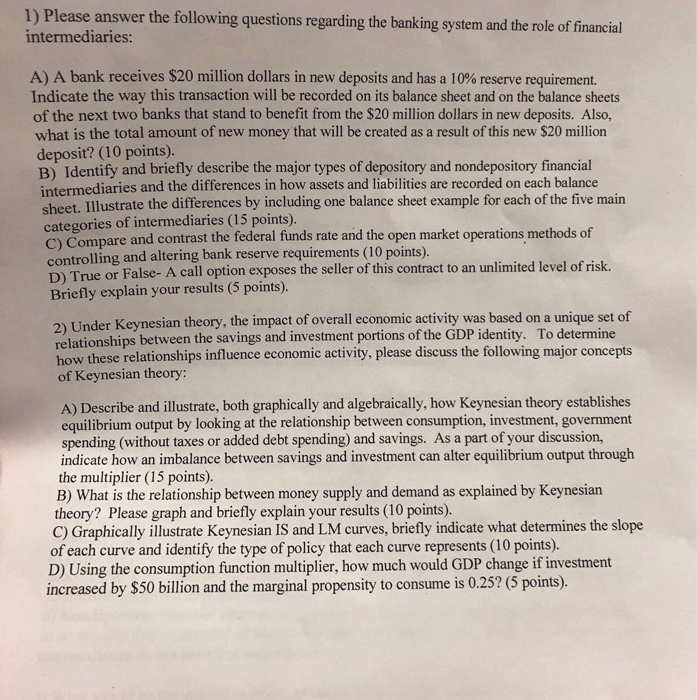

1) Please answer the following questions regarding the banking system and the role of financial intermediaries: A) A bank receives $20 million dollars in new deposits and has a 10% reserve requirement. Indicate the way this transaction will be recorded on its balance sheet and on the balance sheets of the next two banks that stand to benefit from the $20 million dollars in new deposits. Also what is the total amount of new money that will be created as a result of this new $20 million deposit? (10 points) B) Identify and briefly describe the major types of depository and nondepository financial intermediaries and the differences in how assets and liabilities are recorded on each balance t. Illustrate the differences by including one balance sheet example for each of the five main categories of intermediaries (15 points C) Compare and contrast the federal funds rate and the open market operations methods of controlling and altering bank reserve requirements (10 points) True or False- A call option exposes the seller of this contract to an unlimited level of risk. D) Briefly explain your results (5 points). Under Keynesian theory, the impact of overall economic activity was based on a unique set of relationships between the savings and investment portions of the GDP identity. To determine how these relationships influence economic activity, please discuss the following major concepts of Keynesian theory: A) Describe and illustrate, both graphically and algebraically, how Keynesian theory establishes equilibrium output by looking at the relationship between consumption, investment, government spending (without taxes or added debt spending) and savings. As a part of your discussion, indicate how an imbalance between savings and investment can alter equilibrium output through the multiplier (15 points). B) What is the relationship between money supply and demand as explained by Keynesian theory? Please graph and briefly explain your results (10 points) C) Graphically illustrate Keynesian IS and LM curves, briefly indicate what determines the slope of each curve and identify the type of policy that each curve represents (10 points) D) Using the consumption function multiplier, how much would GDP change if investment increased by $50 billion and the marginal propensity to consume is 0.252 (5 points). 1) Please answer the following questions regarding the banking system and the role of financial intermediaries: A) A bank receives $20 million dollars in new deposits and has a 10% reserve requirement. Indicate the way this transaction will be recorded on its balance sheet and on the balance sheets of the next two banks that stand to benefit from the $20 million dollars in new deposits. Also what is the total amount of new money that will be created as a result of this new $20 million deposit? (10 points) B) Identify and briefly describe the major types of depository and nondepository financial intermediaries and the differences in how assets and liabilities are recorded on each balance t. Illustrate the differences by including one balance sheet example for each of the five main categories of intermediaries (15 points C) Compare and contrast the federal funds rate and the open market operations methods of controlling and altering bank reserve requirements (10 points) True or False- A call option exposes the seller of this contract to an unlimited level of risk. D) Briefly explain your results (5 points). Under Keynesian theory, the impact of overall economic activity was based on a unique set of relationships between the savings and investment portions of the GDP identity. To determine how these relationships influence economic activity, please discuss the following major concepts of Keynesian theory: A) Describe and illustrate, both graphically and algebraically, how Keynesian theory establishes equilibrium output by looking at the relationship between consumption, investment, government spending (without taxes or added debt spending) and savings. As a part of your discussion, indicate how an imbalance between savings and investment can alter equilibrium output through the multiplier (15 points). B) What is the relationship between money supply and demand as explained by Keynesian theory? Please graph and briefly explain your results (10 points) C) Graphically illustrate Keynesian IS and LM curves, briefly indicate what determines the slope of each curve and identify the type of policy that each curve represents (10 points) D) Using the consumption function multiplier, how much would GDP change if investment increased by $50 billion and the marginal propensity to consume is 0.252 (5 points)