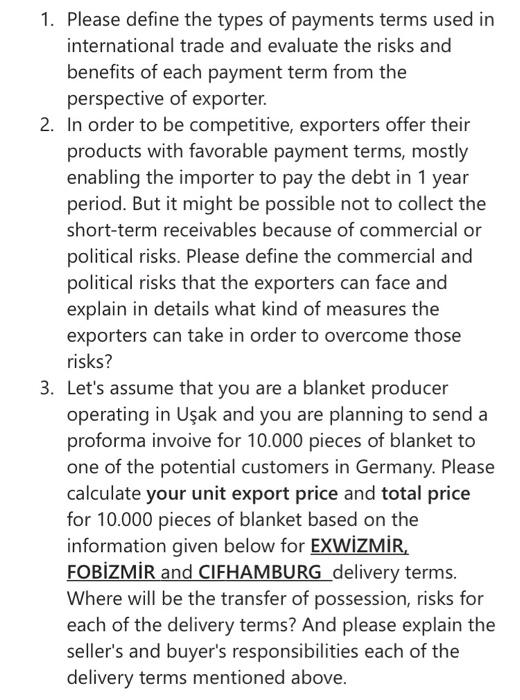

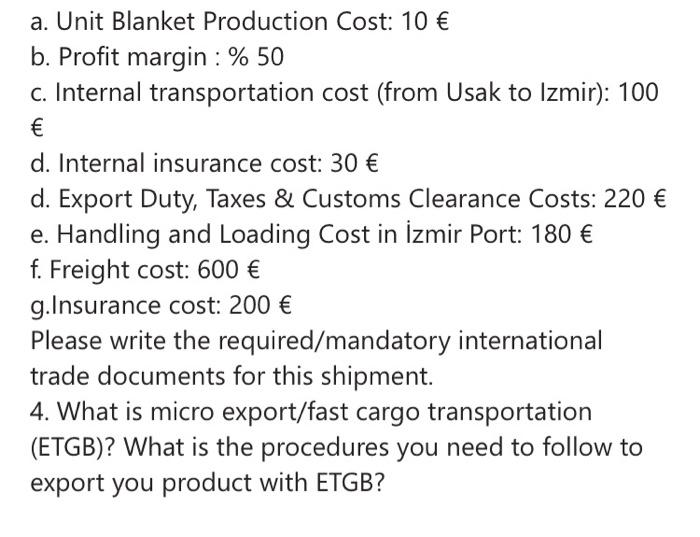

1. Please define the types of payments terms used in international trade and evaluate the risks and benefits of each payment term from the perspective of exporter. 2. In order to be competitive, exporters offer their products with favorable payment terms, mostly enabling the importer to pay the debt in 1 year period. But it might be possible not to collect the short-term receivables because of commercial or political risks. Please define the commercial and political risks that the exporters can face and explain in details what kind of measures the exporters can take in order to overcome those risks? 3. Let's assume that you are a blanket producer operating in Uak and you are planning to send a proforma invoive for 10.000 pieces of blanket to one of the potential customers in Germany. Please calculate your unit export price and total price for 10.000 pieces of blanket based on the information given below for EXWZMR, FOBZMR and CIFHAMBURG delivery terms. Where will be the transfer of possession, risks for each of the delivery terms? And please explain the seller's and buyer's responsibilities each of the delivery terms mentioned above. a. Unit Blanket Production Cost: 10 b. Profit margin : % 50 c. Internal transportation cost (from Usak to Izmir): 100 d. Internal insurance cost: 30 d. Export Duty, Taxes & Customs Clearance Costs: 220 e. Handling and Loading Cost in Izmir Port: 180 f. Freight cost: 600 g. Insurance cost: 200 Please write the required/mandatory international trade documents for this shipment. 4. What is micro export/fast cargo transportation (ETGB)? What is the procedures you need to follow to export you product with ETGB? 1. Please define the types of payments terms used in international trade and evaluate the risks and benefits of each payment term from the perspective of exporter. 2. In order to be competitive, exporters offer their products with favorable payment terms, mostly enabling the importer to pay the debt in 1 year period. But it might be possible not to collect the short-term receivables because of commercial or political risks. Please define the commercial and political risks that the exporters can face and explain in details what kind of measures the exporters can take in order to overcome those risks? 3. Let's assume that you are a blanket producer operating in Uak and you are planning to send a proforma invoive for 10.000 pieces of blanket to one of the potential customers in Germany. Please calculate your unit export price and total price for 10.000 pieces of blanket based on the information given below for EXWZMR, FOBZMR and CIFHAMBURG delivery terms. Where will be the transfer of possession, risks for each of the delivery terms? And please explain the seller's and buyer's responsibilities each of the delivery terms mentioned above. a. Unit Blanket Production Cost: 10 b. Profit margin : % 50 c. Internal transportation cost (from Usak to Izmir): 100 d. Internal insurance cost: 30 d. Export Duty, Taxes & Customs Clearance Costs: 220 e. Handling and Loading Cost in Izmir Port: 180 f. Freight cost: 600 g. Insurance cost: 200 Please write the required/mandatory international trade documents for this shipment. 4. What is micro export/fast cargo transportation (ETGB)? What is the procedures you need to follow to export you product with ETGB