Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Phoebe is married and just took a job marketing above ground pools, her annual salary is going to be $84,000. Determine her monthly take

1. Phoebe is married and just took a job marketing above ground pools, her annual salary is going to be $84,000. Determine her monthly take home pay after the taxes have been taken out.?

2. Zeke makes online videos demonstrating new toys. His annual salary will be $186,000. Determine his monthly take home pay after the taxes have been taken out.?

3. Hi Stick is a professional hockey player whose yearly salary is $4,530,000. Determine his monthly take home pay after taxes have been taken out.

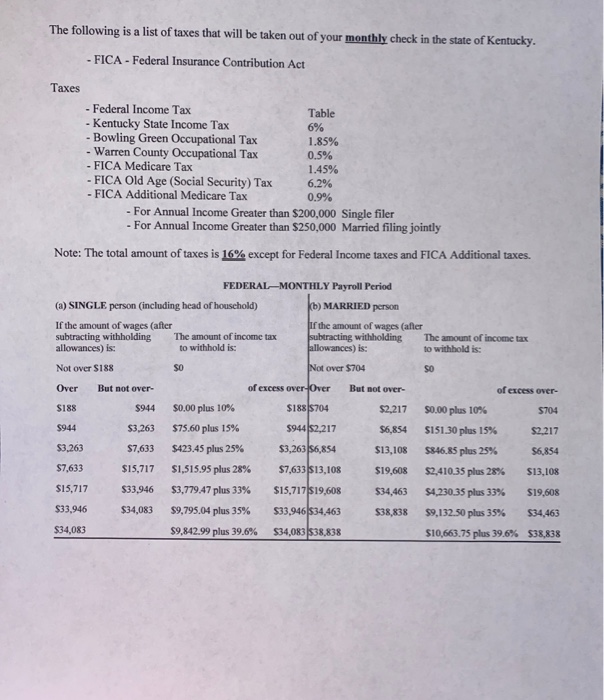

The following is a list of taxes that will be taken out of your monthly check in the state of Kentucky. - FICA - Federal Insurance Contribution Act Taxes - Federal Income Tax - Kentucky State Income Tax - Bowling Green Occupational Tax - Warren County Occupational Tax - FICA Medicare Tax - FICA Old Age (Social Security) Tax - FICA Additional Medicare Tax (a) SINGLE person (including head of household) If the amount of wages (after subtracting withholding allowances) is: Not over $188 Over $188 $944 $3,263 $7,633 $15,717 $33,946 $34,083 But not over- $944 $3,263 $7,633 $15,717 $33,946 $34,083 - For Annual Income Greater than $200,000 Single filer - For Annual Income Greater than $250,000 Married filing jointly Note: The total amount of taxes is 16% except for Federal Income taxes and FICA Additional taxes. The amount of income tax to withhold is: $0 Table 6% FEDERAL-MONTHLY Payroll Period (b) MARRIED person If the amount of wages (after subtracting withholding allowances) is: Not over $704 $0.00 plus 10% $75.60 plus 15% $423.45 plus 25% 1.85% 0.5% 1.45% 6.2% 0.9% $1,515.95 plus 28% $3,779.47 plus 33% $9,795.04 plus 35% $9,842.99 plus 39.6% of excess over-Over $188 $704 $944 $2,217 $3,263 $6,854 $7,633 $13,108 $15,717 $19,608 $33,946 $34,463 $34,083 $38,838 But not over- $2,217 $6,854 $13,108 $19,608 $34,463 $38,838 The amount of income tax to withhold is: SO of excess over- $704 $2,217 $6,854 $0.00 plus 10% $151.30 plus 15% $846.85 plus 25% $2,410.35 plus 28% $4,230.35 plus 33% $9,132.50 plus 35% $10,663.75 plus 39.6% $13,108 $19,608 $34,463 $38,838

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started