Question

1 PhotoCrafter Contributed by Ruth Ann Strickland Kings University College, Western University London, Ontario James Liu had loved photography ever since he received his first

1 PhotoCrafter Contributed by Ruth Ann Strickland Kings University College, Western University London, Ontario James Liu had loved photography ever since he received his first camera as a gift from his grandmother for his fourth birthday. When he was young, he took pictures of everything that interested him, and he stored them in virtual photo albums that he enjoyed looking at. He continually challenged himself to take better and better pictures. At one point, he took 100 pictures of birds of prey and made an entire exhibit of them. He spent so much time taking pictures that soon his nickname became PhotoCrafter. It was a name that he loved. By the time James was in his final year of university, he was asked to take pictures at so many events that he decided to start a business and he began charging for his services. On July 1, 2020, James officially launched his business, which he immediately named PhotoCrafter. He has now graduated and runs PhotoCrafter on a full-time basis. Information about the business is in Exhibit I. It is now the beginning of July 2022, and James would like to know how PhotoCrafter has done during its second fiscal year. He knows that he has been busy, and he knows that he has had fun, but he also wants to know about the financial success of his business so that he can make some important decisions about whether to expand during the upcoming fiscal year. He would also like to know how much he will have to pay in tax, at a rate of 30%. Throughout the year, James withdrew a personal salary of $2,500 per month. James is eager to see the financial results of the year ended June 30, 2022, his second year of business. He has provided you with a trial balance of his accounts as at June 30, 2021 (Exhibit II) and has asked you to prepare journal entries for all transactions, as well as any adjusting or closing entries, for the year ended June 30, 2022. He would also like you to prepare some visualizations from his financial results and financial statements. Please do your very best work so that James will be impressed and will ask you to prepare his financial statements again next year.

Required Prepare: (a) all journal entries, including closing entries (b) at least two visualizations to illustrate the companys financial results (c) a statement of income for the year ended June 30, 2022 (d) a statement of financial position as at June 30, 2022 (e) a memo to James discussing key matters that he should consider relating to the items above, including the visualizations you prepared and your estimate how much he will have to pay in tax

Exhibit 1 Information on PhotoCrafter Operating Expenses James operates PhotoCrafter out of his home and allocates 30% of the total space to his business. He pays rent on the last day of each month for the following month. On January 1, 2022, his rent increased from a total of $1,400 to a total of $1,500 per month. One part-time employee, Karen, helps James during busy periods. Karen earns $16 per hour and was paid cash for 1,400 hours that she worked during fiscal 2022. Prior to year end, she worked an additional 11 hours that had not yet been paid. Karen also receives a 10% commission on sales that she personally makes. During fiscal 2022, Karen was personally responsible for 20% of PhotoCrafters gross photography sales. (Gross photography sales were $94,500. Commissions are paid on the last day of each fiscal year.) Photography supplies were purchased on account during fiscal 2022 for $1,750. (All accounts payable for operating expenses are paid at the end of the current month. Use a separate journal entry.) At the end of June, $400 of supplies were still on hand that had not yet been used. PhotoCrafter has a telephone service plan that costs $80 every month for telephone service. On January 1, 2020, James had purchased a 12-month insurance policy. When it expired, he paid for another 24 months and received a 10% discount off the original price. Because this was a highly mobile business, a major expense for James was operating costs for his car. During fiscal 2022, James drove his car 40,000 km. He kept careful records of all costs and determined that the operating expenses for the car totaled $0.15 per kilometer. These costs were paid in cash as incurred. All of the mileage driven was for business purposes. James has a separate vehicle that he uses for personal purposes. On September 15, 2021, James paid $3,600 for 12 months of advertising in a local photography magazine. The ads were scheduled to start on October 1, 2021.

Property, Plant, and Equipment On July 1, 2020, James had paid $20,000 for a Smart Car that was specially designed for his business. He expects to use this car for a total of five years and calculates depreciation based on an expected 160,000 total kilometers. When James started PhotoCrafter he already owned $6,000 worth of camera equipment that he contributed for exclusive use by the business. Depreciation for this equipment was calculated on a straight-line basis. On April 28, 2022, James traded this equipment in on some newer equipment offered by a local vendor. Because of the excellent condition of Jamess equipment, the vendor gave a trade-in allowance of $4,000, which was the fair value of the equipment. The vendor also extended delayed payment terms by having James sign a $9,000, 4%, 12-month note payable. (All accounts payable for operating expenses are paid at the end of the current month. Use a separate journal entry.) Due to possible rapid obsolescence, James decided to use double declining-balance depreciation for the new equipment, which has a useful life of 10 years and an expected residual value of $3,000. As a condition of the note, the vendor requires a copy of Jamess fiscal 2022 financial statements once they are completed and requires that James not incur any other debt until the note is repaid. An additional requirement is to maintain a current ratio of at least 2:1. PhotoCrafter also has $4,000 worth of computer equipment that is being depreciated on a declining-balance method. For this equipment, there is $300 residual value expected at the end of its useful life.

Intangible Assets On July 1, 2020, James had paid $5,000 to register the name PhotoCrafter as a trade name that has an indefinite life. On the same day, he had also paid $8,000 for a five-year patent to protect his unique photography process. On June 30, 2022, the patent had a fair value of $3,000.

Photography Revenue Many of PhotoCrafters customers are university students who pay by cash or credit card for services as they are received. Students who pay cash receive a 3% discount. Students who pay by credit card do not receive a discount. James pays a 2% service fee to the bank for all credit card transactions. For accounting purposes, credit card purchases are treated as cash. James also does work for schools and for businesses. He calls these corporate customers and allows them to pay later, with generous credit terms of 3/30, net 60. Corporate customers never pay with credit cards. PhotoCrafters gross sales for photography services in fiscal 2022 were $94,500. Of these sales, 78% were to corporate customers; 65% of the corporate customers paid within the discount period. For the remaining sales, 25% were in cash. All unearned revenue from fiscal 2021 was earned during July 2021. (No discounts or credit card fees applied to this revenue.) All accounts receivable were collected in the month following the sale, except as noted in Exhibit III.

Camera Sales Jamess customers often commented on his great skill and the wonderful pictures he took. When they asked him his secret, he said it took years of practice and great equipment. He identified a camera he really liked that sold at a retail price of $450, and he began selling them to interested customers. He found that they were particularly popular as Christmas and Valentines Day gifts. James was able to purchase the camera he liked from CamPro for $325 each if he ordered at least 25 at a time. Otherwise, he paid $350 per camera. Credit terms from CamPro were 2/15, net 60. Shipping was FOB shipping point and was paid by the correct party. The shipping cost was $4 per camera for orders under 40 cameras and a flat rate of $160 on orders of 40 or more. See Exhibit I for a list of camera purchases. Five of the cameras from the November 15 purchase had defective lenses. James had already paid for these cameras before he realized that they were damaged. He called the supplier and arranged to return them and to get a full refund for all of his costs. The supplier also agreed to pay for the shipping cost for returning the cameras. In December 2021, James needed 10 extra cameras for a customer who wanted them for holiday gifts. CamPro was unable to provide them quickly enough, so James had to order them from SnapShots, a supplier in the United States, at a cost of C$400 each. SnapShots did not offer any credit terms and shipped overnight at a cost of C$10 per camera. Duty of 8% was also charged on gross purchase price. Shipping terms were FOB destination. In March 2022, James ordered five more cameras from SnapShots for the same customer, under the same terms as the previous order. James sold a total of 100 cameras during fiscal 2022 and had 15 in ending inventory at the end of the year. Most of the cameras sold at the regular selling price of $450; however, the customer who wanted the special-order cameras from SnapShots paid $500 for each of them. She had paid for them and had received them prior to the end of fiscal 2022. Periodic inventory with a FIFO cost flow was used for the rest of the cameras. All camera sales were for cash at the time of the sale.

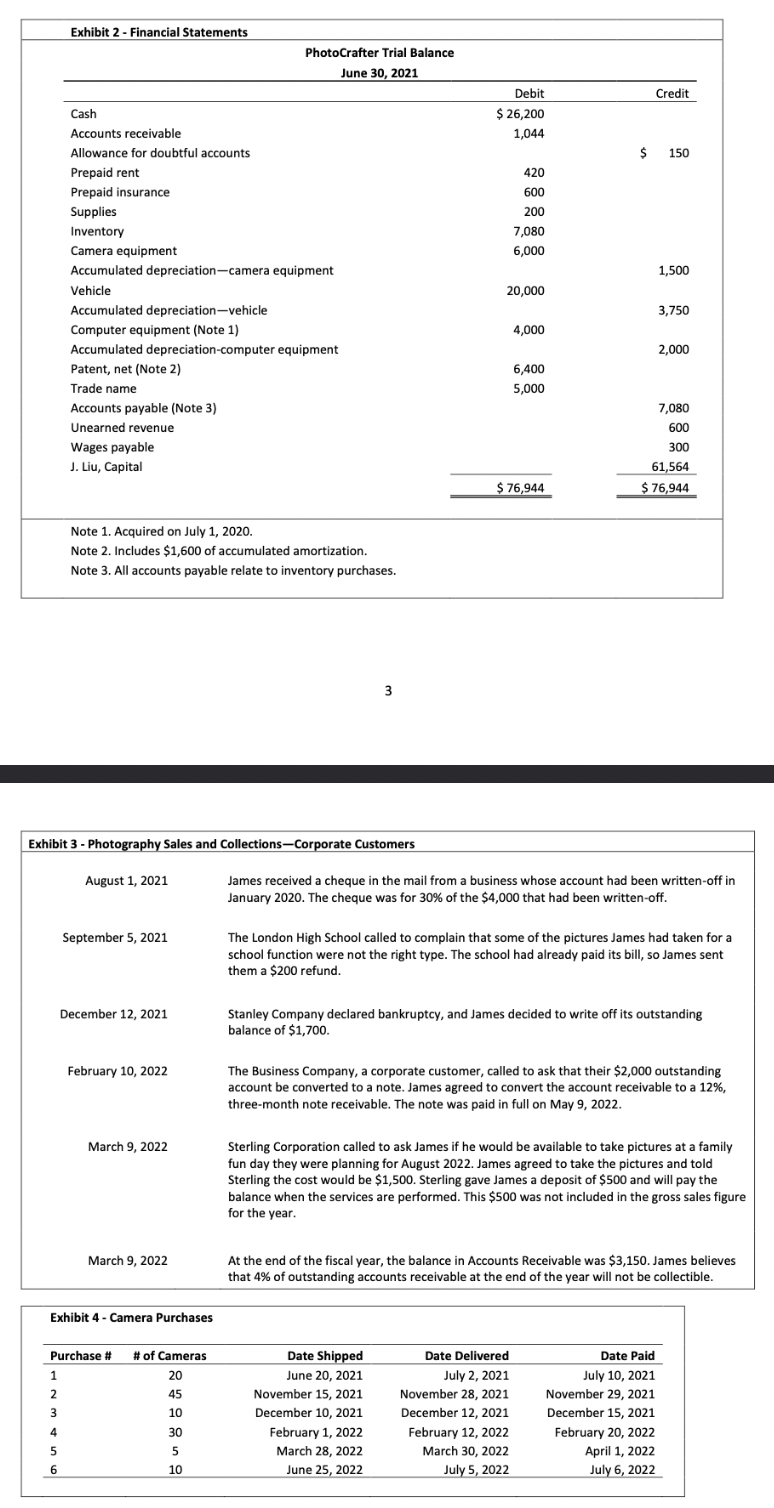

\begin{tabular}{|lrrrr|} \hline \multicolumn{3}{|l|}{ Exhibit 4 - Camera Purchases } & & \\ \hline Purchase # & # of Cameras & Date Shipped & Date Delivered & Date Paid \\ \hline 1 & 20 & June 20, 2021 & July 2, 2021 & July 10, 2021 \\ 2 & 45 & November 15, 2021 & November 28, 2021 & November 29, 2021 \\ 3 & 10 & December 10, 2021 & December 12, 2021 & December 15, 2021 \\ 4 & 30 & February 1, 2022 & February 12, 2022 & February 20, 2022 \\ 5 & 5 & March 28, 2022 & March 30, 2022 & April 1, 2022 \\ 6 & 10 & June 25, 2022 & July 5, 2022 & July 6, 2022 \\ \hline \end{tabular} \begin{tabular}{|lrrrr|} \hline \multicolumn{3}{|l|}{ Exhibit 4 - Camera Purchases } & & \\ \hline Purchase # & # of Cameras & Date Shipped & Date Delivered & Date Paid \\ \hline 1 & 20 & June 20, 2021 & July 2, 2021 & July 10, 2021 \\ 2 & 45 & November 15, 2021 & November 28, 2021 & November 29, 2021 \\ 3 & 10 & December 10, 2021 & December 12, 2021 & December 15, 2021 \\ 4 & 30 & February 1, 2022 & February 12, 2022 & February 20, 2022 \\ 5 & 5 & March 28, 2022 & March 30, 2022 & April 1, 2022 \\ 6 & 10 & June 25, 2022 & July 5, 2022 & July 6, 2022 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started