1. Perform a common size analysis and percentage change analysis. What do these analyses tell you about Computron?

2. Use the extended DuPont equation to provide a breakdown of Computrons projected return on equity. How does the projection compare with the previous years and with the industrys DuPont equation?

3. What are some potential problems and limitations of financial ratio analysis?

4. What are some qualitative factors that analysts should consider when evaluating a companys likely future financial performance?

3.

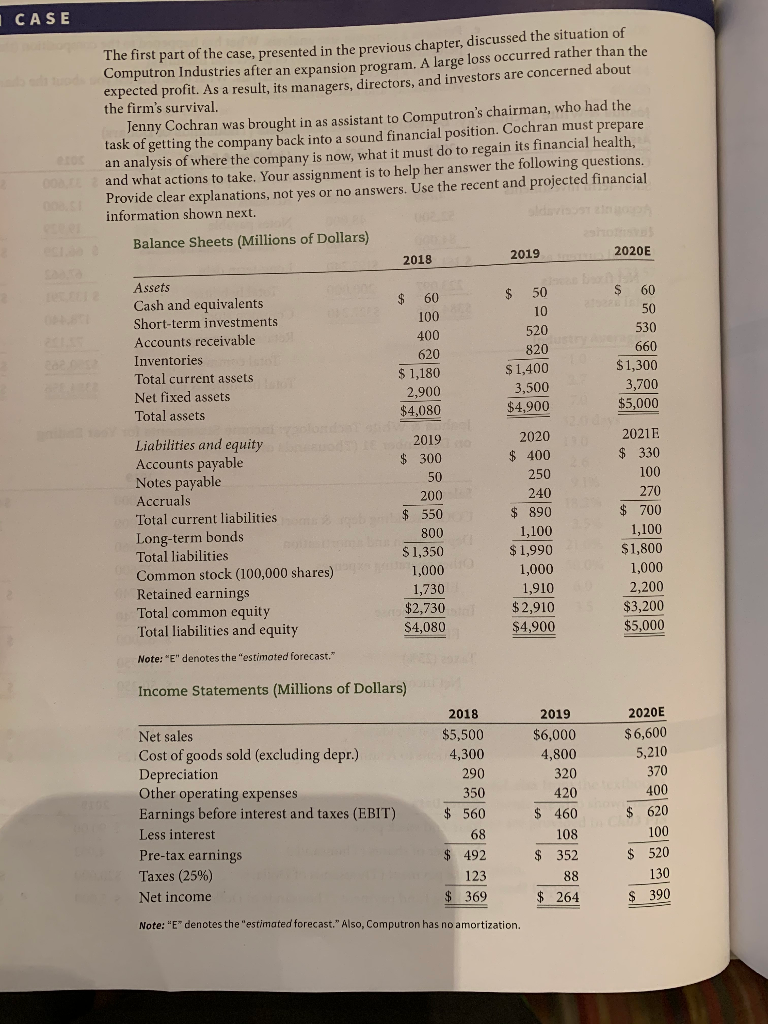

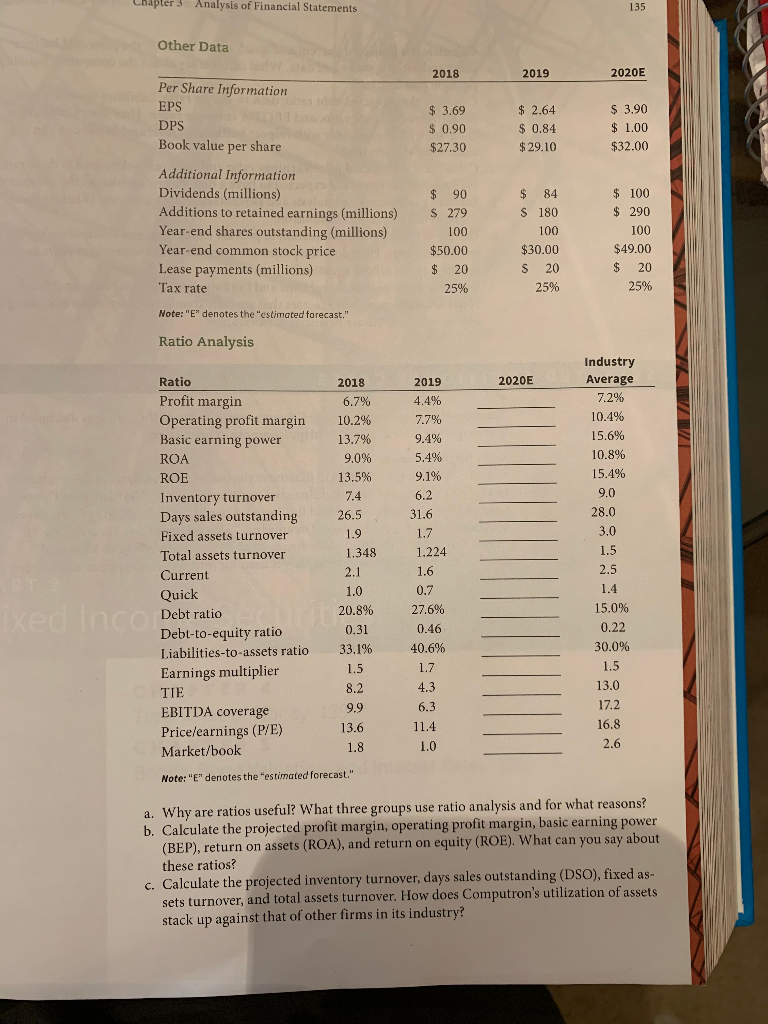

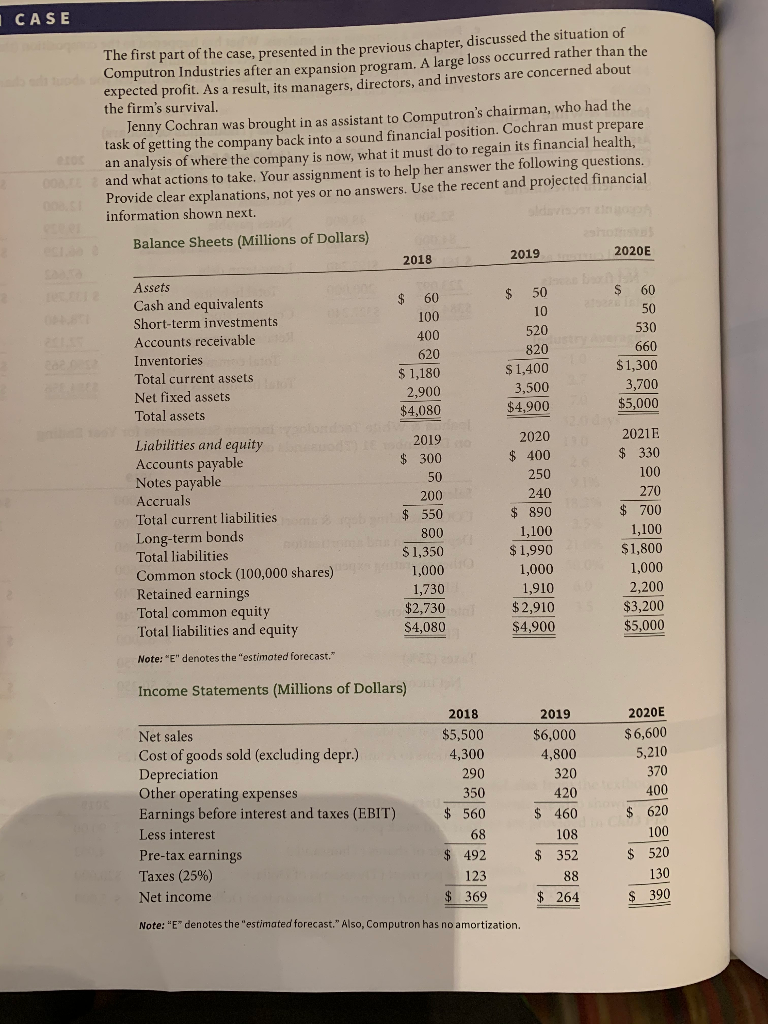

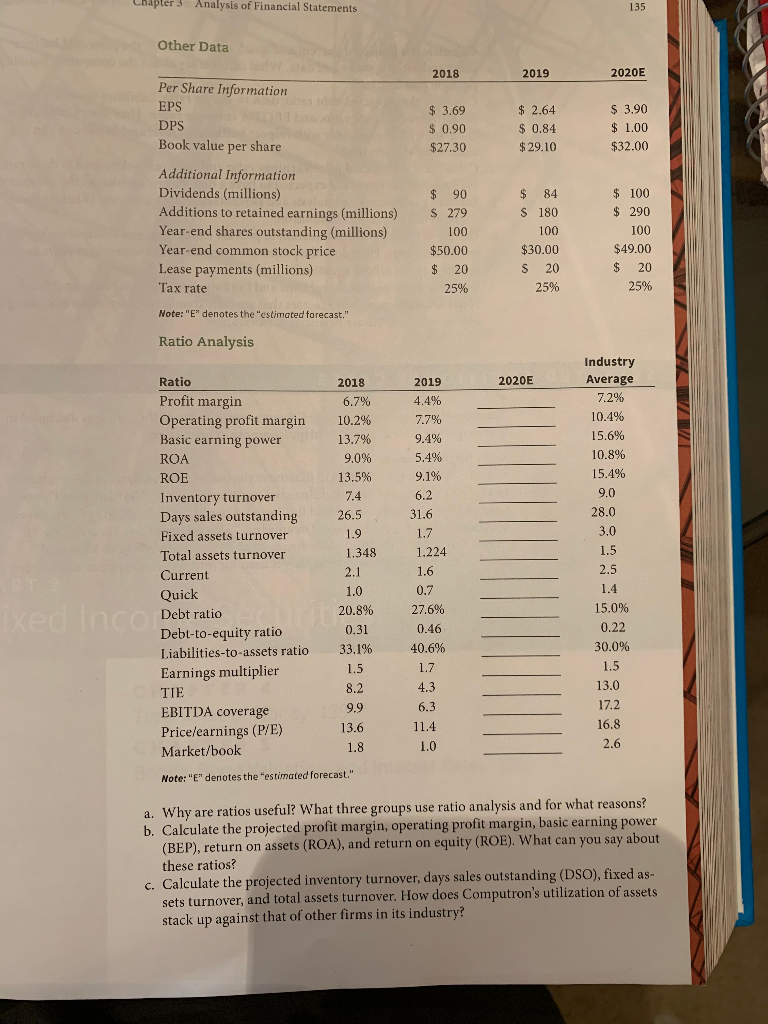

CASE The first part of the case, presented in the previous chapter, discussed the situation of Computron Industries after an expansion program. A large loss occurred rather than the expected profit. As a result, its managers, directors, and investors are concerned about the firm's survival. Jenny Cochran was brought in as assistant to Computron's chairman, who had the task of getting the company back into a sound financial position. Cochran must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions to take. Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers. Use the recent and projected financial information shown next. Balance Sheets (Millions of Dollars) 2018 2020E Assets Cash and equivalents $ $ Short-term investments 100 10 Accounts receivable 400 520 Inventories 620 820 660 Total current assets $ 1,180 $ 1,400 $1,300 Net fixed assets 2,900 3,500 3,700 Total assets $4,080 $4,900 $5,000 2019 50 S 60 60 50 530 2019 Liabilities and equity Accounts payable $ 300 Notes payable 50 Accruals 200 Total current liabilities $ 550 Long-term bonds 800 Total liabilities $1,350 Common stock (100,000 shares) 1,000 Retained earnings 1,730 Total common equity $2,730 Total liabilities and equity 2020 $ 400 250 240 $ 890 1,100 $ 1,990 1,000 1,910 $2,910 $4,900 2021 E $ 330 100 270 $ 700 1,100 $1,800 1,000 2,200 $3,200 $5,000 $4,080 Note: "E" denotes the "estimated forecast." Income Statements (Millions of Dollars) Net sales Cost of goods sold (excluding depr.) Depreciation Other operating expenses Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes (25%) Net income 2018 $5,500 4,300 290 350 $ 560 68 $ 492 123 $ 369 2019 $6,000 4,800 320 420 $ 460 108 $ 352 2020E $6,600 5,210 370 400 $ 620 100 $ 520 130 $ 390 88 $ 264 Note: "E" denotes the "estimated forecast." Also, Computron has no amortization. Chapter 3 Analysis of Financial Statements 135 Other Data 2018 2019 2020E $ 3.69 $ 0.90 $27.30 $ 2.64 $ 0.84 $29.10 $ 3.90 $ 1.00 $32.00 Per Share Information EPS DPS Book value per share Additional Information Dividends (millions) Additions to retained earnings (millions) Year-end shares outstanding (millions) Year-end common stock price Lease payments (millions) Tax rate $ 90 $ 279 100 $50.00 $ 20 25% $ 84 $ 180 100 $30.00 S 20 25% $ 100 $ 290 100 $49.00 $ 20 25% Note: "E" denotes the "estimated forecast." Ratio Analysis 2020E Ratio Profit margin Operating profit margin Basic earning power ROA ROE Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Current Quick Debt ratio Debt-to-equity ratio Liabilities-to-assets ratio Earnings multiplier 2018 6.7% 10.2% 13.7% 9.0% 13.5% 7.4 26.5 1.9 1.348 2.1 1.0 20.8% 0.31 33.1% 1.5 8.2 9.9 13.6 1.8 2019 4.4% 7.7% 9.4% 5.4% 9.1% 6.2 31.6 1.7 1.224 1.6 0.7 27.6% 0.46 40.6% 1.7 4.3 6.3 11.4 Industry Average 7.2% 10.4% 15.6% 10.8% 15.4% 9.0 28.0 3,0 1.5 2.5 1.4 15.0% 0.22 30.0% 1.5 13.0 17.2 16.8 2.6 xed Inco TIE EBITDA coverage Price/earnings (P/E) Market/book 1.0 Note: "E" denotes the estimated forecast." a. Why are ratios useful? What three groups use ratio analysis and for what reasons? b. Calculate the projected profit margin, operating profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What can you say about these ratios? C. Calculate the projected inventory turnover, days sales outstanding (DSO), fixed sets turnover, and total assets turnover. How does Computron's utilization of assets stack up against that of other firms in its industry? CASE The first part of the case, presented in the previous chapter, discussed the situation of Computron Industries after an expansion program. A large loss occurred rather than the expected profit. As a result, its managers, directors, and investors are concerned about the firm's survival. Jenny Cochran was brought in as assistant to Computron's chairman, who had the task of getting the company back into a sound financial position. Cochran must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions to take. Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers. Use the recent and projected financial information shown next. Balance Sheets (Millions of Dollars) 2018 2020E Assets Cash and equivalents $ $ Short-term investments 100 10 Accounts receivable 400 520 Inventories 620 820 660 Total current assets $ 1,180 $ 1,400 $1,300 Net fixed assets 2,900 3,500 3,700 Total assets $4,080 $4,900 $5,000 2019 50 S 60 60 50 530 2019 Liabilities and equity Accounts payable $ 300 Notes payable 50 Accruals 200 Total current liabilities $ 550 Long-term bonds 800 Total liabilities $1,350 Common stock (100,000 shares) 1,000 Retained earnings 1,730 Total common equity $2,730 Total liabilities and equity 2020 $ 400 250 240 $ 890 1,100 $ 1,990 1,000 1,910 $2,910 $4,900 2021 E $ 330 100 270 $ 700 1,100 $1,800 1,000 2,200 $3,200 $5,000 $4,080 Note: "E" denotes the "estimated forecast." Income Statements (Millions of Dollars) Net sales Cost of goods sold (excluding depr.) Depreciation Other operating expenses Earnings before interest and taxes (EBIT) Less interest Pre-tax earnings Taxes (25%) Net income 2018 $5,500 4,300 290 350 $ 560 68 $ 492 123 $ 369 2019 $6,000 4,800 320 420 $ 460 108 $ 352 2020E $6,600 5,210 370 400 $ 620 100 $ 520 130 $ 390 88 $ 264 Note: "E" denotes the "estimated forecast." Also, Computron has no amortization. Chapter 3 Analysis of Financial Statements 135 Other Data 2018 2019 2020E $ 3.69 $ 0.90 $27.30 $ 2.64 $ 0.84 $29.10 $ 3.90 $ 1.00 $32.00 Per Share Information EPS DPS Book value per share Additional Information Dividends (millions) Additions to retained earnings (millions) Year-end shares outstanding (millions) Year-end common stock price Lease payments (millions) Tax rate $ 90 $ 279 100 $50.00 $ 20 25% $ 84 $ 180 100 $30.00 S 20 25% $ 100 $ 290 100 $49.00 $ 20 25% Note: "E" denotes the "estimated forecast." Ratio Analysis 2020E Ratio Profit margin Operating profit margin Basic earning power ROA ROE Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Current Quick Debt ratio Debt-to-equity ratio Liabilities-to-assets ratio Earnings multiplier 2018 6.7% 10.2% 13.7% 9.0% 13.5% 7.4 26.5 1.9 1.348 2.1 1.0 20.8% 0.31 33.1% 1.5 8.2 9.9 13.6 1.8 2019 4.4% 7.7% 9.4% 5.4% 9.1% 6.2 31.6 1.7 1.224 1.6 0.7 27.6% 0.46 40.6% 1.7 4.3 6.3 11.4 Industry Average 7.2% 10.4% 15.6% 10.8% 15.4% 9.0 28.0 3,0 1.5 2.5 1.4 15.0% 0.22 30.0% 1.5 13.0 17.2 16.8 2.6 xed Inco TIE EBITDA coverage Price/earnings (P/E) Market/book 1.0 Note: "E" denotes the estimated forecast." a. Why are ratios useful? What three groups use ratio analysis and for what reasons? b. Calculate the projected profit margin, operating profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What can you say about these ratios? C. Calculate the projected inventory turnover, days sales outstanding (DSO), fixed sets turnover, and total assets turnover. How does Computron's utilization of assets stack up against that of other firms in its industry