Question: 1. Please use the Dividend Discount Model to determine the theoretical price of the stock (Po) given the following information: The company just paid a

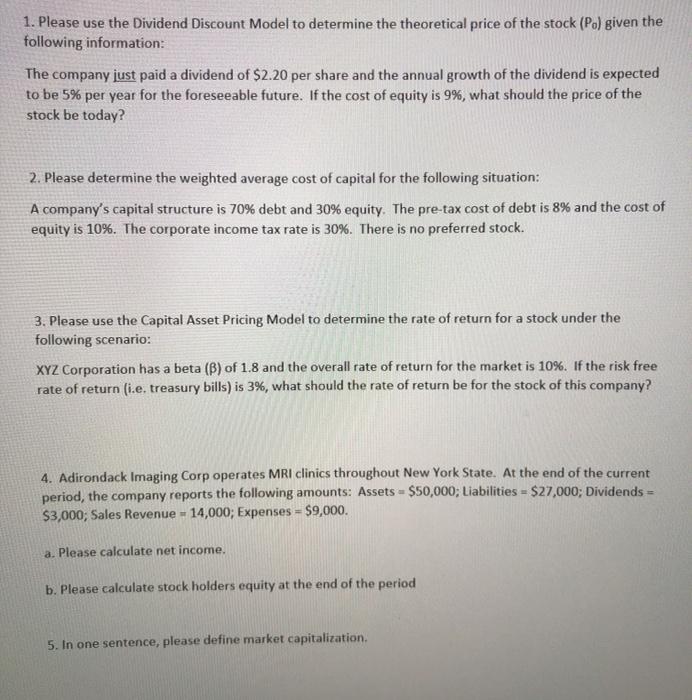

1. Please use the Dividend Discount Model to determine the theoretical price of the stock (Po) given the following information: The company just paid a dividend of $2.20 per share and the annual growth of the dividend is expected to be 5% per year for the foreseeable future. If the cost of equity is 9%, what should the price of the stock be today? 2. Please determine the weighted average cost of capital for the following situation: A company's capital structure is 70% debt and 30% equity. The pre-tax cost of debt is 8% and the cost of equity is 10%. The corporate income tax rate is 30%. There is no preferred stock. 3. Please use the Capital Asset Pricing Model to determine the rate of return for a stock under the following scenario: XYZ Corporation has a beta (B) of 1.8 and the overall rate of return for the market is 10%. If the risk free rate of return (i.e. treasury bills) is 3%, what should the rate of return be for the stock of this company? 4. Adirondack Imaging Corp operates MRI clinics throughout New York State. At the end of the current period, the company reports the following amounts: Assets - $50,000; Liabilities = $27,000; Dividends - $3,000; Sales Revenue - 14,000; Expenses - $9,000. a. Please calculate net income. b. Please calculate stock holders equity at the end of the period 5. In one sentence, please define market capitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts