Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 please prepare the General Ledger 1 please prepare the General Ledger Practice Set CHART OF ACCOUNTS General Fund -General Ledaer Account Codes Assets A200

1 please prepare the General Ledger

1 please prepare the General Ledger

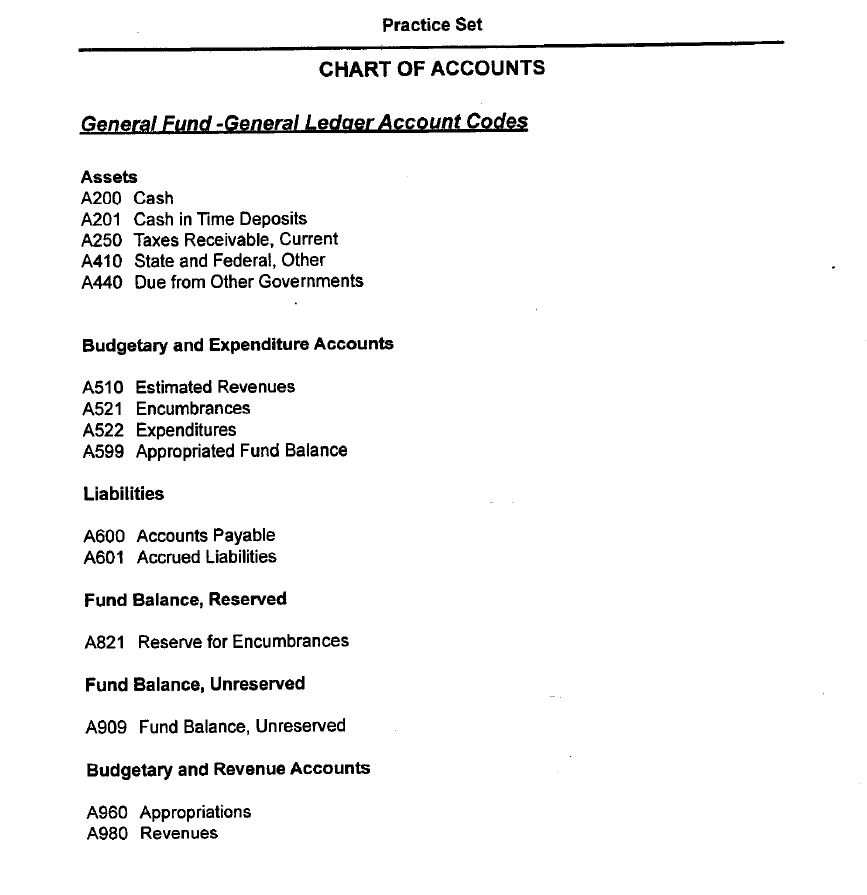

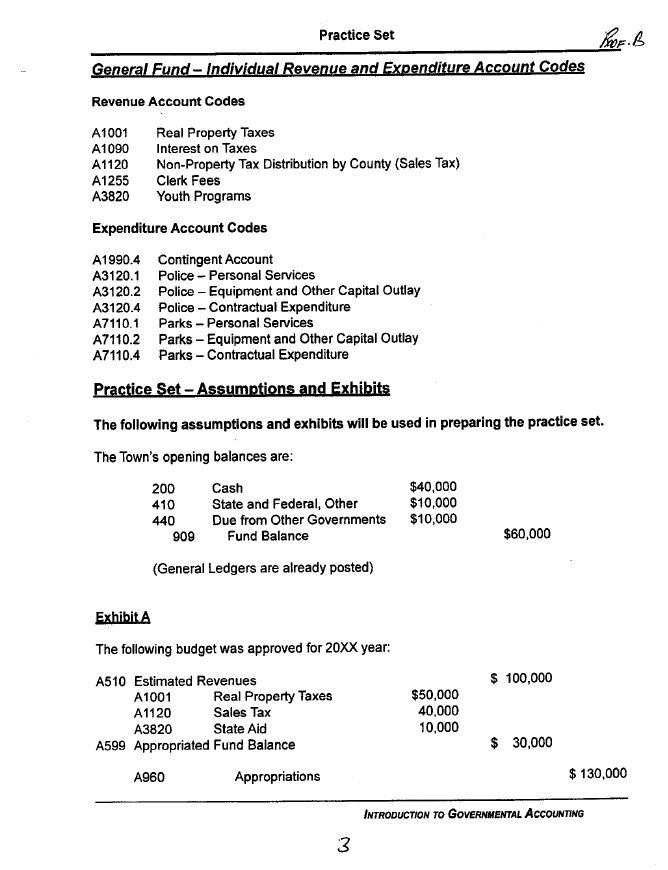

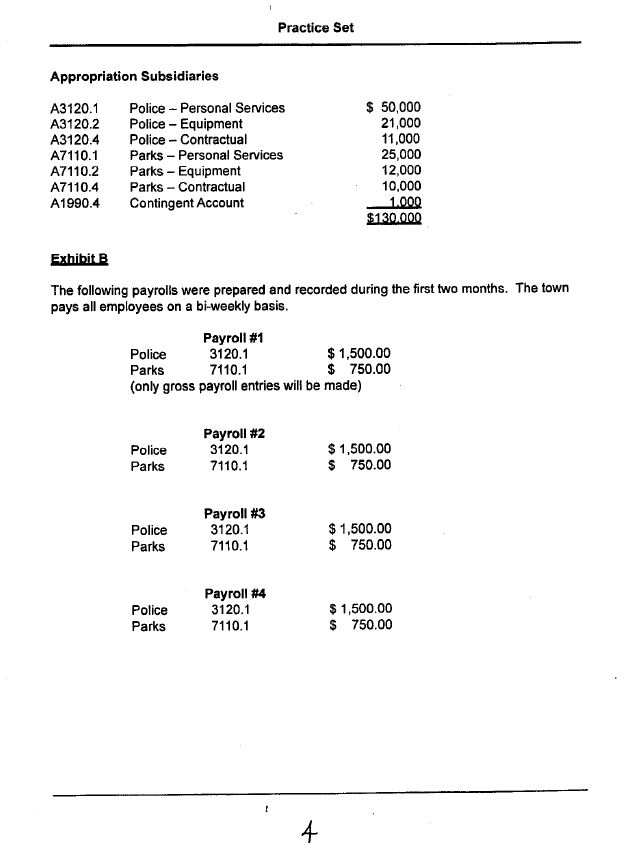

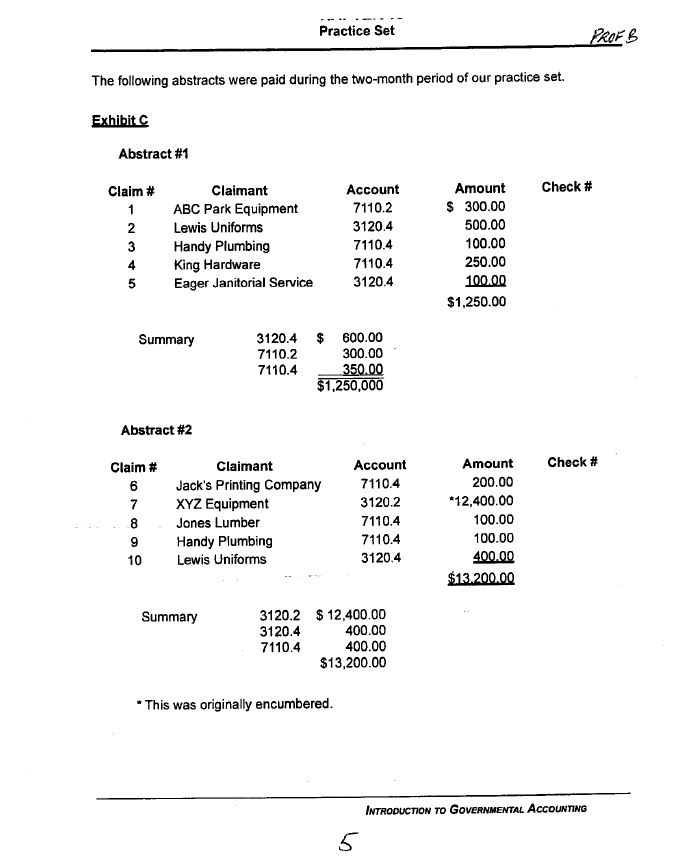

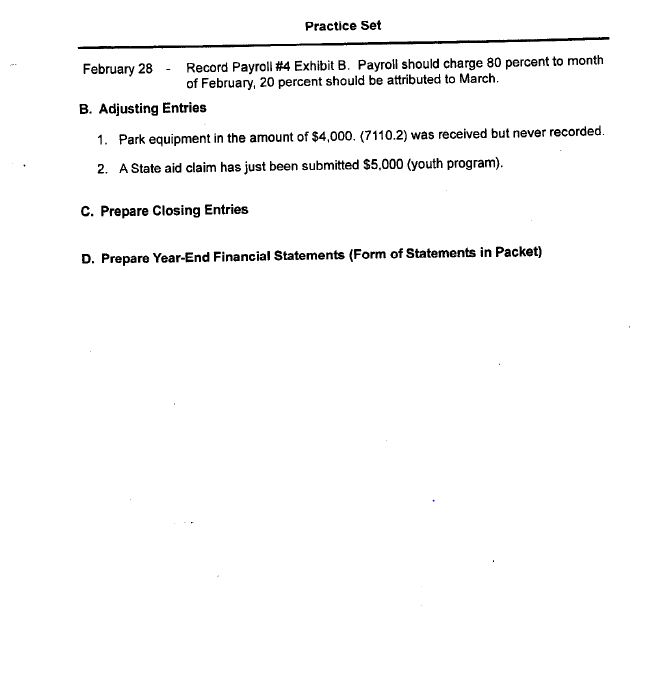

Practice Set CHART OF ACCOUNTS General Fund -General Ledaer Account Codes Assets A200 Cash A201 Cash in Time Deposits A250 Taxes Receivable, Current A410 State and Federal, Other A440 Due from Other Governments Budgetary and Expenditure Accounts A510 Estimated Revenues A521 Encumbrances A522 Expenditures A599 Appropriated Fund Balance Liabilities A600 Accounts Payable A601 Accrued Liabilities Fund Balance, Reserved A821 Reserve for Encumbrances Fund Balance, Unreserved A909 Fund Balance, Unreserved Budgetary and Revenue Accounts A960 Appropriations A980 Revenues Practice Set PROF.B General Fund - Individual Revenue and Expenditure Account Codes Revenue Account Codes A1001 Real Property Taxes A1090 Interest on Taxes A1120 Non-Property Tax Distribution by County (Sales Tax) A1255 Clerk Fees A3820 Youth Programs Expenditure Account Codes A1990.4 Contingent Account A3120.1 Police - Personal Services A3120.2 Police - Equipment and Other Capital Outlay A3120.4 Police - Contractual Expenditure A7110.1 Parks - Personal Services A7110.2 Parks - Equipment and Other Capital Outlay A7110.4 Parks - Contractual Expenditure Practice Set - Assumptions and Exhibits The following assumptions and exhibits will be used in preparing the practice set. The Town's opening balances are: 200 410 440 909 Cash State and Federal, Other Due from Other Governments Fund Balance $40,000 $10,000 $10,000 $60,000 (General Ledgers are already posted) Exhibita The following budget was approved for 20XX year: $ 100,000 A510 Estimated Revenues A1001 Real Property Taxes A1120 Sales Tax A3820 State Aid A599 Appropriated Fund Balance $50,000 40,000 10,000 $ 30,000 A960 Appropriations $ 130,000 INTRODUCTION TO GOVERNMENTAL ACCOUNTING 3 Practice Set Appropriation Subsidiaries A3120.1 A3120.2 A3120.4 A7110.1 A7110.2 A7110.4 A1990.4 Police - Personal Services Police - Equipment Police - Contractual Parks - Personal Services Parks - Equipment Parks - Contractual Contingent Account $ 50,000 21,000 11,000 25,000 12,000 10,000 1.000 $130.000 Exhibit B The following payrolls were prepared and recorded during the first two months. The town pays all employees on a bi-weekly basis. Payroll #1 Police 3120.1 $ 1,500.00 Parks 7110.1 $ 750.00 (only gross payroll entries will be made) Police Parks Payroll #2 3120.1 7110.1 $1,500.00 $ 750.00 Police Parks Payroll #3 3120.1 7110.1 $1,500.00 $ 750.00 Police Parks Payroll #4 3120.1 7110.1 $ 1,500.00 $ 750.00 4 Practice Set PROFB The following abstracts were paid during the two-month period of our practice set. Exhibit C Abstract #1 Check # Claim # 1 2 3 4 5 Claimant ABC Park Equipment Lewis Uniforms Handy Plumbing King Hardware Eager Janitorial Service Account 7110.2 3120.4 7110.4 7110.4 3120.4 Amount $ 300.00 500.00 100.00 250.00 100.00 $1,250.00 Summary 3120.4 $ 600.00 7110.2 300.00 7110.4 350.00 $1,250,000 Abstract #2 Check # Claim # 6 7 8 9 10 Claimant Jack's Printing Company XYZ Equipment Jones Lumber Handy Plumbing Lewis Uniforms Account 7110.4 3120.2 7110.4 7110.4 3120.4 Amount 200.00 *12,400.00 100.00 100.00 400.00 $13.200.00 Summary 3120.2 $ 12,400.00 3120.4 400.00 7110.4 400.00 $13,200.00 * This was originally encumbered. INTRODUCTION TO GOVERNMENTAL ACCOUNTING 5 Practice Set February 28 Record Payroll #4 Exhibit B. Payroll should charge 80 percent to month of February, 20 percent should be attributed to March. B. Adjusting Entries 1. Park equipment in the amount of $4,000. (7110.2) was received but never recorded. 2. A State aid claim has just been submitted $5,000 (youth program). C. Prepare Closing Entries D. Prepare Year-End Financial Statements (Form of Statements in Packet) Practice Set CHART OF ACCOUNTS General Fund -General Ledaer Account Codes Assets A200 Cash A201 Cash in Time Deposits A250 Taxes Receivable, Current A410 State and Federal, Other A440 Due from Other Governments Budgetary and Expenditure Accounts A510 Estimated Revenues A521 Encumbrances A522 Expenditures A599 Appropriated Fund Balance Liabilities A600 Accounts Payable A601 Accrued Liabilities Fund Balance, Reserved A821 Reserve for Encumbrances Fund Balance, Unreserved A909 Fund Balance, Unreserved Budgetary and Revenue Accounts A960 Appropriations A980 Revenues Practice Set PROF.B General Fund - Individual Revenue and Expenditure Account Codes Revenue Account Codes A1001 Real Property Taxes A1090 Interest on Taxes A1120 Non-Property Tax Distribution by County (Sales Tax) A1255 Clerk Fees A3820 Youth Programs Expenditure Account Codes A1990.4 Contingent Account A3120.1 Police - Personal Services A3120.2 Police - Equipment and Other Capital Outlay A3120.4 Police - Contractual Expenditure A7110.1 Parks - Personal Services A7110.2 Parks - Equipment and Other Capital Outlay A7110.4 Parks - Contractual Expenditure Practice Set - Assumptions and Exhibits The following assumptions and exhibits will be used in preparing the practice set. The Town's opening balances are: 200 410 440 909 Cash State and Federal, Other Due from Other Governments Fund Balance $40,000 $10,000 $10,000 $60,000 (General Ledgers are already posted) Exhibita The following budget was approved for 20XX year: $ 100,000 A510 Estimated Revenues A1001 Real Property Taxes A1120 Sales Tax A3820 State Aid A599 Appropriated Fund Balance $50,000 40,000 10,000 $ 30,000 A960 Appropriations $ 130,000 INTRODUCTION TO GOVERNMENTAL ACCOUNTING 3 Practice Set Appropriation Subsidiaries A3120.1 A3120.2 A3120.4 A7110.1 A7110.2 A7110.4 A1990.4 Police - Personal Services Police - Equipment Police - Contractual Parks - Personal Services Parks - Equipment Parks - Contractual Contingent Account $ 50,000 21,000 11,000 25,000 12,000 10,000 1.000 $130.000 Exhibit B The following payrolls were prepared and recorded during the first two months. The town pays all employees on a bi-weekly basis. Payroll #1 Police 3120.1 $ 1,500.00 Parks 7110.1 $ 750.00 (only gross payroll entries will be made) Police Parks Payroll #2 3120.1 7110.1 $1,500.00 $ 750.00 Police Parks Payroll #3 3120.1 7110.1 $1,500.00 $ 750.00 Police Parks Payroll #4 3120.1 7110.1 $ 1,500.00 $ 750.00 4 Practice Set PROFB The following abstracts were paid during the two-month period of our practice set. Exhibit C Abstract #1 Check # Claim # 1 2 3 4 5 Claimant ABC Park Equipment Lewis Uniforms Handy Plumbing King Hardware Eager Janitorial Service Account 7110.2 3120.4 7110.4 7110.4 3120.4 Amount $ 300.00 500.00 100.00 250.00 100.00 $1,250.00 Summary 3120.4 $ 600.00 7110.2 300.00 7110.4 350.00 $1,250,000 Abstract #2 Check # Claim # 6 7 8 9 10 Claimant Jack's Printing Company XYZ Equipment Jones Lumber Handy Plumbing Lewis Uniforms Account 7110.4 3120.2 7110.4 7110.4 3120.4 Amount 200.00 *12,400.00 100.00 100.00 400.00 $13.200.00 Summary 3120.2 $ 12,400.00 3120.4 400.00 7110.4 400.00 $13,200.00 * This was originally encumbered. INTRODUCTION TO GOVERNMENTAL ACCOUNTING 5 Practice Set February 28 Record Payroll #4 Exhibit B. Payroll should charge 80 percent to month of February, 20 percent should be attributed to March. B. Adjusting Entries 1. Park equipment in the amount of $4,000. (7110.2) was received but never recorded. 2. A State aid claim has just been submitted $5,000 (youth program). C. Prepare Closing Entries D. Prepare Year-End Financial Statements (Form of Statements in Packet)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started