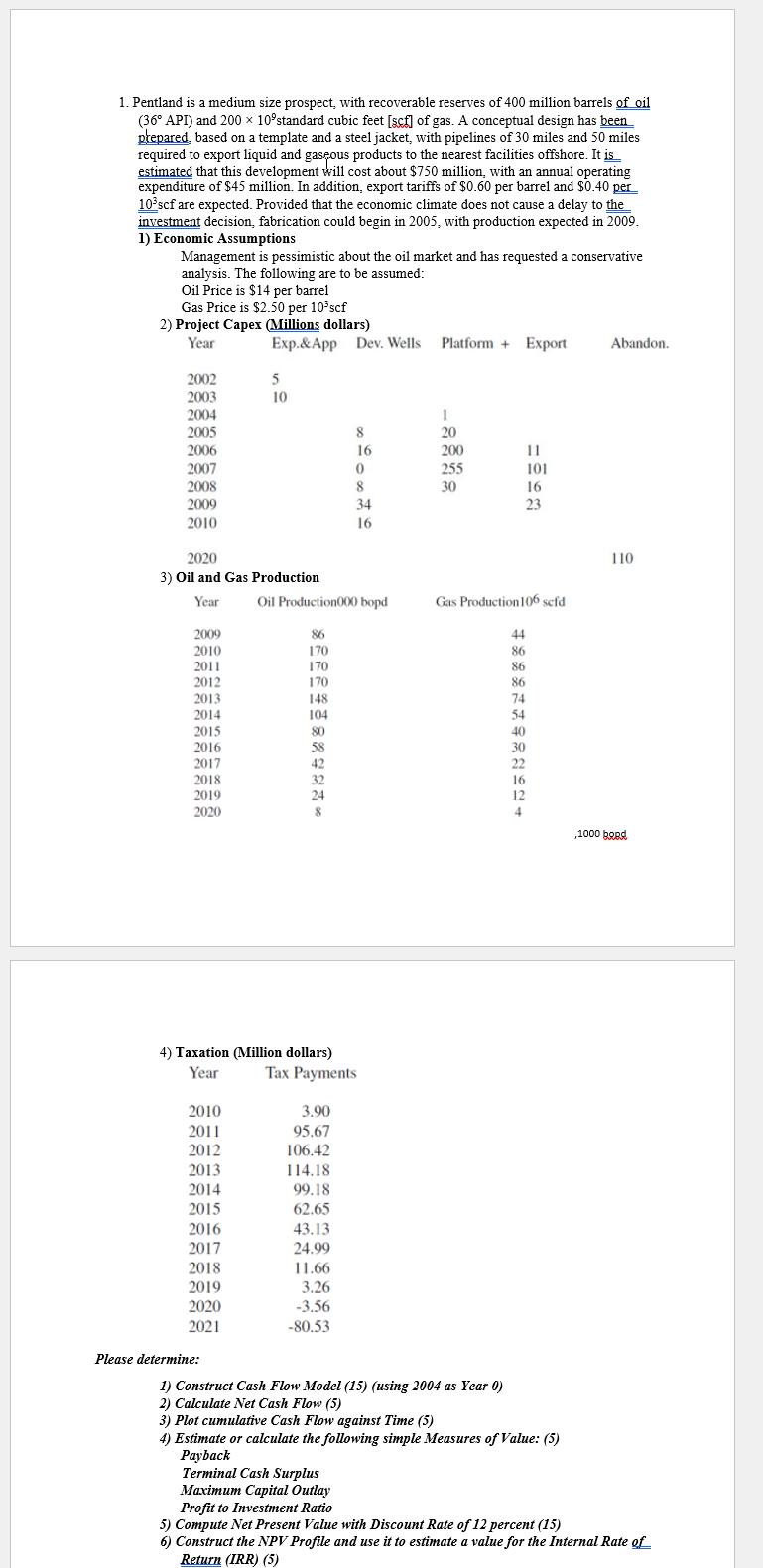

1. Pentland is a medium size prospect, with recoverable reserves of 400 million barrels of oil (36 API) and 200 x 10standard cubic feet [scf] of gas. A conceptual design has been prepared, based on a template and a steel jacket, with pipelines of 30 miles and 50 miles required to export liquid and gaseous products to the nearest facilities offshore. It is estimated that this development will cost about $750 million, with an annual operating expenditure of $45 million. In addition, export tariffs of $0.60 per barrel and $0.40 per 10scf are expected. Provided that the economic climate does not cause a delay to the investment decision, fabrication could begin in 2005, with production expected in 2009. 1) Economic Assumptions Management is pessimistic about the oil market and has requested a conservative analysis. The following are to be assumed: Oil Price is $14 per barrel Gas Price is $2.50 per 10 scf 2) Project Capex (Millions dollars) Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2009 2010 2011 2012 2013 2014 2014 2015 2016 2017 2018 2019 2020 2020 3) Oil and Gas Production Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Exp.& App Dev. Wells 2020 2021 5 4) Taxation (Million dollars) Year Please determine: 10 86 170 170 170 148 104 80 58 42 32 24 8 8 Oil Production000 bopd 16 3.90 95.67 106.42 114.18 99.18 62.65 43.13 24.99 11.66 3.26 -3.56 -80.53 0 8 34 16 Tax Payments Platform Export 1 20 200 255 30 Gas Production 106 scfd 4666440 M2K24 86 86 86 74 11 101 16 23 54 30 16 12 1) Construct Cash Flow Model (15) (using 2004 as Year 0) 2) Calculate Net Cash Flow (5) 3) Plot cumulative Cash Flow against Time (5) 4) Estimate or calculate the following simple Measures of Value: (5) Payback Terminal Cash Surplus Maximum Capital Outlay Profit to Investment Ratio 5) Compute Net Present Value with Discount Rate of 12 percent (15) Abandon. 110 ,1000 Beed 6) Construct the NPV Profile and use it to estimate a value for the Internal Rate of Return (IRR) (5)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings 1 Cash Flow Model years 20042021 2004 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started