Answered step by step

Verified Expert Solution

Question

1 Approved Answer

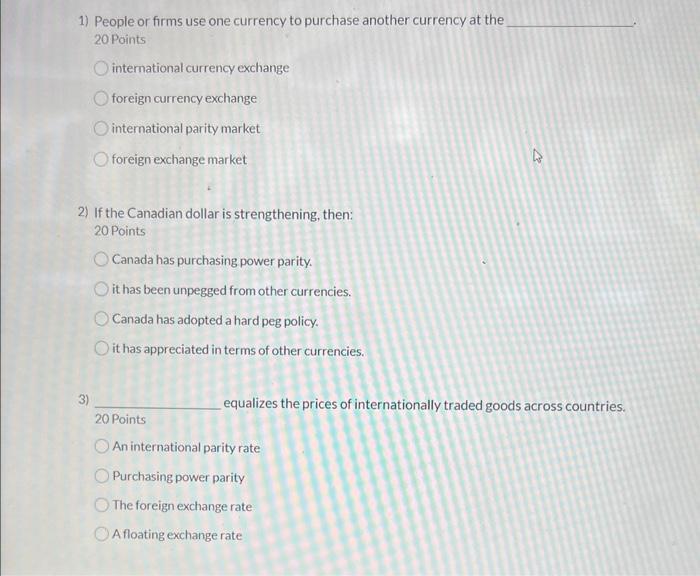

1) People or firms use one currency to purchase another currency at the 20 Points international currency exchange foreign currency exchange international parity market

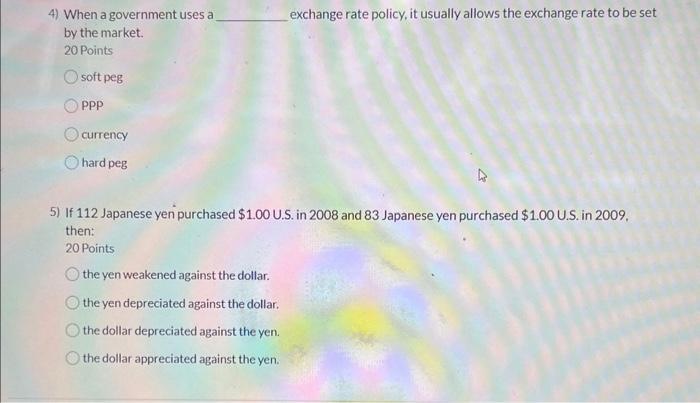

1) People or firms use one currency to purchase another currency at the 20 Points international currency exchange foreign currency exchange international parity market O foreign exchange market 2) If the Canadian dollar is strengthening, then: 20 Points O Canada has purchasing power parity. O it has been unpegged from other currencies. 3) O Canada has adopted a hard peg policy. O it has appreciated in terms of other currencies. 20 Points 27 equalizes the prices of internationally traded goods across countries. An international parity rate Purchasing power parity The foreign exchange rate A floating exchange rate 4) When a government uses a by the market. 20 Points Osoft peg PPP currency hard peg exchange rate policy, it usually allows the exchange rate to be set 5) If 112 Japanese yen purchased $1.00 U.S. in 2008 and 83 Japanese yen purchased $1.00 U.S. in 2009, then: 20 Points the yen weakened against the dollar. the yen depreciated against the dollar. the dollar depreciated against the yen. the dollar appreciated against the yen.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below I consider options as ABC and D Answer 1 is D foreign exchange market The foreign exchange market is the global marketplace where currencie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started