1.) please help me fill in the blanks

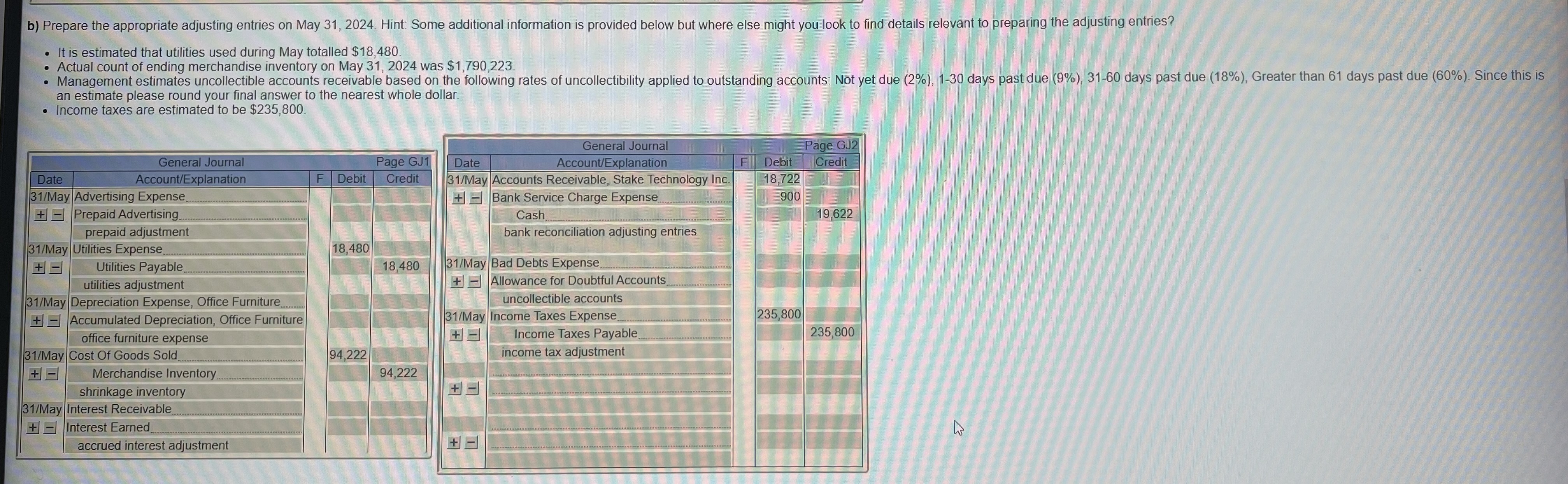

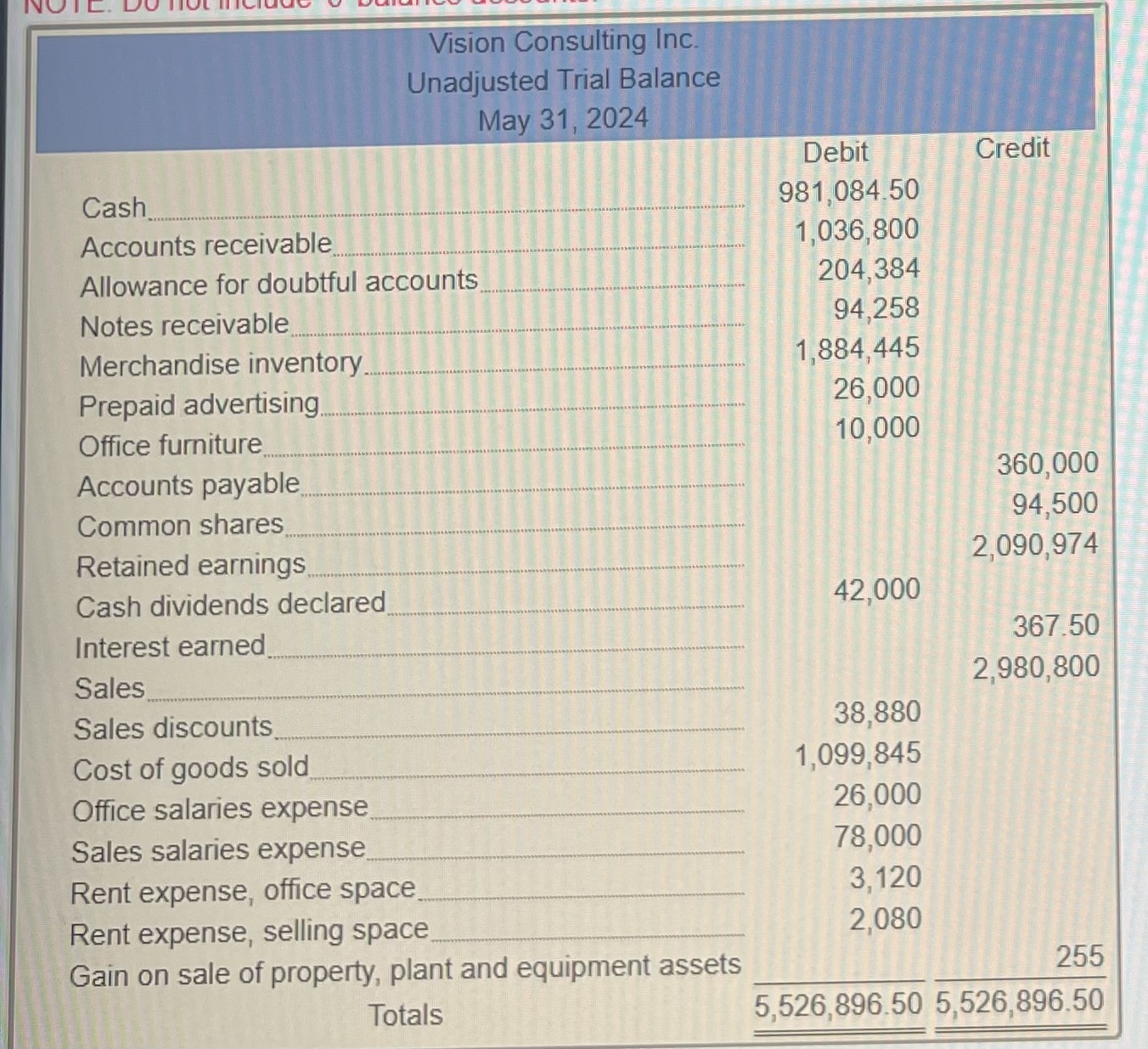

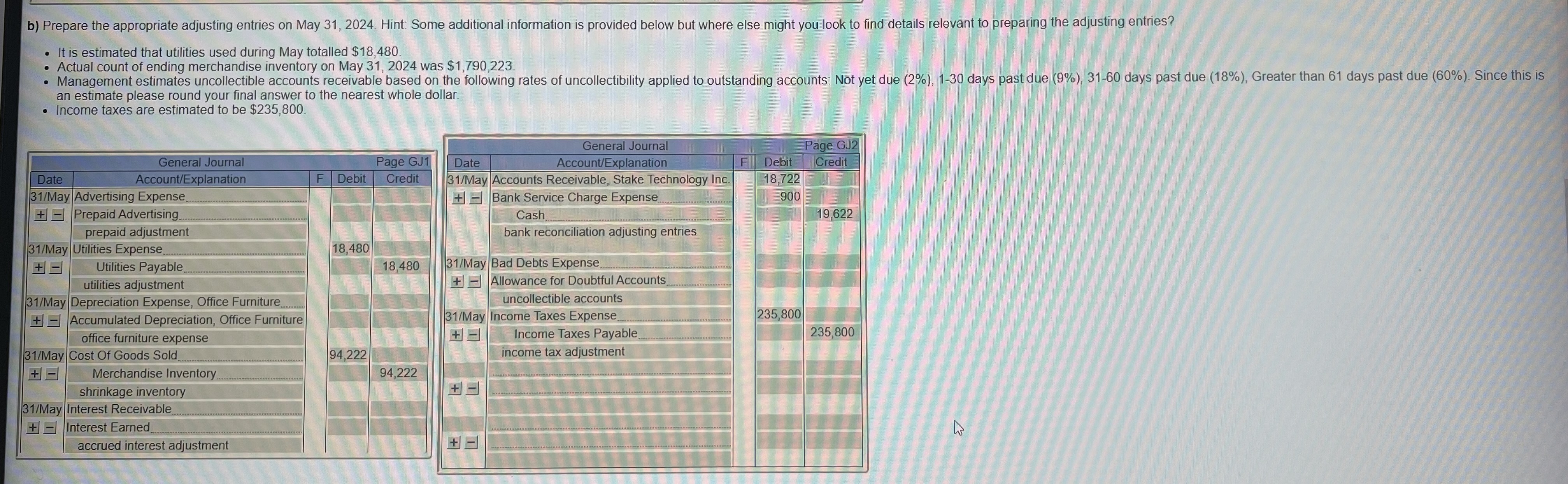

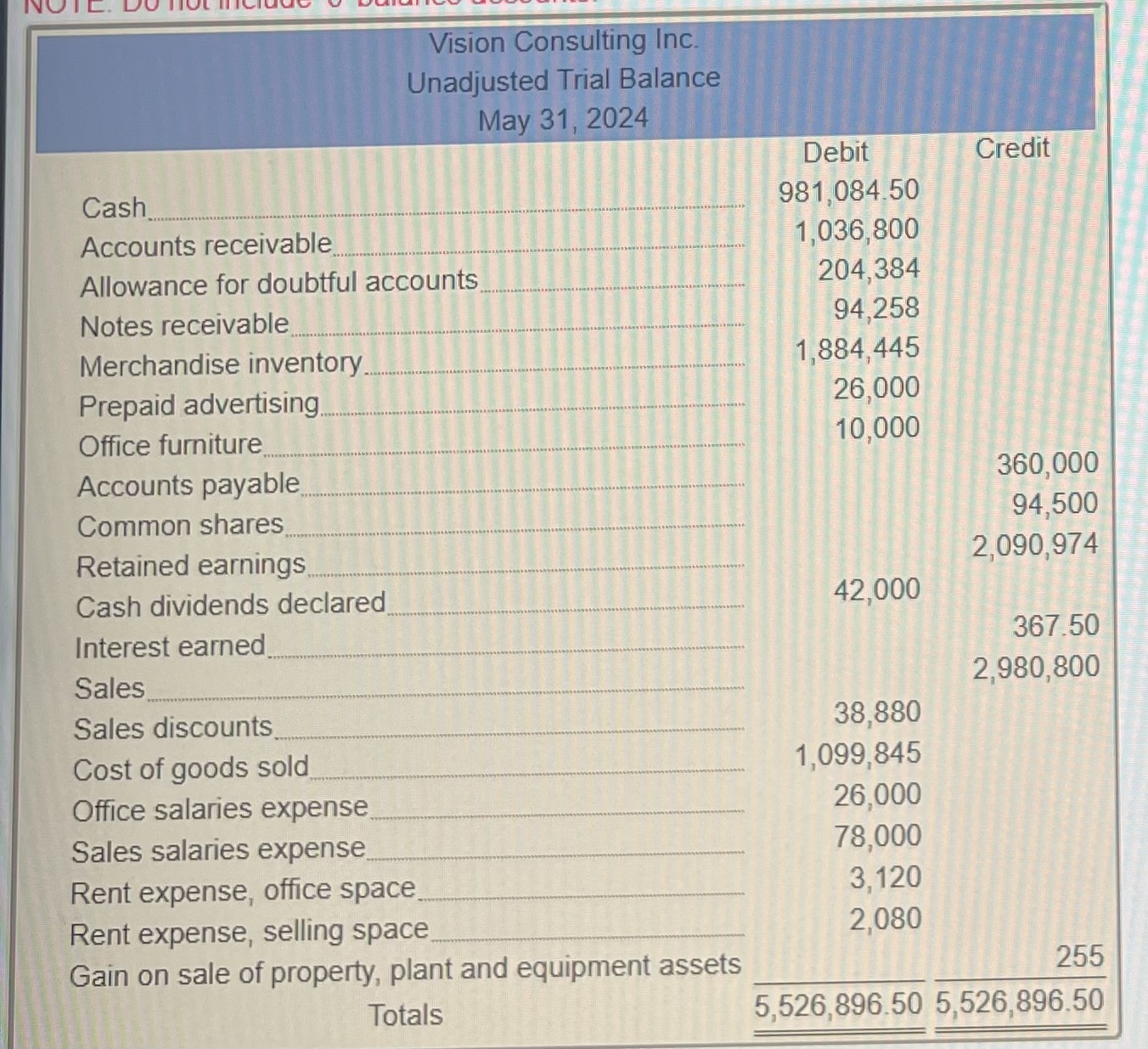

b) Prepare the appropriate adjusting entries on May 31,2024 . Hint: Some additional information is provided below but where else might you look to find details relevant to preparing the adjusting entries? - It is estimated that utilities used during May totalled $18,480. - Actual count of ending merchandise inventory on May 31,2024 was $1,790,223. - Income taxes are estimated to be $235,800 Vision Consulting Inc. Unadjusted Trial Balance May 31, 2024 Cash Debit Credit Accounts receivable Allowance for doubtful accounts Notes receivable. Merchandise inventory. Prepaid advertising Office furniture 981,084.50 1,036,800 204,384 94,258 Accounts payable Common shares Retained earnings Cash dividends declared 1,884,445 Interest earned 26,000 10,000 Sales Sales discounts. Cost of goods sold 360,000 94,500 2,090,974 Office salaries expense Sales salaries expense 367.50 2,980,800 Rent expense, office space Rent expense, selling space 42,000 Gain on sale of property, plant and equipment assets 38,880 1,099,845 26,000 78,000 3,120 2,080 Totals 5,526,896.505,526,896.50255 b) Prepare the appropriate adjusting entries on May 31,2024 . Hint: Some additional information is provided below but where else might you look to find details relevant to preparing the adjusting entries? - It is estimated that utilities used during May totalled $18,480. - Actual count of ending merchandise inventory on May 31,2024 was $1,790,223. - Income taxes are estimated to be $235,800 Vision Consulting Inc. Unadjusted Trial Balance May 31, 2024 Cash Debit Credit Accounts receivable Allowance for doubtful accounts Notes receivable. Merchandise inventory. Prepaid advertising Office furniture 981,084.50 1,036,800 204,384 94,258 Accounts payable Common shares Retained earnings Cash dividends declared 1,884,445 Interest earned 26,000 10,000 Sales Sales discounts. Cost of goods sold 360,000 94,500 2,090,974 Office salaries expense Sales salaries expense 367.50 2,980,800 Rent expense, office space Rent expense, selling space 42,000 Gain on sale of property, plant and equipment assets 38,880 1,099,845 26,000 78,000 3,120 2,080 Totals 5,526,896.505,526,896.50255