Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Please name three potential issuers of debt 2) What is interest rate risk? Question 3: Which financing offer do you take? Question 4: Why

1) Please name three potential issuers of debt

2) What is interest rate risk?

Question 3: Which financing offer do you take?

Question 3: Which financing offer do you take?

Question 4: Why did you pick that offer?

Question 5: Are there other considerations besides the cost

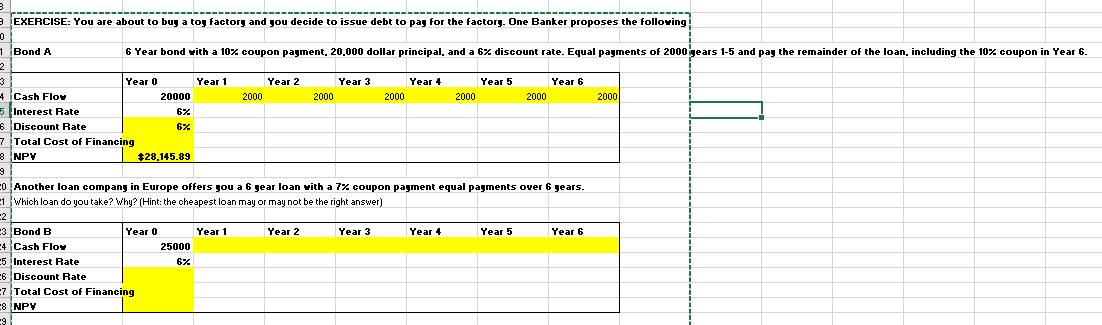

3 ======= EXERCISE: You are about to buy a toy factory and you decide to issue debt to pay for the factory. One Banker proposes the following 0 1 Bond A 6 Year bond with a 10% coupon payment, 20.000 dollar principal, and a 6% discount rate. Equal payments of 2000 years 1-5 and pay the remainder of the loan, including the 10% coupon in Year 6. 2 3 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 4 Cash Floy 20000 2000 2000 2000 2000 2000 2000 5 Interest Rate 67 6 Discount Rate 67 7 Total Cost of Financing 8 NPY $28,145.89 3 0 Another loan company in Europe offers you a 6 gear loan with a 77 coupon payment equal payments over 6 years. 1 Which loan do you take? Why? (Hint: the cheapest loan may or may not be the right answer) 2 3 Bond B Year 0 Year 1 Year 2 Year 3 Year + Year 5 Year 6 -4 Cash Flow 25000 -5 Interest Rate 6% 6 Discount Rate -7 Total Cost of Financing -8 NPY -9 3 ======= EXERCISE: You are about to buy a toy factory and you decide to issue debt to pay for the factory. One Banker proposes the following 0 1 Bond A 6 Year bond with a 10% coupon payment, 20.000 dollar principal, and a 6% discount rate. Equal payments of 2000 years 1-5 and pay the remainder of the loan, including the 10% coupon in Year 6. 2 3 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 4 Cash Floy 20000 2000 2000 2000 2000 2000 2000 5 Interest Rate 67 6 Discount Rate 67 7 Total Cost of Financing 8 NPY $28,145.89 3 0 Another loan company in Europe offers you a 6 gear loan with a 77 coupon payment equal payments over 6 years. 1 Which loan do you take? Why? (Hint: the cheapest loan may or may not be the right answer) 2 3 Bond B Year 0 Year 1 Year 2 Year 3 Year + Year 5 Year 6 -4 Cash Flow 25000 -5 Interest Rate 6% 6 Discount Rate -7 Total Cost of Financing -8 NPY -9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started