Question

1. Use these six companies in the previous Financial Ratios to list the stock prices of June 1 and July 1, 2020. ? Use the

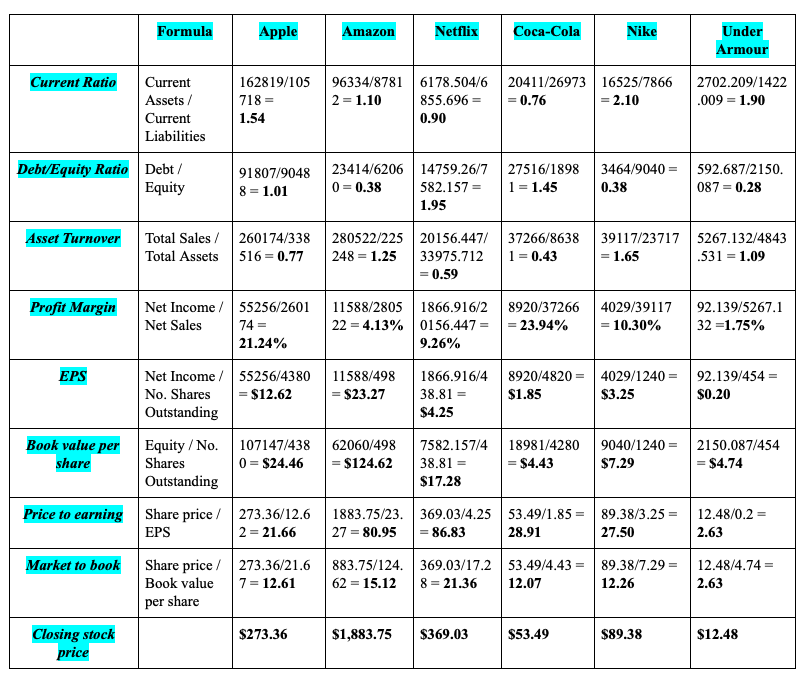

1. Use these six companies in the previous "Financial Ratios" to list the stock prices of June 1 and July 1, 2020. ? Use the above info to compute stock return for an individual stock (1%, listing the computation).2. Collect the Beta coefficient for each stock and explain the risk (high, low, or close to the average)3. Conclude your portfolio investments in these six stocks and the risk and returns.?

EXPLANATIONS OF THE RATIOS OF THE FIRMS TO POTENTIAL INVESTORS:?

Current Ratio: The higher the ratio, the more liquid the company is. Nike & Under Armour have the best current ratios because they are greatly higher than one.?

A commonly acceptable current ratio for companies is a comfortable position for most enterprises. Debt to Equity Ratio: A higher debt/equity ratio is not good for companies. Amazon, Nike & Under Armour have the lowest debt/equity ratios, significantly lower than one. Asset Turnover Ratio: Amazon and Under Armour have the best asset turnover ratio, slightly better than the other 4 companies.?

The higher the ratio, the better it is because this means that the company is able to utilize its assets to generate sales. Profit Margin: Apple & Coca-Cola have the best profit margins.?

Generally, a profit margin of 10% net is considered average, a 20% margin is considered high and good, and 5% margin or lower is considered low and not great.?

Price to Earning Ratio: Netflix's P/E ratio is the highest, higher P/E is not good if it cannot provide higher earnings. A lower P/E ratio means that the share is cheaper. Market to Book Ratio: Netflix's price to book value ratio is the highest because its market capitalization and current price are the highest

Current Ratio Asset Turnover Debt/Equity Ratio Debt / Equity Profit Margin EPS Book value per share Formula Market to book Current Assets/ Current Liabilities Closing stock price Total Sales / Total Assets Price to earning Share price / EPS Equity / No. Shares Outstanding Apple 162819/105 718= 1.54 Net Income / 55256/2601 Net Sales Share price/ Book value per share 91807/9048 8 = 1.01 260174/338 516=0.77 Net Income / 55256/4380 = $12.62 No. Shares Outstanding 74= 21.24% 107147/438 0 = $24.46 273.36/12.6 2 = 21.66 273.36/21.6 7 = 12.61 $273.36 Amazon 96334/8781 2 = 1.10 23414/6206 0=0.38 280522/225 248 = 1.25 11588/2805 22=4.13% 11588/498 = $23.27 62060/498 = $124.62 1883.75/23. 27 = 80.95 Netflix $1,883.75 6178.504/6 855.696 = 0.90 14759.26/7 582.157 = 1.95 20156.447/ 33975.712 = 0.59 1866.916/2 0156.447 = 9.26% 1866.916/4 38.81 = $4.25 7582.157/4 38.81 = $17.28 369.03/4.25 = 86.83 883.75/124. 369.03/17.2 62 = 15.12 8=21.36 $369.03 Coca-Cola 20411/26973 = 0.76 27516/1898 1 = 1.45 37266/8638 1 = 0.43 8920/37266 = 23.94% $1.85 53.49/1.85= 28.91 Nike 53.49/4.43= 12.07 16525/7866 = 2.10 8920/48204029/1240= $3.25 $53.49 3464/9040 = 0.38 39117/23717 = 1.65 18981/4280 9040/1240= = $4.43 $7.29 4029/39117 = 10.30% 89.38/3.25 = 27.50 89.38/7.29 = 12.26 $89.38 Under Armour 2702.209/1422 .009 = 1.90 592.687/2150. 087 = 0.28 5267.132/4843 .531 = 1.09 92.139/5267.1 32 =1.75% 92.139/454 $0.20 2150.087/454 = $4.74 12.48/0.2 = 2.63 = 12.48/4.74= 2.63 $12.48

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Stock Prices of June 1 and July 1 2020 Nike June 1 10437 July 1 10069 Under Armour June 1 1168 July ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started